- Utah Investor Report

- Posts

- Utah Homebuilding Ranks No. 4 in Nation

Utah Homebuilding Ranks No. 4 in Nation

Salt Lake City Fourplex Listed for $769k; Utah Firmly Tilted Toward Buyers Market; Capital Gains Tax Cut Coming?

> Featured Listings

Click images below to request details.

Investor Special in Clearfield! This property has been completely gutted due to fire damage and is being sold AS-IS. The interior has been stripped down to the studs, and there is currently no power to the home. This is an excellent opportunity for investors or contractors looking for a full renovation or rebuild project. Located in a well-established neighborhood with easy access to schools, parks, and major roads. Cash or hard money only.

This is the best-priced 4-plex in Salt Lake City. This property offers room for upside in rents, excellent cash-flow potential and long-term appreciation. Each unit features: 2 bedrooms, 1 full bathroom, Washer/ Dryer Hook-ups in each unit, ~884 SF. Built in 1969, this brick 3,528 SF property sits on a quiet street directly across from a park and just minutes from freeway access, making it ideal for commuters and tenants alike. 100% leased with M-T-M tenancy Very convenient neighborhood. On the Good Landlord List New Membrane Roof 2 years ago. New Sewer line less than 5 years ago

I personally work with a limited number of serious buyers to acquire 4-50 unit multifamily properties in Utah—sourced through my private pipeline of pre-market and off-market deals.

These opportunities come from years of direct-to-owner outreach, long-standing broker relationships, and my private network of over 4,000 investors. Click the button above to learn more.

Turnkey multifamily property with consistent high occupancy and a proven rental history. All four units are easily rented-tenants love the quiet & convenient location with well-maintained secluded grounds. Each unit features spacious layouts with many updates. Ideal for investors seeking stable cash flow or owner-occupants looking to live in one unit while renting out the others. Separate meters, ample parking, and onsite storage sheds. An incredible, income-producing gem-don't miss this one!

Canovo Group may not be the listing brokerage for the above properties. The information provided is not guaranteed and should not be relied upon to make investment decisions. Buyers should complete their own analysis and due diligence before making any investment.

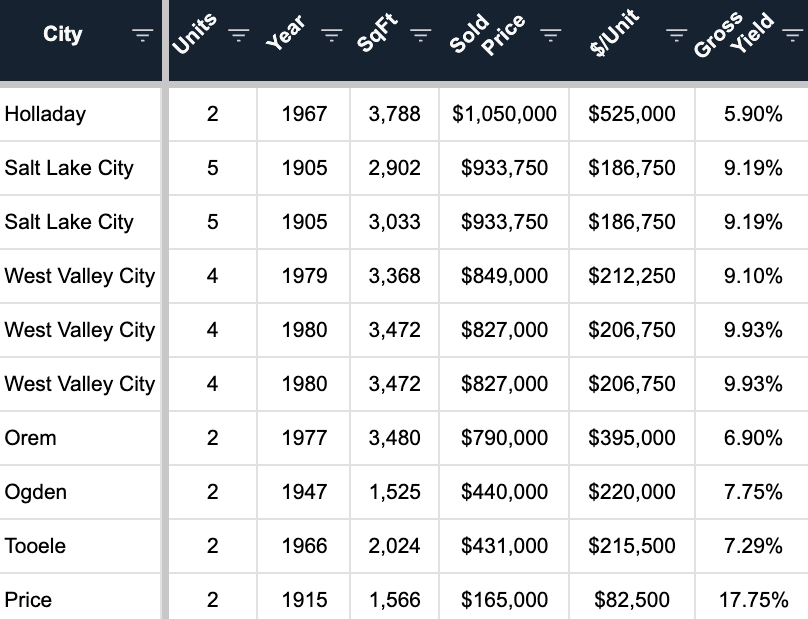

> Sold Multi-Unit Listings

What is my rental property worth?

Get a free, no obligation, property-value estimate. See nearby sales comps and market trends.

> Utah Market Data

Utah Supply vs Demand Summary — July 2025

Utah’s housing market is firmly tilted toward a buyer’s market. As of June 2025, the months of supply (MOS) rose to 3.76, the highest seasonal level in recent years, while the absorption rate dropped below 25%, indicating weaker buyer activity. The gauge shows the MOS index at 95.66%, putting it near the top end of the “buyer’s market” scale.

