- Utah Investor Report

- Posts

- The Streak Is Over: Utah Multi-Unit Prices Pause in 2025

The Streak Is Over: Utah Multi-Unit Prices Pause in 2025

Ogden 24 Unit listed for $130k/unit; Rates Dropped Below 6% Boosting Buying Power

Utah Market Data

Median Sold Price Per SqFt Trend (Single Family vs Multi-Unit)

source: WFRMLS

Over the past decade, both single-family homes and multi-unit properties in Utah have seen strong growth in median sold price per square foot. From 2016 through 2021, prices rose steadily, with a big jump during the pandemic as demand increased and supply stayed low. For most of this period, multi-unit properties sold for slightly more per square foot than single-family homes, showing strong investor demand.

In the last few years, the market began to shift. Prices peaked around 2022, then softened in 2023 as interest rates rose. In 2024, multi-unit prices climbed again, reaching about $251 per square foot, while single-family homes stayed closer to the low $230s per square foot.

In 2025, the difference between the two markets became clearer. Single-family homes edged slightly higher, rising from about $232 to $234 per square foot, an increase of roughly 1%, showing steady and stable pricing. Multi-unit properties, however, moved the opposite direction, falling from about $251 to $241 per square foot, a drop of roughly 4% year over year. This marks one of the first meaningful price declines for multi-unit properties after many years of growth.

The big takeaway: Over the long term, both markets have grown significantly, but in 2025, single-family prices remained stable and slightly higher, while multi-unit prices declined, likely due to higher interest rates and tighter investor returns. This shows that single-family housing has been more resilient, while the multi-unit market is still adjusting to today’s financing environment.

Featured Listings

Weber Heights Apartments, a well-located, value-add multifamily investment opportunity in the heart of Ogden, Utah. Positioned just one block north of Weber State University and McKay-Dee Hospital-two of the area's largest education and employment anchors-Weber Heights offers a strong foundation of durable renter demand and long-term growth potential. The asset presents multiple clear paths to increase income, including targeted cosmetic renovations, RUBS implementation, and ancillary revenue streams. With its strategic location, proven demand drivers, and operational upside, Weber Heights Apartments represents a rare opportunity to acquire a high-performing asset in one of Ogden's most stable and supply-constrained rental corridors.

Legal rambler-style duplex near BYU on a .23-acre lot-ideal for investors or owner-occupants. Two separate units, each with 2 beds and 1 bath (4 beds/2 baths total). Updates include roof, full electrical, newer water heaters, updated HVAC, and fresh paint. Garage/storage space and ample outdoor area with room for future use. Move-in ready with rental potential.

Triplex with PRIVATE Bungalow! Tenants pay ALL UTILITIES and do snow removal. Zero-scaped property is low cost and low maintenance. Roof replaced in 2020 and on back building in 2022. NEWLY REMODELED BASEMENT UNIT. Updated W/D in #1 & #2. New AC in #1. #3 has new floors and appliances. New paint in #1, #2, & #3. Convenient to freeways and businesses, but on a quiet street. Yearly leases, but tenants could be removed for owner-occupied purchase.

Wonderful opportunity to own this clean and charming duplex in the heart of Spanish Fork! Upstairs has 3 bedrooms/1 bath, downstairs 2 bedroom/1 bath. Excellent location, close to restaurants, schools and downtown Spanish Fork main street! This will make a great investment property or house-hack! Live in one unit and rent the other!

Canovo Group may not be the listing brokerage for the above properties. The information provided is not guaranteed and should not be relied upon to make investment decisions. Buyers should complete their own analysis and due diligence before making any investment.

Mortgage Rates & Financing

Mortgage Rates (as of Jan 14, 2026)

Mortgage rates moved slightly higher today but are still clearly lower than they were a year ago. The 30-year fixed rate is at 6.07%, up a bit from yesterday, but down 1.19% year over year. Other loan types show the same pattern—small daily bumps, but solid declines compared to last year, which continues to improve affordability.

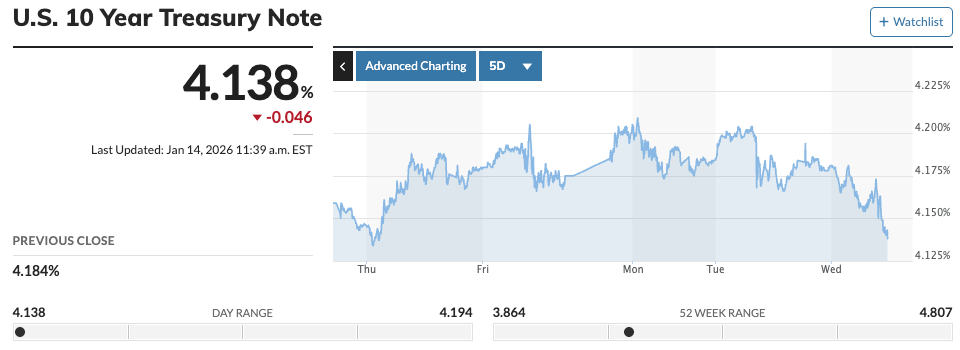

10-Year Treasury Yield (as of Jan 14, 2026)

At the same time, the 10-Year Treasury dropped to about 4.14%, down noticeably from earlier in the week. Since mortgage rates closely follow the 10-Year Treasury, this drop helps explain why rates remain lower overall despite short-term fluctuations.

