- Utah Investor Report

- Posts

- Utah Buyers Get The Upper Hand

Utah Buyers Get The Upper Hand

SLC 6-Plex with Seller Financing; Rents Cool Nationwide – Utah Feels the Pressure; SLC Property Tax Hike Approved.

Utah Market Data

Market Overview - January 2026

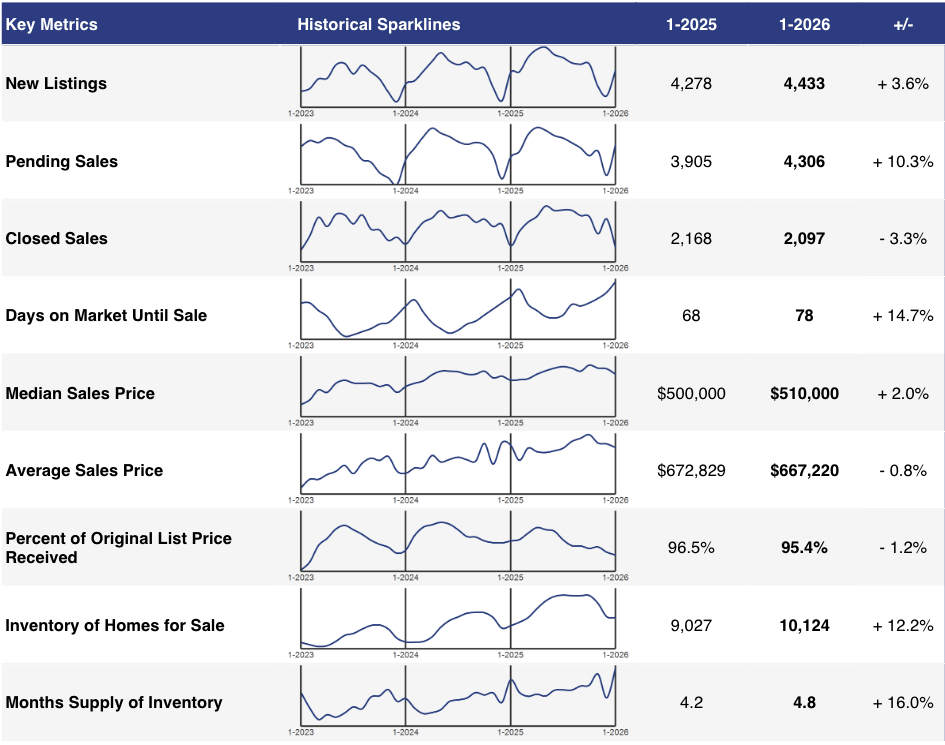

SINGLE FAMILY PROPERTY

source: WFRMLS

Single Family Summary - Inventory Grows While Prices Hold Firm

New listings increased modestly to start the year. January saw 4,433 new listings, up 3.6% from January 2025. This shows more sellers are entering the market, adding fresh supply after a tight few years.

Closed sales dipped slightly. January recorded 2,097 closed sales, down 3.3% year over year. This suggests buyer activity is a bit slower, likely due to higher interest rates and more cautious buyers.

Median sales price continued to move higher despite slower sales. The median price rose to $510,000, up 2.0% from last January. This tells us prices are still holding firm, even as inventory grows and homes take longer to sell.

Bottom line: More homes are coming on the market, fewer are closing right away, but prices are still rising. The single-family market is shifting toward better balance, not a downturn.