Looking back over the past year, supply has steadily increased while demand has softened. For example, supply grew from 9,219 listings in Dec 2024 to 13,551 by June 2025, while demand fell from over 3,100 to just 3,605 despite the inventory spike. The monthly trend chart shows a steady rise in supply since mid-2022, while the absorption rate continues to decline.

In short, more inventory and less buyer urgency mean that sellers need to price carefully and may face longer days on market. For buyers, current conditions present more choice and better negotiating power.

> Rates & Financing

Mortgage Rates as of 7/22/2025

Source: Mortgage News Daily

> Passive Investor Principles

Time-Value of Effort — Passive investing trades control for leverage. You give up decision-making power, but gain time, scalability, and access to institutional-quality deals.

> Headlines & Insights

FEATURED

U.S. apartment construction remains strong, but the number of new units completed is starting to fall after peaking in late 2024.

Main takeaways:

Developers completed 108,200 apartments in Q2 2025—down from the 159,000 peak in Q3 2024 but still historically high.

The South led all regions with nearly 57,800 units delivered, although that’s a drop from earlier quarters.

Top metro areas for new deliveries in Q2 included Dallas, New York, Phoenix, and Austin—all with more than 5,000 new units each.

What this means for Utah investors:

While Utah wasn’t called out directly, slower national apartment deliveries suggest the recent flood of new supply is tapering off. That could help stabilize rents and occupancy in fast-growing Utah markets like Salt Lake City, especially if local construction starts to cool in sync with national trends. Investors should watch for tightening rental conditions in late 2025 and 2026.

Utah Headlines

Utah Homebuilding Ranks No. 4 – Despite a 25% drop since 2022, Utah ranks No. 4 in the nation for new home construction, with 18.6 units authorized per 1,000 existing homes in 2024. The Salt Lake City, Provo-Orem-Lehi, Ogden, St. George, and Logan metros all made national top-50 rankings, showing strong building activity—even as high prices and slowing permits pose challenges.

Builder Power Grows in Utah – In 2024, Salt Lake City saw a sharp 10.5% jump in market share held by its top 10 builders, reaching nearly 70%. This marks one of the largest increases nationwide, highlighting growing consolidation among Utah’s biggest homebuilders.

Affordable New Homes Disappear in the West – From 2020 to 2024, new single-family home sales across the West—including Utah—dropped 28%, mostly in the under-$500K price range. Rising construction and regulatory costs pushed builders toward higher-end homes, shrinking affordable options for first-time and middle-income buyers.

Utah Inventory Surge – Salt Lake City and Ogden rank among the top 10 U.S. metros with the biggest jump in housing inventory over the past year. Salt Lake saw a 30.8% increase and Ogden 30.5%, signaling more choices for buyers and potential pricing pressure for sellers.

National Headlines

Capital Gains Cut Coming? – Trump voiced support for eliminating capital gains taxes on home sales, backing a new bill from Rep. Marjorie Taylor Greene. The proposal would remove the tax on primary residence profits—a move aimed at freeing up inventory and helping homeowners keep more equity.

Rise of the Accidental Landlords – More frustrated sellers are pulling listings and turning to rentals, competing with institutional investors like Invitation Homes and Progress Residential. These “accidental landlords” are especially active in Sun Belt markets, where inventory is up 20%+ year-over-year. The shift is starting to pressure rent growth, which may slow from 4–5% to just 1–2% in some areas.

Powell Under Pressure, But Not Out – Treasury Secretary Scott Bessent says Fed Chair Jerome Powell shouldn’t resign, despite political heat and controversy over a $2.5B renovation. Instead, Bessent urges an internal Fed review—excluding monetary policy—to boost transparency and right-size operations. Markets still expect no rate cut in July, but are leaning toward one in September.

David Robinson

Principal Broker/Owner

Whenever you’re ready, here are a few ways I can help you:

1. Access David’s Private Deal Flow: Get access to my private pipeline of pre-market and off-market multi-unit deals.

2. Free Property Value Estimate: Thinking about selling, exchanging, or refinancing? Request a Free Property Valuation.

3. Free 15-Minute Strategy Call: Whether you're a new or experienced investor, this quick call is a chance to talk through your goals, learn more about our services, explore investment options, or get feedback on a current property or project.