- Utah Investor Report

- Posts

- Utah Rent Notice Bill Fails Again

Utah Rent Notice Bill Fails Again

Utah Multi-Unit Inventory Spikes - Single Family Sales Down; SLC 20-unit - Listed for $200k/Unit; [REPORT] Singles Face Heavier Housing Burden

Featured Multi-Unit Listings

Click images below to view details and run cash flow analysis.

> RESIDENTIAL (2-4 UNITS):

> COMMERCIAL (5+ UNITS):

Canovo Group may not be the listing brokerage for the above properties. The information provided is not guaranteed and should not be relied upon to make investment decisions. Buyers should complete their own analysis and due diligence before making any investment.

Utah Market Snapshot

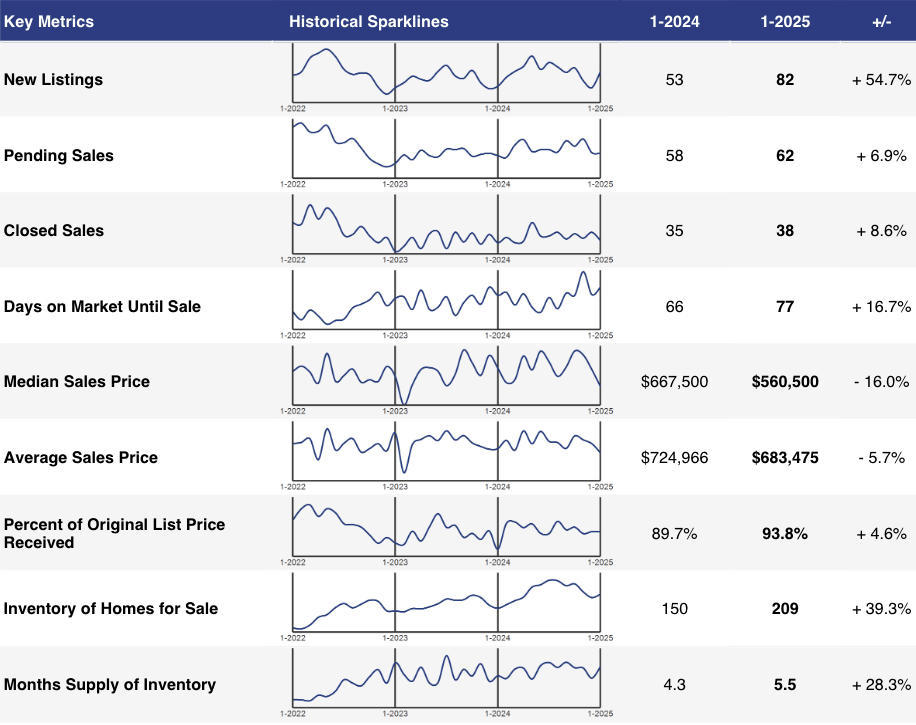

> Multi-Unit (2+ Units) - January 2025 Market Summary

In January 2025, Utah's multi-unit property market experienced a notable 8.6% increase in closed sales compared to January 2024, rising from 35 to 38 transactions. However, the median sales price dropped significantly by 16.0%, from $667,500 to $560,500, suggesting a shift in buyer preferences or market dynamics. Meanwhile, inventory saw a sharp rise of 39.3%, with available properties increasing from 150 to 209, indicating more options for buyers but potentially a more competitive environment for sellers.

> Single Family - January 2025 Market Summary

In January 2025, Utah's single-family home market showed mixed trends. Closed sales decreased by 9.9%, from 2,234 in January 2024 to 2,013. Meanwhile, the median sales price increased slightly by 2.1%, rising from $489,900 to $500,000, reflecting stable demand for homes despite fewer transactions. Inventory levels saw a substantial 30.9% increase, with the number of homes for sale growing from 6,897 to 9,030, contributing to a 45.3% rise in the months' supply of inventory, from 3.1 to 4.5 months, indicating a more balanced market.