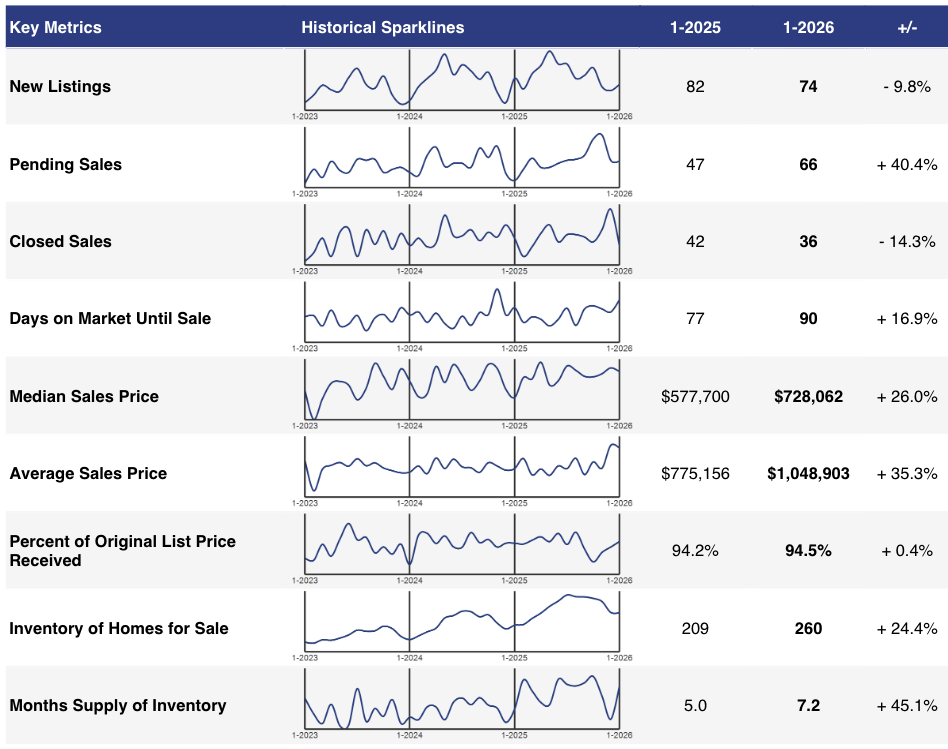

MULIT-UNIT PROPERTY (2+ UNITS)

source: WFRMLS

Multi-Unit Summary - Quieter Market, Stronger Deals for Multi-Unit Properties

New listings pulled back to start the year. January recorded 74 new multi-unit listings, down 9.8% from January 2025. This suggests fewer sellers are testing the market right now, likely due to rate uncertainty and tougher deal math.

Closed sales also slowed. There were 36 closed multi-unit sales, a 14.3% drop year over year. Even though fewer deals are closing, this is partly due to the small size of the market—just a handful of transactions can swing the numbers.

Median sales price jumped sharply. The median price rose to $728,062, up 26.0% from last January. This large increase points to higher-quality or larger properties trading, rather than broad price inflation across all deals.

Bottom line: The multi-unit market is quieter in terms of listings and sales, but pricing remains strong. Fewer deals are closing, yet the properties that do sell are commanding much higher prices, showing that serious investors are still active—just more selective.

