- Utah Investor Report

- Posts

- Utah Lands $2B AI Data Center

Utah Lands $2B AI Data Center

29-Unit Ogden Portfolio Listed for $4M; Salt Lake City to Overhaul Zoning Map; New Report Identified Lease/Most Stable Markets

Featured Listings

> Click images below to view details and run cash flow analysis.

Canovo Group may not be the listing brokerage for the above properties. The information provided is not guaranteed and should not be relied upon to make investment decisions. Buyers should complete their own analysis and due diligence before making any investment.

Utah Market Data

> Multi-Unit (2+ Units) - Sold Price Per Square Foot - Median

In the most recent data (2025 Q1), the median price per square foot sits at about $249. That is down slightly from the previous quarter (2024 Q4), when it was around $250, and it also represents a small decrease from roughly $253 at the start of 2024 (i.e., last year’s Q1). Overall, prices remain above the lows of early 2023 but have eased modestly since reaching their peak in mid‐2024.

Multi-Unit Active Listings

> Single Family - Sold Price Per Square Foot- Median

This chart shows Utah’s single‐family median sold price per square foot over the last few years, with a peak of $241.90 in mid‐2022, followed by a dip through early 2023 (down to $218.80) and then a gradual climb back up through 2024. By Q1 2025, the median stands at $233.50. That figure is a small increase over the prior quarter (Q4 2024: $232.60) and is also up from the same quarter one year ago (Q1 2024: $228.00). Overall, the market remains below the 2022 high but has regained much of the ground lost after early 2023’s low.

Single Family Active Listings

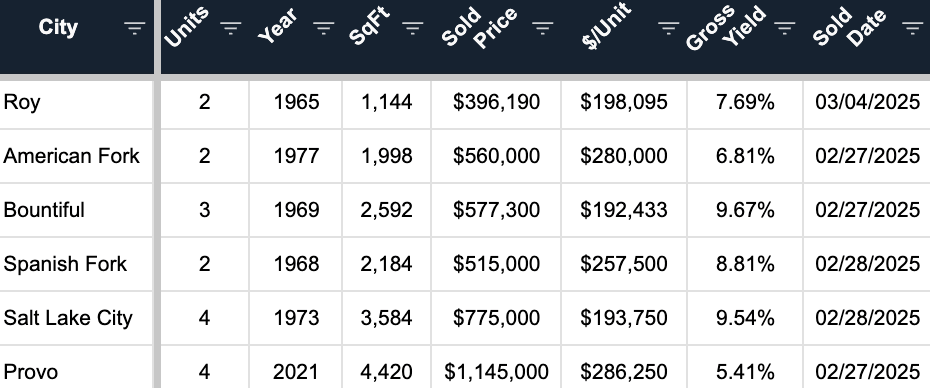

Sold Multi-Unit This Week

Rates & Financing

> Mortgage Rates as of 3/05/2025

Source: Mortgage News Daily

Headlines & Insights

Featured Story

Some U.S. housing markets have remained steady through economic ups and downs, while others have experienced major price swings. A new analysis ranks the most stable housing markets based on historical price volatility, offering insights for buyers and investors looking for long-term value.

Main takeaways:

Buffalo, NY; Oklahoma City, OK; and Pittsburgh, PA, were the most stable large metros, with a 0% chance of home prices dropping more than 5% since 2000.

Salt Lake City, UT, ranked among the more stable large metros, with a 20.7% chance of experiencing a 5% price drop—better than many volatile markets but still showing some price fluctuations.

Las Vegas, NV, ranked as the most volatile major metro, with a nearly 50% chance of experiencing a significant price drop.

What this means for investors:

Investors looking for relative stability may find Salt Lake City to be a strong market compared to riskier alternatives like Las Vegas or Phoenix. However, its moderate price fluctuation history suggests that while it’s not among the most volatile, it’s also not as steady as markets like Buffalo or Oklahoma City. Understanding local trends and economic drivers will be crucial for maximizing long-term returns in Utah’s housing market.

More News & Reports

Utah

Utah Lands $2B AI Data Center – A 100-acre AI data center in West Jordan, Utah, secured a $2B construction loan, reflecting the surging demand for AI infrastructure. The fully leased facility will provide 175 megawatts of power and feature an innovative cooling system to reduce water use in the arid region.

Salt Lake City Zoning Overhaul – Salt Lake City is planning a major zoning rewrite to simplify regulations and allow more housing units per lot to address affordability issues. The city hopes the changes will encourage a mix of housing types, reversing enrollment declines and improving supply. Public input is being sought as officials refine the proposal.

Utah Lawmaker Drops Corporate Homebuyer Ban – Rep. Tyler Clancy has abandoned a bill that would have prohibited companies from purchasing single-family homes in Utah. While Clancy cited grassroots support, opposition from industry groups led to the bill’s demise. Critics argued it wouldn’t lower home prices, which remain around $500,000 statewide. Clancy plans to refine his approach for future legislation.

National

Mortgage Demand Surges – Mortgage applications jumped 20.4% last week as 30-year fixed rates dropped to 6.73%, the lowest since December 2024. Refinancing activity soared 37%, while home purchase applications increased 9%, signaling early signs of a spring market rebound. However, new tariffs on China, Canada, and Mexico could push home prices higher, particularly for new construction.

Investor Home Purchases Decline – Investor activity in the U.S. housing market dropped 3.9% year-over-year in Q4 2024, with the biggest declines in Florida markets. High home prices, rising inventory, and economic uncertainty are driving investors away, though some areas, like the Bay Area and Seattle, saw an uptick in investor purchases.

New vs. Existing Home Prices Converge – The price gap between new and existing homes nearly vanished by the end of 2024, with new homes selling for a median of $419,200—just $9,100 more than existing homes. This marks a significant shift from the 10-year average gap of $50,657, driven by rising existing home prices due to tight inventory and builder adjustments to affordability challenges.

February Job Growth Falls Short – Private employers added just 77,000 jobs, well below expectations. Trade, transportation, and utilities saw significant losses, while leisure, hospitality, and construction showed modest gains. Analysts cite economic uncertainty, tariff concerns, and slowing consumer spending as key factors. The slowdown raises concerns about broader economic growth as businesses take a cautious hiring approach.

What did you think of today's report? |

David Robinson

Principal Broker/Managing Partner

Whenever you’re ready, there are a couple of ways I can help you:

Buy The Best Multi-Unit Properties in Utah:

Work directly with our team to find, finance, buy and manage the best multi-unit properties in Utah (2-50 units) to grow your wealth.Sell Your Multi-Unit Property for Top Dollar:

We’ll strategically position your multi-unit property for full market exposure, extract maximum value, and streamline the sales process.