- Utah Investor Report

- Posts

- Utah Multi-Unit Listings Up 26%

Utah Multi-Unit Listings Up 26%

Salt Lake City Ranks 4th in Renter Affordability; Salt Lake Fourplex sells for $825k; Mortgage Rates Drop Slightly on Back of Trump Inauguration

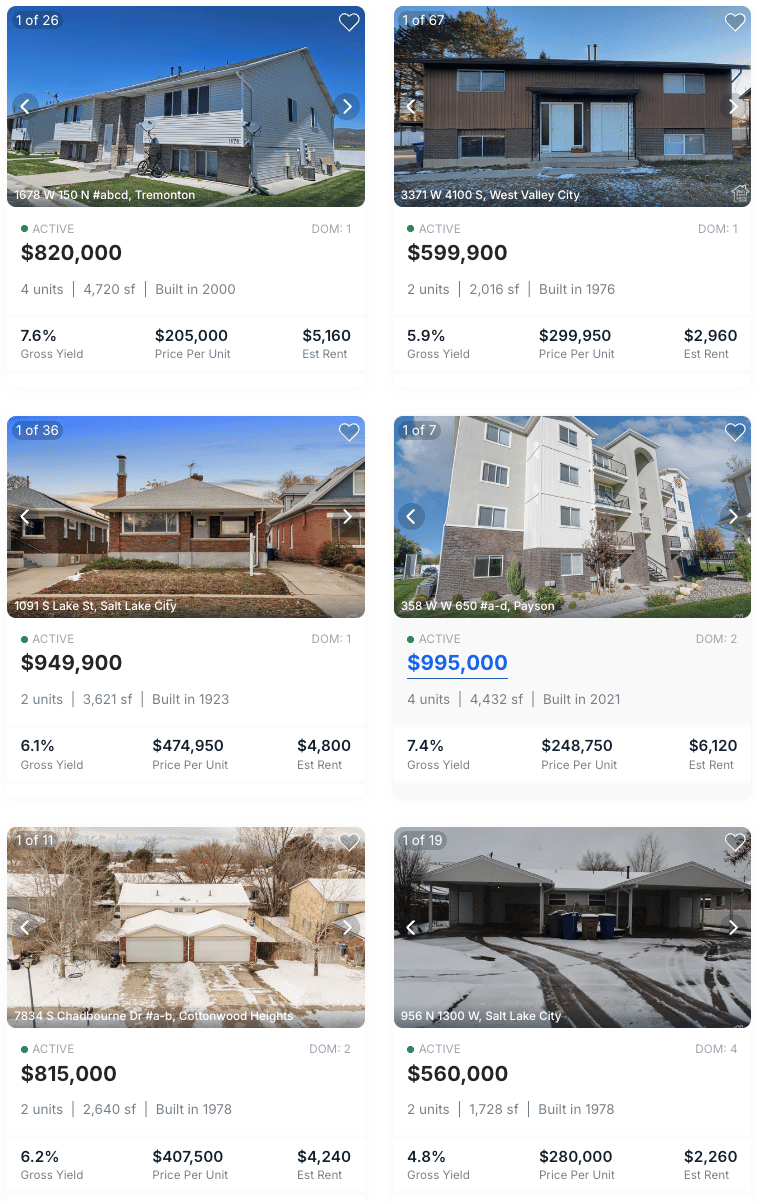

Featured Multi-Unit Listings

Click images below to view details and run cash flow analysis.

> DUPLEX LISTINGS:

> FOURPLEX LISTINGS:

> 5+ UNITS:

Canovo Group may not be the listing brokerage for the above properties. The information provided is not guaranteed and should not be relied upon to make investment decisions. Buyers should complete their own analysis and due diligence before making any investment.

Utah Market Snapshot

> Multi-Unit (2+ Units) - Active Listings & Price Per Square Foot:

The current number of multi-unit listings is 195 which is up 26% compared to this same day last year (155)

The current median asking price per square foot for multi-unit listings is $253 which is down 4.8% compared to this same day last year. ($265)

> Single Family - Active Listings & Price Per Square Foot

The current number of single family listings is 8,942 which is up 26% compared to this same day last year (7,084)

The current median asking price per square foot for single family listings is $247 which is down .5% compared to this same day last year. ($248)

Sold Multi-Unit Listings This Week

Rates & Financing

> Mortgage Rates as of 1/22/2025

Source: Mortgage News Daily

Property Management

> Offer Lease Renewal Incentives

Encouraging tenants to renew their leases can save you the hassle of finding new renters and reduce vacancy periods. One effective way to do this is by offering small incentives for lease renewals, such as a rent discount for renewing early or upgrading appliances or fixtures. You can also provide a "thank you" gesture like a gift card or a small home improvement allowance to show appreciation for their loyalty. This approach helps build long-term relationships with tenants, reduces turnover costs, and ensures your property stays occupied.