Featured Listings

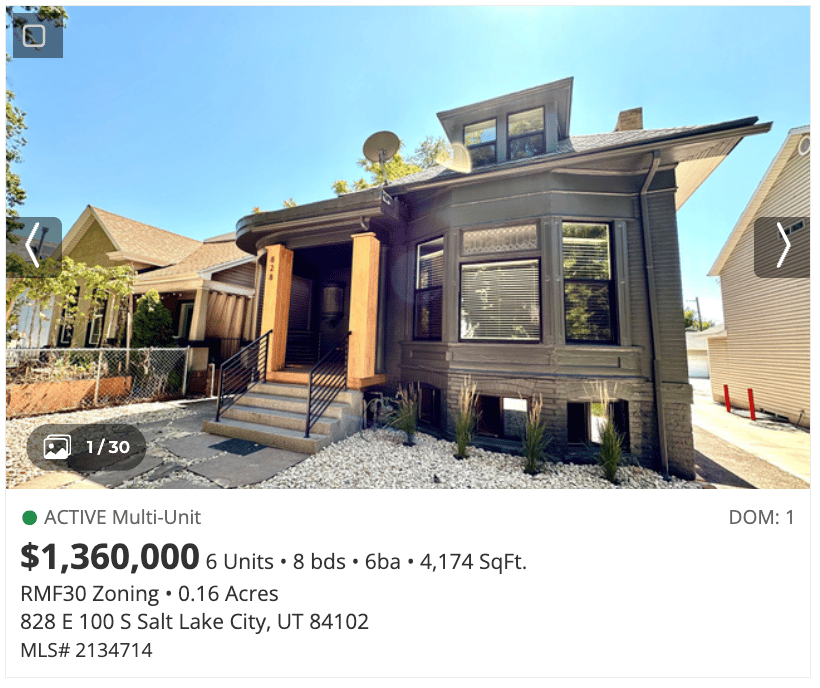

SELLER FINANCING AVAILABLE: This prime investment opportunity features six units, four of which have been recently updated with brand-new appliances and cosmetic upgrades, creating a modern and attractive living experience for tenants. Located just minutes from the University of Utah, the property benefits from consistently high rental demand due to its proximity to campus, public transportation, dining, shopping, and downtown Salt Lake City. Additional highlights include on-site parking and well-maintained shared spaces, appealing to both students and working professionals. With a mix of updated units and value-add potential, this 6-plex offers steady income today with upside for long-term growth. Square footage figures are provided as a courtesy estimate only and were obtained from tax data; buyer is advised to obtain an independent measurement. Owner is a licensed broker in the state of Utah. Seller is willing to offer seller financing with 20% down at 5.10% for approximately four years.

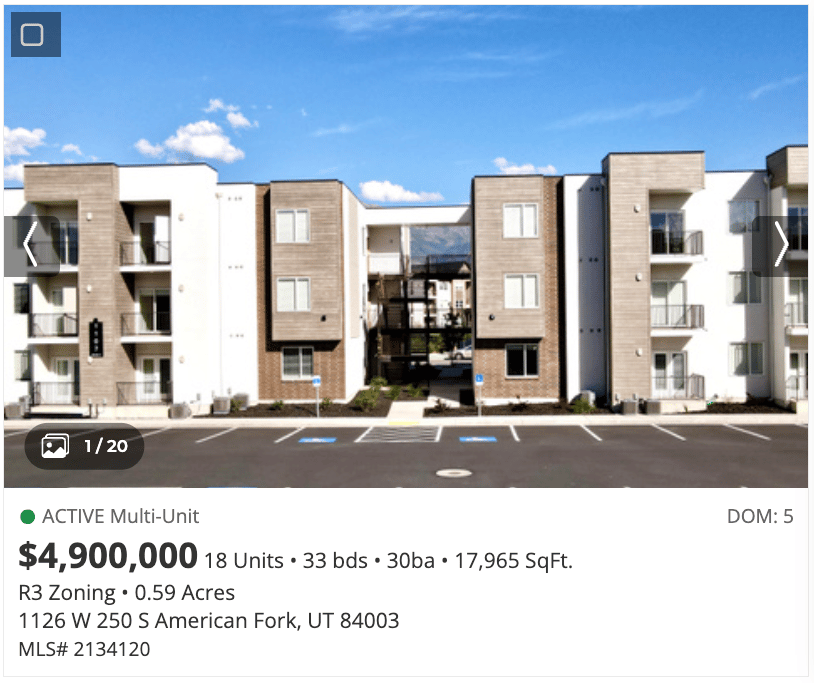

Newly constructed in 2024, this stabilized 18-unit multifamily asset offers investors a rare opportunity to acquire a modern, low-maintenance property with strong in-place rents and high occupancy. Professionally managed and thoughtfully designed, the building features contemporary finishes and efficient unit layouts that continue to drive tenant demand. Located in the heart of Utah County with convenient access to major employment centers, retail, and transportation corridors. With no deferred maintenance and minimal capital expenditure requirements, this property is well-suited for investors seeking predictable cash flow, long-term appreciation, and accelerated depreciation benefits. An excellent hands-off acquisition for 1031 exchange buyers or investors seeking a high-quality, stabilized multifamily asset.

Exceptional, ground-up constructed four-plex. Designed and built from scratch with no expense spared, this modern luxury complex features four fully custom residences, each thoughtfully crafted with high-end finishes and refined architectural detail throughout. Every unit offers the feel of a private, contemporary home-elevated design, clean lines, and intentional craftsmanship at every turn. Ideal for both owner-occupants and savvy investors, the two rear units are already leased, providing immediate rental income from day one. All four units are separate parcels, offering unmatched flexibility to live in one, rent the others, sell individually, or hold as a long-term luxury asset. This is a rare opportunity to own a newly built, income-producing property where modern living and smart investment align seamlessly. An absolute must-see.

Canovo Group may not be the listing brokerage for the above properties. The information provided is not guaranteed and should not be relied upon to make investment decisions. Buyers should complete their own analysis and due diligence before making any investment.