Bottom line: Rates may move around day to day, but the bigger trend is still downward compared to last year, which is a positive sign for buyers and investors.

Source: Mortgage News Daily

Headlines & Insights

FEATURED ARTICLE

Rates Dipped Below 6% – Mortgage rates fell to 5.99% on January 9, the lowest level in nearly three years, after President Trump ordered a $200 billion purchase of mortgage bonds. This sudden drop has given buyers a meaningful boost in buying power.

What changed for buyers:

A buyer with a $3,000 monthly budget can now afford a home priced around $479,750, up from $466,000 just one month ago when rates were 6.35%. Compared to six months ago, when rates were closer to 6.8%, that same buyer has gained over $30,000 in purchasing power. On the median U.S. home price of about $433,000, monthly payments are now roughly $180 lower than they were last summer.

Why this matters now:

Economists caution that rates may not fall much further, as this bond purchase is relatively small by historical standards and the Fed is expected to hold rates steady in the near term. With more sellers than buyers still in the market, buyers have room to negotiate—but lower rates could bring more competition as the spring market approaches.

Bottom line:

Sub-6% mortgage rates are improving affordability for the first time in years. Buyers who have been on the sidelines may want to act soon, and sellers may benefit from listing while improved rates are drawing more serious buyers back into the market.

Utah Headlines

Salt Lake’s 2026 Housing Crossroads – Salt Lake County is expected to see lower mortgage rates and strong interest from younger buyers in 2026, which could help boost activity after a slow period. However, high home prices, slower job growth, and fewer people moving into Utah may continue to make it hard for first-time buyers to break into the market.

Housing Push at the Capitol – Utah leaders, including Gov. Spencer Cox, say affordable housing is a top priority in the 2026 legislative session, with a strong focus on building more starter homes. Lawmakers say infrastructure gaps, fees, and local regulations are slowing progress, but new partnerships and policy changes aim to keep young families in Utah and make homeownership more attainable.

Rail Investment Boosts Uintah County – Utah officials approved a performance-based tax incentive for a new rail and resource project in Uintah County that is expected to bring $87 million into the local economy over six years. The expansion is projected to create about 40 high-paying jobs and strengthen the Uinta Basin’s role in energy, logistics, and rural infrastructure growth.

National Headlines

Multifamily Debt Keeps Growing – Commercial and multifamily mortgage debt rose in the third quarter of 2025, led by strong growth in multifamily lending. Multifamily debt now totals $2.24 trillion, showing investors and lenders are still backing apartments despite market uncertainty.

Trump Housing Executive Order in the Works – The White House is drafting an executive order aimed at tackling housing affordability, including proposals to limit big investors from buying single-family homes and potentially ease access to funds like 401(k) savings for home purchases.

Inflation Cools Unevenly – December inflation showed continued easing overall, but some everyday costs like housing and services are still rising faster than the Fed’s target. This mixed picture keeps pressure on interest rates and means borrowing costs may stay higher for longer, even as inflation trends lower.

Refinance Activity Rebounds Fast – Mortgage refinance demand jumped about 40% as rates dipped to their lowest levels in months, pulling sidelined homeowners back into the market. While activity is still well below pandemic highs, even small rate declines are proving enough to unlock pent-up refinancing demand.

Trump Fed Probe Stirs Backlash – Treasury Secretary Scott Bessent warned President Trump that a criminal investigation into Federal Reserve Chair Jerome Powell has “made a mess” and could hurt financial markets, reflecting internal concern about the politically charged move. The Justice Department’s probe and Trump’s attacks on Powell have drawn criticism from lawmakers and financial leaders who say undermining Fed independence risks market confidence and complicated future Federal Reserve appointments.

Construction Costs Stay High – Building material prices kept rising in November, with costs for new homes up over 4% from a year ago, even as home construction slows. Metal products are driving most of the increase, while concrete and lumber prices have eased, keeping overall building costs elevated for builders.

Apartment Market Faces 2026 Headwinds – The U.S. apartment market may face pressure in 2026 from slower job growth, weaker consumer confidence, and less migration, which could reduce demand for new rentals. Even though new apartment construction is slowing, the large wave of supply from recent years will likely keep rents and occupancy under pressure in many markets.

Thinking about buying, selling, or exchanging investment property in Utah?

David Robinson - Principal Broker | Investor