- Utah Investor Report

- Posts

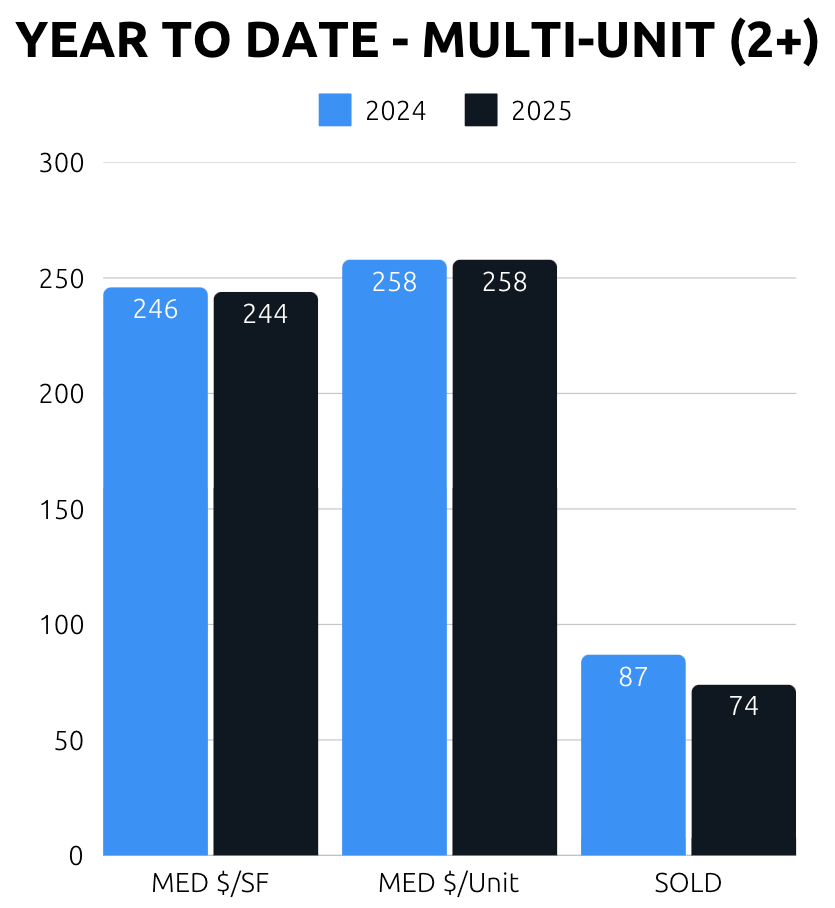

- Utah multi-unit sales down 15% YTD

Utah multi-unit sales down 15% YTD

Inflation slows to 2.8% in Feb; Provo Fourplex sells for $172k per unit; 78% of Utah’s priced out of housing

Featured Listings

> Click images below to view details and run cash flow analysis.

Canovo Group may not be the listing brokerage for the above properties. The information provided is not guaranteed and should not be relied upon to make investment decisions. Buyers should complete their own analysis and due diligence before making any investment.

Utah Market Data

> Multi-Unit (2+ Units) - Year to Date Data

The data for multi-unit sales in 2025 is starting much the same as last year with virtual the same median price per square foot and median price per unit. The only significant change in this three metrics is the number of sold properties which is down from 87 sold last year to date and only 74 so far this year - a 15% decline.

Sold Multi-Unit This Week

Rates & Financing

> Mortgage Rates as of 3/12/2025

Source: Mortgage News Daily

Headlines & Insights

Featured Story

Inflation cooled more than expected in February, with the consumer price index rising 2.8% annually, offering some relief to consumers and policymakers. Despite lingering concerns over tariffs and economic growth, the slowdown strengthens the case for future Federal Reserve rate cuts.

Main takeaways:

The overall inflation rate eased to 2.8% annually, while core inflation (excluding food and energy) dropped to 3.1%, both slightly below expectations.

Shelter costs, which make up a significant portion of CPI, rose 4.2% year-over-year but showed signs of slowing.

The Federal Reserve is expected to hold rates steady at its next meeting, with markets anticipating cuts beginning in June.

What this means for investors:

A cooling inflation environment could lead to lower borrowing costs in the long term, improving affordability for real estate investors and homebuyers. However, uncertainty around tariffs and economic growth may continue to impact market sentiment, making strategic timing crucial for investment decisions.

More News & Reports

Utah

Salt Lake City Faces Climate Risks – A new Zillow analysis finds that $92.4 billion worth of residential real estate in Salt Lake City is at major risk of fire, with an additional $27 billion exposed to flood risks. As climate concerns grow, rising insurance costs and potential property damage are reshaping homebuyer decisions in Utah and nationwide.

Utah's Housing Affordability Crisis – A new NAHB analysis reveals that 77.88% of Utah households cannot afford a median-priced new home at $568,425. With mortgage rates at 6.5%, buyers need an income of $163,491 to qualify, highlighting the affordability challenges in the state.

Wealthy Renters in Salt Lake City – A growing number of high-income earners in Salt Lake City are choosing to rent instead of buy, reflecting a national trend identified by Redfin. In the Salt Lake metro area, 6.7% of renters are among the top 20% of earners, an increase of just 0.3 percentage points since 2019. This shift comes as median rents have risen 40.7% in that period, while home prices surged 48.6%, making renting a more flexible and cost-effective option for many.

Salt Lake City’s $1B Revitalization Plan Moves Forward – Utah lawmakers passed SB26, allowing Salt Lake City and Salt Lake County to use tax increment financing for a $1 billion downtown redevelopment, including major renovations to the Salt Palace Convention Center. The bill does not raise taxes but reallocates existing tax revenues to fund the project, which is expected to boost tourism and economic growth. City and county leaders celebrated the move, highlighting its potential to attract more events, strengthen preparations for the 2034 Olympics, and revitalize the downtown area.

National

Canada Retaliates with Tariffs – Canada is imposing 25% tariffs on over $20 billion worth of U.S. goods, including steel, aluminum, computers, and sports equipment, in response to the Trump administration’s new tariffs. These new duties come on top of previous counter-tariffs on $30 billion of U.S. imports.

Mnuchin Downplays Economic Concerns – Former Treasury Secretary Steven Mnuchin says fears over Trump's policies are exaggerated, rejecting predictions of a U.S. recession. While trade tensions with Canada, Mexico, and China have escalated, Mnuchin argues that market declines are a "healthy correction" rather than a sign of economic trouble.

Recession Risks and Housing – The likelihood of a recession has risen to 40% due to policy uncertainty, but the housing market remains insulated. Most homeowners have locked in low mortgage rates and hold significant equity, reducing the risk of forced sales or price declines. Renters, however, face higher vulnerability to job losses, which could soften rental demand and drive rents lower.

What did you think of today's report? |

David Robinson

Principal Broker/Managing Partner

Whenever you’re ready, there are a couple of ways I can help you:

Buy The Best Multi-Unit Properties in Utah:

Work directly with our team to find, finance, buy and manage the best multi-unit properties in Utah (2-50 units) to grow your wealth.Sell Your Multi-Unit Property for Top Dollar:

We’ll strategically position your multi-unit property for full market exposure, extract maximum value, and streamline the sales process.