Mortgage Rates & Financing

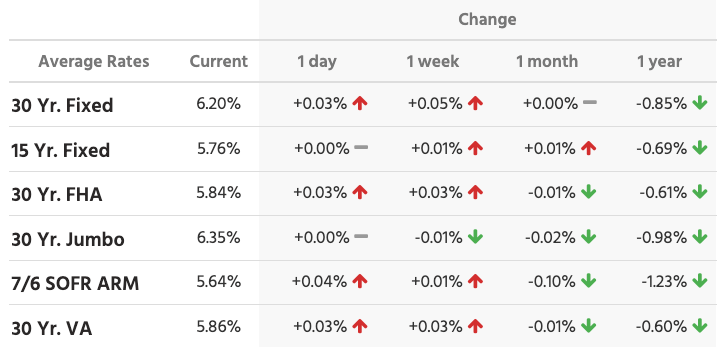

Mortgage Rates (as of Feb 4, 2026)

Mortgage rates ticked slightly higher this week, with the 30-year fixed now around 6.20% after small day-over-day and week-over-week increases. Even with this short-term bump, rates are still meaningfully lower than a year ago—down roughly 0.6% to 0.9% year over year across most loan types. The trend over the past month remains mostly flat to slightly down, showing that rates are moving sideways, not breaking out.

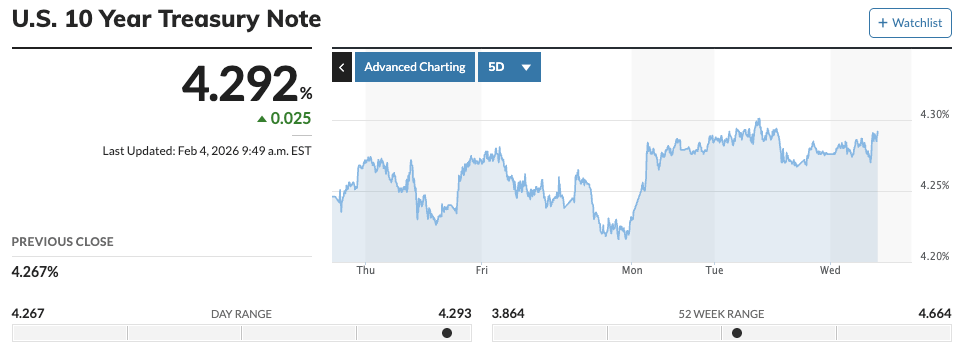

10-Year Treasury Yield (as of Feb 4, 2026)

Meanwhile, the 10-year Treasury is hovering around 4.29%, drifting higher over the last few days. This explains the recent upward pressure on mortgage rates. Bottom line: rates are choppy in the short term, but the bigger picture still points to stabilization rather than a return to last year’s highs.

