- Utah Investor Report

- Posts

- Utah Multifamily Cap Rates Reach 5.75%

Utah Multifamily Cap Rates Reach 5.75%

Utah Population Growth Slowing But Still Among Top · New Millcreek Townhomes Listed for $516k/Unit · Mortgage Rates ~0.9% lower YoY

Utah Market Data

Cap Rate Trend for Commercial Multifamily in Salt Lake County & Utah County

source: CREXI

Cap Rates Reset: Utah Multifamily Finds a New Normal in the Mid-5% Range

Over the past few years, multifamily cap rates have moved higher, especially since interest rates began rising in 2022. Cap rates climbed from the low 4% range in 2021 to the mid-5% range by 2023 as buyers demanded higher returns to offset higher borrowing costs.

In 2024, cap rates bounced around but generally held steady in the low-to-mid 5% range, showing that pricing began to stabilize even as transaction volume slowed. By Q4 2025, the median sale cap rate reached about 5.75%, up nearly 10% year over year, according to Crexi.

The big takeaway: Investors are now paying prices that reflect higher required yields than in the ultra-low-rate years. Cap rates appear to be leveling out near the mid-5% range, suggesting the multifamily market in Salt Lake and Utah counties may be finding a new, more balanced pricing baseline after the rate shock of the past few years.

Featured Listings

14 brand new rental townhomes in the heart of Millcreek. There are thirty-one total units in this complex each with their own tax id. So its possible to buy two full building of 14 units or break it up into different unit counts. Each high-end townhomes has premium interior finishes including quartz waterfall countertops, modern cabinetry, high efficiency HVAC, Google Fiber, ample windows providing an abundance of natural daylight and its own tandem 2 car garage. Common area pickleball/sport court and park. Wonderful east side Millcreek location close to ski resorts, downtown Salt Lake, great schools and shopping. Willing to sell to investors in groups of 3-25 units. Target rent is 2600 +200 utility and internet fee. Target expense is 25%.

This well positioned fourplex offers a compelling opportunity for investors seeking stable income in one of Utah County's most consistently in demand rental markets. Located minutes from major employment corridors and nearby medical facilities, the property benefits from steady tenant demand tied to the broader Provo economy. Residents enjoy convenient access to Downtown Provo, home to local restaurants, shops, and year round events, as well as the Provo River Trail, offering miles of walking and biking paths through one of the area's most scenic outdoor corridors. Proximity to Utah Lake adds recreational appeal, while easy access to major roadways supports commuter convenience throughout Utah County and beyond. The surrounding neighborhood continues to see reinvestment and growth, strengthening long term appreciation potential.

Storage Hybrid/Industrial Investment - 2970 S West Temple | Asking $2,300,000 | 8,366 SF on .45 Acre | Rarely available in the Salt Lake Valley 42 shops, 2 apartments, Flex unit and office space. 100% occupied. Fantastic location in West Jordan near Jordan Landing, Airport 2, and many rooftops. Gross Income: $302,505 Expenses: $57,590 NOI: $244,915 . Owner Agent

Canovo Group may not be the listing brokerage for the above properties. The information provided is not guaranteed and should not be relied upon to make investment decisions. Buyers should complete their own analysis and due diligence before making any investment.

Mortgage Rates & Financing

Mortgage Rates (as of Jan 27, 2026)

Mortgage rates are slowly drifting lower across most loan types. The 30-year fixed is sitting around 6.15%, down almost 0.9% from a year ago, with similar year-over-year declines across FHA, VA, jumbo, and ARM products. Short-term moves are modest, but the bigger story is that rates are meaningfully lower than this time last year, even if progress has been choppy week to week.

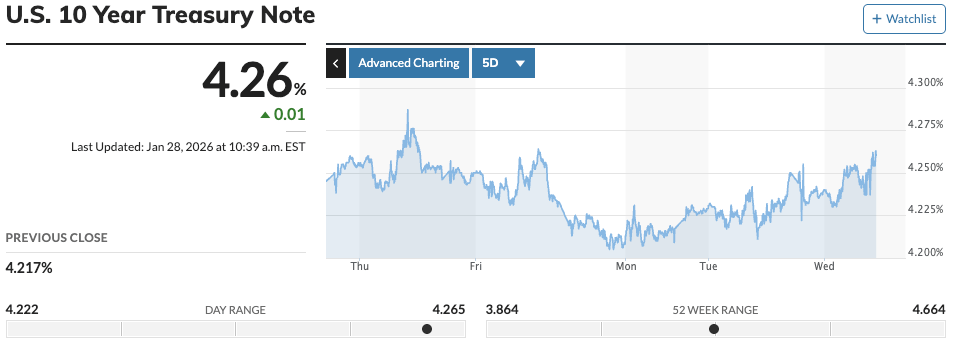

10-Year Treasury Yield (as of Jan 28, 2026)

At the same time, the 10-year Treasury is holding near 4.26%, moving sideways after recent volatility. This tells us the bond market is still cautious, but not panicking. Together, these charts suggest mortgage rates may continue to ease slowly, not crash lower—supportive for buyers and investors, but still keeping pressure on pricing and deal math.