Get professional property management starting at only $59/unit. Learn more.

Headlines & Insights

Featured Story

Overview:

Apartment rent growth in 2025 is expected to pick up slightly but will still lag behind previous decade norms due to elevated supply levels. Local market dynamics will play a significant role in shaping growth expectations, which vary widely across regions. Salt Lake City near peak supply.

Markets Expected to Outpace the U.S. Average

Minimal Supply Pressure, Stable Demand (3%-4% Rent Growth):

Examples: Chicago, Cincinnati, Indianapolis, Kansas City, Pittsburgh, Richmond, Virginia Beach

Steady economies with limited new apartment deliveries.

Gateway/Gateway-Adjacent Markets with Stable Occupancy (3%-4% Rent Growth):

Examples: Boston, Inland Empire (Riverside), Newark (Jersey City), Orange County (Anaheim), San Francisco/San Jose, Seattle, Washington, DC

Recovering demand and occupancy levels nearing historical norms.

Markets Hovering Around the U.S. Average

Little Supply but Demand Headwinds (2%-3% Rent Growth):

Examples: Baltimore, Cleveland, Greensboro-Winston Salem, Memphis, Milwaukee, Philadelphia, Sacramento, St. Louis

Limited inventory growth but weaker demand limits rent increases.

Sun Belt Markets Near Peak Supply (1.5%-2.5% Rent Growth):

Examples: Dallas, Houston, Las Vegas, Orlando, Salt Lake City, South Florida (Miami Area), Tampa

Elevated supply will moderate rent growth, despite strong demand.

Markets Expected to Lag Behind the U.S. Average

Weaker Demand Fundamentals (0%-2% Rent Growth):

Examples: Atlanta, Los Angeles, Minneapolis, Oakland, Portland, San Diego

Persistent demand softness despite manageable new supply.

Prolonged Supply Pressure (0%-1.5% Rent Growth):

Examples: Austin, Charlotte, Phoenix, Raleigh/Durham, San Antonio

Excess supply from 2024 and beyond will challenge rent growth recovery.

Key Takeaways for 2025:

Strong Performers: Midwest and Gateway markets with steady demand and less supply pressure will lead.

Moderate Growth: Sun Belt markets near peak supply will see modest gains.

Challenges Ahead: Markets with oversupply or weak demand will struggle to achieve rent increases.

More News & Reports

Utah

Utah Lawmakers Want to Lossen Eviction Laws: Utah Senator Nate Blouin proposes SB125 to modify state eviction laws by eliminating treble damages, facing strong opposition in a landlord-friendly legislature. This proposal aims to reduce the financial burden on renters during evictions, amidst concerns that current laws disproportionately penalize tenants struggling to maintain housing.

Salt Lake City Ranks 4th For Most Affordable Metro for Renters: In 2024, renters needed an annual income of $63,680 to afford the median U.S. apartment rent, marking the lowest income requirement since 2022, with affordability improvements evident in major Texas metros but less so in cities like Providence, Miami, and New York.

National

The 10-year Treasury yield fell to 4.566% following President Donald Trump's inauguration and a flurry of new executive orders, reflecting investor caution amid Trump's proposed tariffs and economic policies.

The Consumer Financial Protection Bureau (CFPB) ordered Equifax to pay a $15 million penalty for inadequately investigating consumer disputes about credit report inaccuracies, failing to follow dispute resolution procedures required by law, and other compliance failures.

Stuck at home: Economic pressures keep young adults living with parents. Rental affordability issues, dwindling pandemic savings, and high mortgage rates have stalled the trend of young adults moving out of their parental homes. In 2023, 19.2% of adults aged 25-34 still lived with their parents, a figure that has remained static from 2022 and remains high by historical standards, particularly in Southern and Northeastern states.

Minneapolis shines as the top city to watch for renters in 2025, according to a RentCafe.com analysis, driven by rising rental interest and online engagement rates throughout 2024. The Midwest and West regions are closely matched in popularity, each hosting ten of the top thirty cities for rental activity, with Southern cities like Atlanta maintaining strong appeal due to their vibrant job markets and quality of life.

What did you think of today's report? |

David Robinson

Principal Broker/Managing Partner

Whenever you’re ready, there are a couple of ways I can help you:

Buy The Best Multi-Unit Properties in Utah:

Work directly with our team to find, finance, buy and manage the best multi-unit properties in Utah (2-50 units) to grow your wealth.Sell Your Multi-Unit Property for Top Dollar

We’ll strategically position your multi-unit property for full market exposure, extract maximum value, and streamline the sales process.