Source: Mortgage News Daily/Market Watch

Headlines & Insights

FEATURED ARTICLE

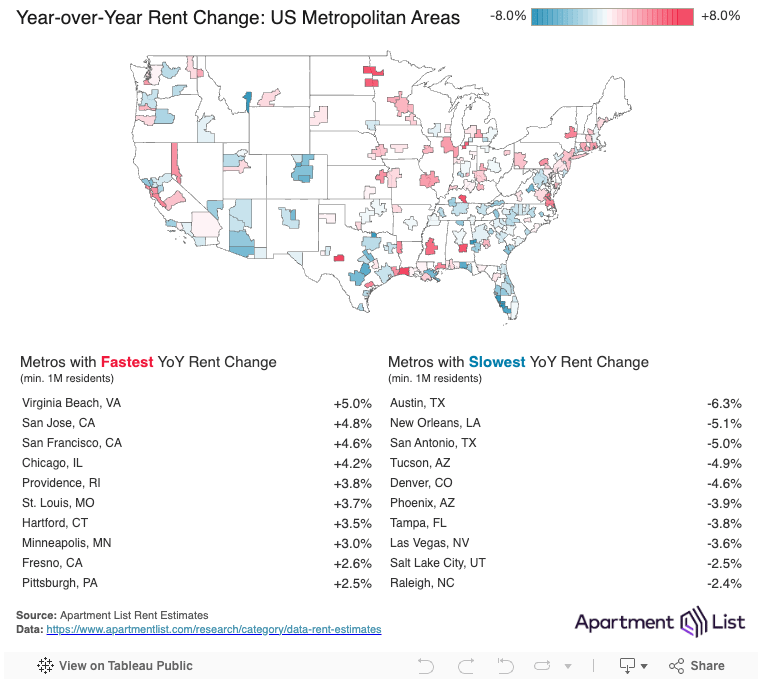

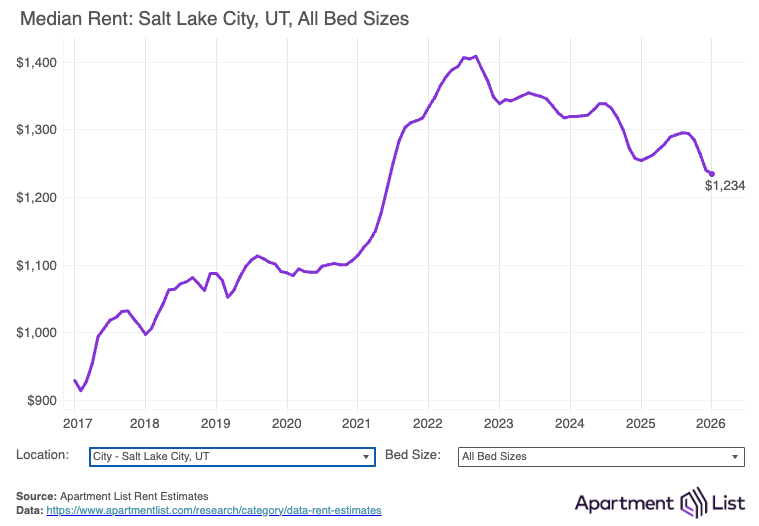

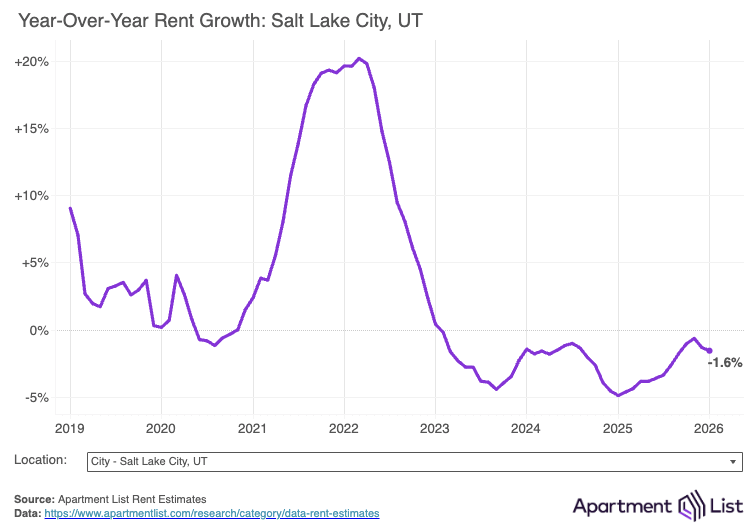

U.S. rents continued to slide in January, marking the sixth straight month of declines as elevated supply and slower demand reshape the rental market. The data shows a clear divide: while a handful of Midwest and East Coast metros are still growing, much of the Sun Belt and Mountain West—including Salt Lake City—are experiencing year-over-year rent declines and rising vacancies.

Key Takeaways

The national median rent fell 0.2% month-over-month and is now down 1.4% year-over-year, sitting at $1,353.

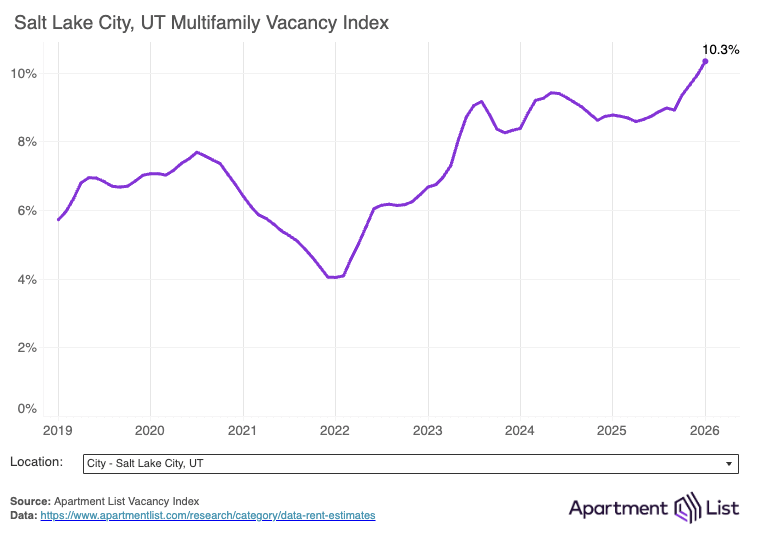

Vacancy rates are rising, with Salt Lake City’s multifamily vacancy climbing to ~10.3%, well above pre-pandemic levels.