Sold Multi-Unit Listings This Week

Rates & Financing

> Mortgage Rates as of 2/5/2025

Source: Mortgage News Daily

Property Management

> Create a Pet-Friendly Policy with Clear Guidelines

With many renters owning pets, offering a pet-friendly policy can give your property a competitive edge. To protect your investment, establish clear rules from the start. Outline acceptable pet types, any breed or size restrictions, and require a pet deposit or monthly pet rent to cover potential extra wear and tear. Additionally, set expectations for pet behavior, such as leash rules and waste cleanup. This balanced approach attracts responsible pet owners while keeping your property well-maintained and ensuring a comfortable environment for all tenants.

Get professional property management starting at only $59/unit. Learn more.

Headlines & Insights

Featured Story

> Single Renters Face a Heavier Housing Burden

A recent Redfin survey reveals that nearly 70% of single, divorced, or separated people have difficulty affording housing payments, compared to just 52% of married couples. Without the advantage of shared incomes and tax benefits, many singles even skip meals or work extra gigs to make ends meet.

Main takeaways:

Almost 70% of single and divorced individuals struggle with housing costs, while only about half of married people face the same challenge.

Single renters in expensive cities like Washington, D.C. can pay nearly $12,000 more per year than those splitting costs with a partner, highlighting the extra financial strain.

Lower household incomes among singles—about 63% earn under $50,000—contrast sharply with married couples, who benefit from two incomes and tax breaks; even in markets like Salt Lake City, UT, with a median rent of $1,299, the affordability gap remains a concern.

What this means for investors:

Investors could tap into the growing need for affordable, single-occupancy housing by developing smaller units, co-living spaces, or accessory dwelling units (ADUs). As singles face increased financial pressure, rental properties and innovative housing solutions in urban markets—including cities like Salt Lake City, Washington, D.C., and Los Angeles—offer promising opportunities for stable returns.

More News & Reports

Utah

Utah Lawmakers Target Big Investors – Two bills aim to curb institutional investors from outbidding local families, with proposals to delay investor purchases and prioritize owner-occupants. Representatives Gay Lynn Bennion and Tyler Clancy seek to level the playing field as rising investor activity drives up home prices and limits homeownership opportunities for Utahns.

Salt Lake City Ranks Among Most Affordable for Renters – A new Redfin report lists Salt Lake City as one of the most affordable U.S. rental markets, alongside Austin, Houston, and Dallas. While city officials acknowledge rental affordability, they warn that high home prices are keeping many from buying, sustaining demand for rentals amid a housing crisis.

Utah Rent Notice Bill Fails Again – A proposal requiring 60 days’ notice for rent increases failed in a 6-6 House committee vote, marking its third consecutive defeat. Supporters argued it would help renters plan, but opponents, including the Rental Housing Association of Utah, said it disrupted the existing landlord-tenant balance.

National

Multifamily Investors Adapt to Higher Rates – With the Fed keeping rates steady, investors are shifting strategies, accepting a prolonged higher-rate environment. Many plan to be more aggressive in 2025, selling underperforming assets and deploying capital into higher-growth opportunities, signaling renewed confidence in the multifamily sector.

Tariffs, Immigration, and Housing Policy in Focus – At the NMHC Apartment Strategies Conference, experts discussed how Trump's new tariffs and immigration policies could disrupt multifamily construction. Panelists also debated potential privatization of Fannie Mae and Freddie Mac, along with tax policy shifts that could impact affordable housing incentives.

Top Cities for Short-Term Rentals – Peoria, IL, and Fairbanks, AK, top the list of the best markets for short-term rental (STR) investments in 2025. Rising occupancy and daily rates are expected to offset higher property costs, with strong demand in small and mid-sized cities like Akron, Columbus, and Page, AZ, signaling continued growth opportunities for investors.

What did you think of today's report? |

David Robinson

Principal Broker/Managing Partner

Whenever you’re ready, there are a couple of ways I can help you:

Buy The Best Multi-Unit Properties in Utah:

Work directly with our team to find, finance, buy and manage the best multi-unit properties in Utah (2-50 units) to grow your wealth.Sell Your Multi-Unit Property for Top Dollar:

We’ll strategically position your multi-unit property for full market exposure, extract maximum value, and streamline the sales process.