Source: Mortgage News Daily/Market Watch

Headlines & Insights

FEATURED ARTICLE

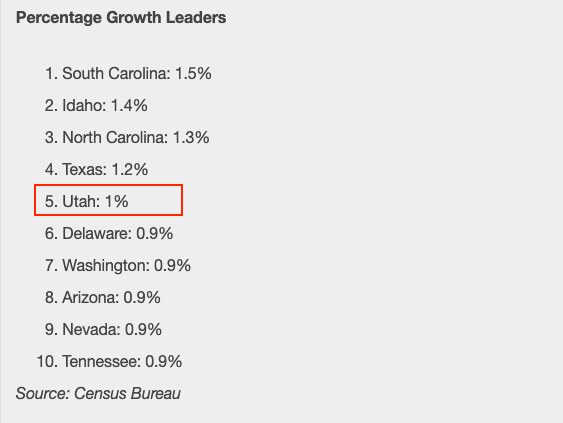

Utah’s population growth cooled in 2025, but the state still ranked among the fastest-growing in the country, according to new U.S. Census Bureau data. Growth slowed to 1% year-over-year, down from 2024, as fewer people moved into the state—but Utah continues to outperform most of the nation.

Key Takeaways

Utah added nearly 36,000 residents from July 2024 to July 2025, ranking 5th nationally in percentage growth.

Growth is now driven more by natural change (births minus deaths) than by people moving into the state, as net migration has declined.

Housing affordability and rising costs are likely contributing to slower in-migration, according to state demographers.

What This Means for Utah Investors

While Utah’s growth is moderating, it remains a top-tier growth state, especially compared to the national population growth rate of just 0.5%. Slower migration may ease some short-term housing pressure, but strong natural population growth—combined with Utah and Salt Lake counties accounting for over half of new residents—continues to support long-term demand for housing. For investors, this points to a shift from explosive growth to a more stable, sustainable environment, where location, affordability, and fundamentals matter more than ever.

Utah Headlines

New Affordable Units Funded – KeyBank is providing $43 million to help build a new affordable housing project in Salt Lake City. The project will add about 100 new housing units aimed at lower-income residents. Leaders say the investment helps address Utah’s growing housing shortage and affordability challenges.

Push for Housing Near Transit – Utah Sen. John Curtis introduced bipartisan legislation aimed at speeding up housing construction near transit stations. The proposal would reduce red tape and better align transportation funding with housing development. Supporters say it could boost housing supply, improve affordability, and make better use of existing infrastructure.

National Headlines

Fed On Hold Likely – Markets are pricing in a strong chance the Federal Reserve keeps rates unchanged at its late January meeting. Current odds show about a 97% probability that rates stay in the 3.50%–3.75% range. This suggests no near-term relief on borrowing costs, keeping pressure on housing and real estate markets.

Pandemic-Era Multifamily Loans Stressed – Multifamily loans made in 2021 and 2022 are showing stress first as low-rate loans reset in a much higher interest rate environment. Many of these deals were underwritten with aggressive rent growth and tight margins. As rates adjust and expenses rise, some owners are facing cash flow pressure and refinancing challenges.

J.P. Morgan: What's The Fed's Next Move? - "Looking ahead, J.P. Morgan Global Research expects the Fed to remain on hold through 2026, keeping the funds rate steady at 3.5–3.75%."

Build-To-Rent Momentum Holds – RealPage reports that the build-to-rent market stayed strong in late 2025, even as the broader housing market cooled. Demand for rental homes remained solid, especially in suburban areas. Slower new construction could help keep rents stable or rising into 2026.

Rates Stay Uncertain – Federal Reserve policy and signals from the White House are keeping interest rates volatile. Recent economic data shows inflation cooling, but not fast enough to guarantee rate cuts soon. As a result, mortgage rates may stay choppy, keeping pressure on housing affordability and buyer confidence.

Thinking about buying, selling, leasing or exchanging property in Utah? Let’s game plan.

David Robinson - Principal Broker | Investor

Disclaimer: Canovo Group LLC is not a registered broker-dealer, investment adviser, or financial advisor. This email is for informational purposes only and does not constitute an offer to sell, solicitation of an offer to buy, or a recommendation of any securities or investment strategies. All investments carry risk, including the potential loss of principal. Recipients should perform their own due diligence and consult with their own legal, tax, and financial advisors before making any investment decisions. Canovo Group LLC it’s licensed brokers or agents do not endorse, guarantee, or verify the accuracy of any third-party information provided herein.