Metro-level data places Salt Lake City among the slower rent-growth markets, down roughly 2–3% year-over-year, though not as severe as Austin, Denver, or Phoenix.

What This Means for Utah Investors

The charts confirm that Utah is in a normalization phase after an aggressive post-2020 run-up, not a structural downturn. Salt Lake City rents remain well above pre-pandemic levels, but higher vacancies and negative rent growth mean less pricing power and longer lease-up times in the short term. For Utah investors, this is a market that rewards disciplined underwriting, realistic rent assumptions, and strong operations, with opportunities emerging for buyers who can acquire quality assets while sentiment is soft and supply is still being absorbed.

Utah Headlines

Salt Lake County Property Tax Hike Approved – Salt Lake County approved a 2026 budget that includes a property tax increase of about 14.65%. For the average homeowner, this equals less than $6 per month and only affects the county’s portion of the tax bill. Officials say the increase is needed to cover rising costs and maintain essential services.

Utah Ranks #1 for Neighborly Cities – Redfin ranked Salt Lake City as the most neighborly city in the U.S. for 2026. The city stood out for high volunteerism, strong community involvement, and relatively affordable home prices. Portland and Kansas City followed close behind, showing that connection and affordability often go hand in hand.

St. George Corridor Controversy Returns – The Bureau of Land Management has re-approved the Northern Corridor highway near St. George, reigniting debate in southern Utah. Supporters say the road would reduce traffic, accidents, and travel times across the city. Opponents argue it would damage desert land, wildlife habitat, and recreation areas that define the region.

Provo Sets Housing at Top of 2026 Priorities – Marsha Judkins outlined Provo’s goals for 2026, with a strong focus on housing affordability, economic growth, and public safety. City leaders plan to remove barriers to housing, support owner-occupied homes, and encourage smart development. Collaboration, community connection, and respectful governance were key themes throughout the address.

National Headlines

More Multifamily Loans Stress – Three apartment properties moved into loan servicing in January, including two in Colorado and one in Houston. In several cases, higher expenses, ownership issues, or preferred equity clauses—not poor occupancy—triggered the distress. The trend shows how even stable properties can face trouble in today’s high-cost, high-rate environment.

High Mortgage Rates More Common – About 20% of U.S. homeowners now have mortgage rates above 6%, a sharp jump from just a few years ago. That shift is fueling a refinance rebound, with activity up sharply as rates dip. Still, small rate drops offer limited monthly savings, so affordability challenges remain.

Buyers Finally Have the Upper Hand – Homebuyers in 2025 scored the biggest discounts in over a decade, signaling a clear shift away from the pandemic-era frenzy. Nearly two-thirds of buyers paid less than the list price, and those who did saw an average discount of 7.9%, the largest since 2012.

Trump’s New Pick Signals Fed Shift – Kevin Warsh is President Donald Trump’s pick to lead the Federal Reserve. Warsh is a Fed veteran who is skeptical of aggressive stimulus and large bond-buying programs. While he supports Fed independence, his appointment could signal a tougher stance on inflation and a shift in monetary policy direction.

Thinking about buying, selling, leasing or exchanging property in Utah? Let’s game plan.

David Robinson - Principal Broker | Investor

Disclaimer: Canovo Group LLC is not a registered broker-dealer, investment adviser, or financial advisor. This email is for informational purposes only and does not constitute an offer to sell, solicitation of an offer to buy, or a recommendation of any securities or investment strategies. All investments carry risk, including the potential loss of principal. Recipients should perform their own due diligence and consult with their own legal, tax, and financial advisors before making any investment decisions. Canovo Group LLC it’s licensed brokers or agents do not endorse, guarantee, or verify the accuracy of any third-party information provided herein.