- Utah Investor Report

- Posts

- Utah Single-Family Sales Slow, Prices Hold Firm

Utah Single-Family Sales Slow, Prices Hold Firm

Logan duplex listed for $475k; mortgage rates dip again.

> Featured Listings

Well-maintained duplex with two separate units: one remodeled in recent years and one in classic condition, offering built-in value-add potential. Features include washer/dryer hookups in both units, newer furnace and water heater, a detached 2-car garage with storage loft, and a low-maintenance yard with automatic sprinklers. Strong rental demand in an established area makes this a solid long-term hold.

This well established fourplex is perfect. Located in a cul de sac. Close to restaurants, freeway and HAFB. Units have been updated. Single level living.

BRAND NEW townhomes! The upstairs has 2 bedrooms, each with a full bathroom. The laundry room is also upstairs. Main floor kitchen boasts granite countertops, custom cabinetry, and gleaming stainless steel appliances all included. 2-car garage. Each unit comes with a brand new washer and dryer. Located in the heart of Midvale and close to everything. Each unit comes with its own unique finishes.

Canovo Group may not be the listing brokerage for the above properties. The information provided is not guaranteed and should not be relied upon to make investment decisions. Buyers should complete their own analysis and due diligence before making any investment.

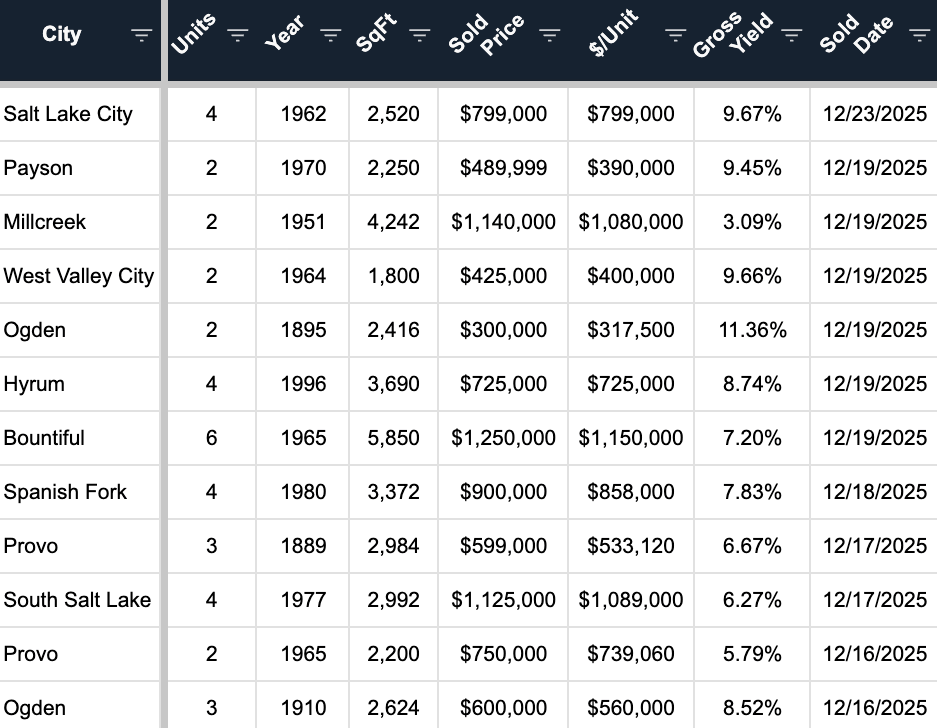

> Sold Multi-Unit Listings

Sell Your Property for Top Dollar

Request a free, no obligation property value estimate. Get market rent data, sales comparables and a return on equity analysis.

> Utah Market Data

Utah Single-Family Sales Slow, Prices Hold Firm

Over the last 24 months, Utah’s single-family housing market has cooled on the sales side, while price per square foot has stayed relatively stable.

Recent activity shows a slowdown in closings:

Sold volume is down 7.1% month-to-date compared to the same time last year

Quarter-to-date sales are down 5.3% year over year

Year-to-date sales are still up 1.8%, showing the slowdown is recent, not long-term

Prices are proving more resilient:

Average price per square foot is:

Down 6.3% month-to-date

Down 1.0% quarter-to-date

Up 1.3% year-to-date

Median price per square foot shows a similar trend:

Down 0.9% MTD

Down 0.1% QTD

Up 0.9% YTD

Big Picture Takeaway

Utah buyers are clearly moving more cautiously, with fewer homes closing in recent months. However, prices per square foot are not breaking down—they’re holding slightly higher than last year on a year-to-date basis.

This is a classic rate-driven slowdown, not a price collapse.

What This Means for Utah Investors

Less competition: Fewer buyers means more room to negotiate, especially on days-on-market and seller concessions

Pricing discipline still matters: Sellers aren’t panicking, so deals need to be underwritten carefully

Cash-flow deals matter more than appreciation bets in the short term

This environment favors patient, well-capitalized investors who can move while others wait

> Mortgage Rates & Financing

Mortgage Rates (as of Dec 23, 2025)

Mortgage rates moved lower again this week and are now clearly down from a year ago. The 30-year fixed rate is 6.21%, down 0.06% from last week and nearly 0.9% lower than last year. FHA, VA, jumbo, and ARM loans all saw small drops as well, continuing the slow downward trend.

10-Year Treasury Yield (as of Dec 24, 2025)

The 10-Year Treasury fell to about 4.14%, down from earlier in the week. Since mortgage rates closely follow the 10-Year Treasury, this drop helps explain why mortgage rates are easing.

Source: Mortgage News Daily

David Robinson

Principal Broker/Owner

Thinking about buying, selling, or exchanging investment property in Utah?