- Utah Investor Report

- Posts

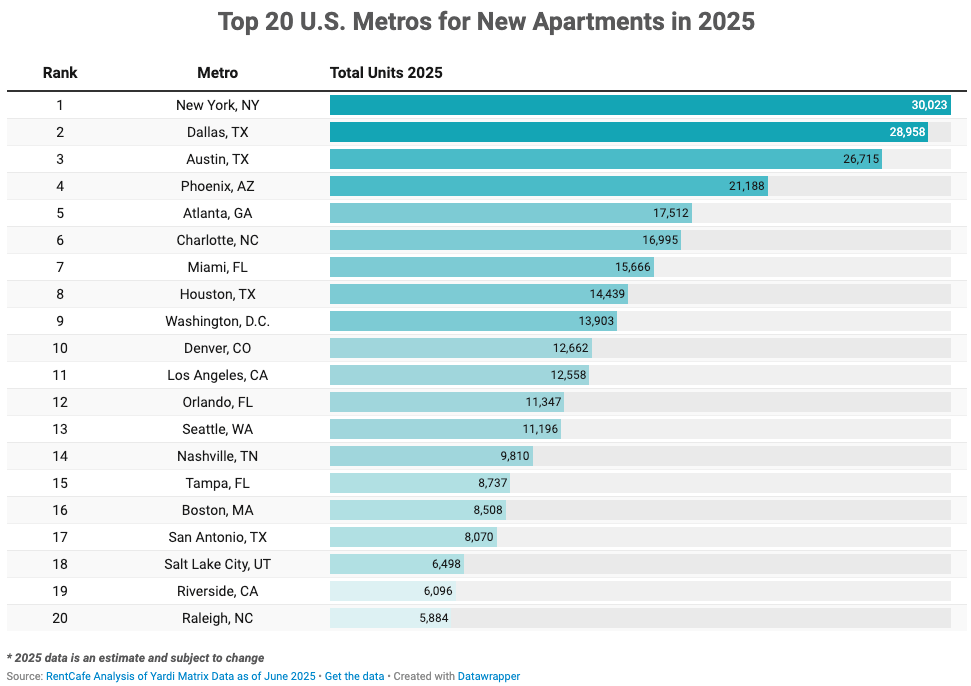

- SLC Ranks 18th in Nation for Apartment Deliveries in 2025

SLC Ranks 18th in Nation for Apartment Deliveries in 2025

Murray Duplex Sells for $389k/Unit; Seller Finance 20-unit Listed; DOM Continues to Climb in Utah

> Featured Listings

Click images below to request details.

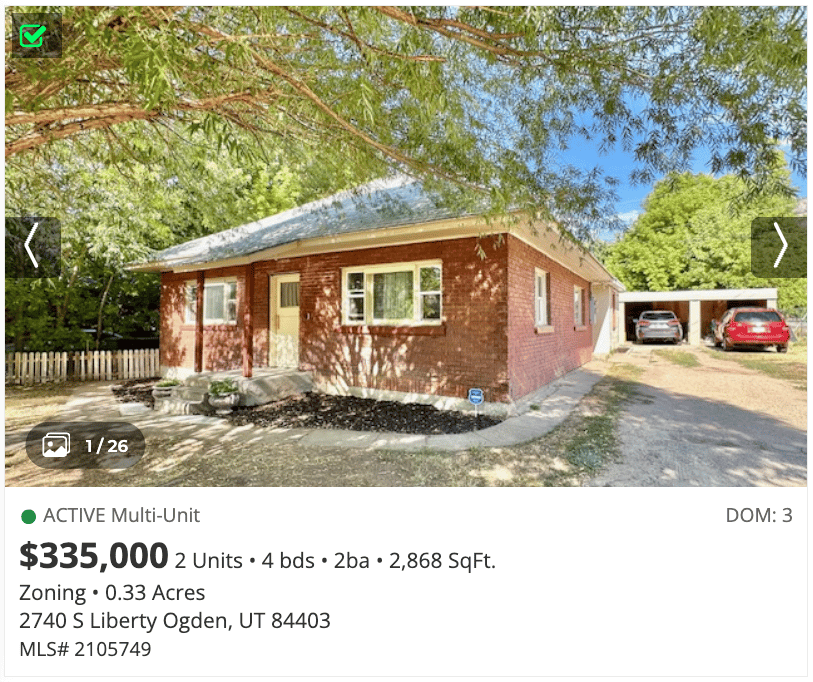

Spacious side-by-side duplex offering a prime value-add play in a strong rental market. Each unit is 3 bed/3 bath with separate gas and electric meters and central air. Currently producing $4,300/month, with room to raise rents through cosmetic upgrades. Built in 1977, this property sits on a 0.21-acre lot and offers solid construction with functional layouts. Ideal for an investor seeking a low-maintenance, cash-flowing asset with immediate upside potential.

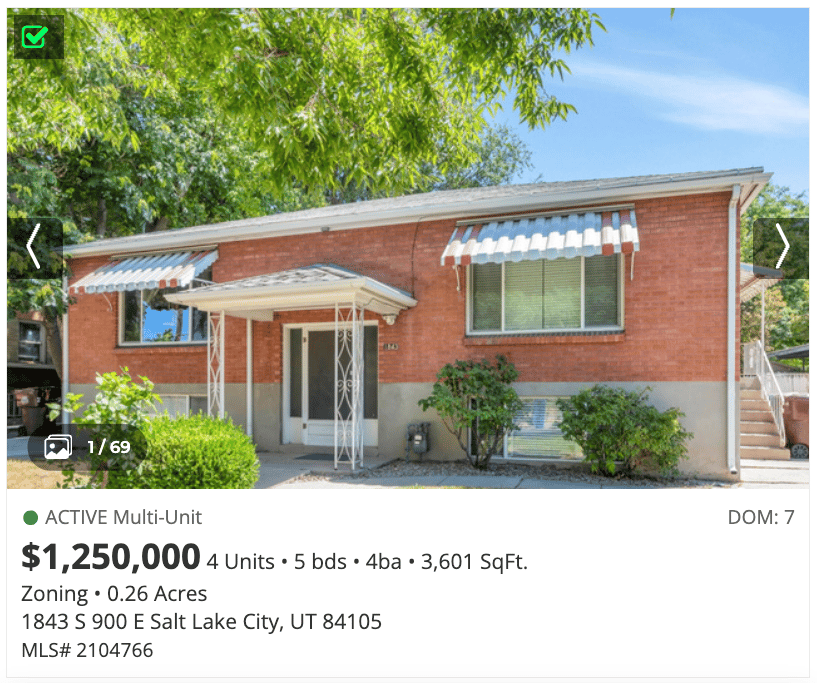

Rare Sugarhouse Fourplex. Fourplexes of this quality and location rarely hit the open market. Meticulously maintained and significantly upgraded over the years. All units have been fully remodeled with updated kitchens, bathrooms, flooring, fixtures, electrical panels, and plumbing improvements. Exterior upgrades include new double-pane vinyl windows, motion lighting, updated walkways, and a new boiler, tankless water heater, and evaporative coolers. The detached garages have been secured, finished, and freshly painted. Located on a spacious 0.26-acre lot in one of Salt Lake City's most desirable neighborhoods, this turnkey asset offers stable cash flow, low maintenance, and strong long-term appreciation potential.

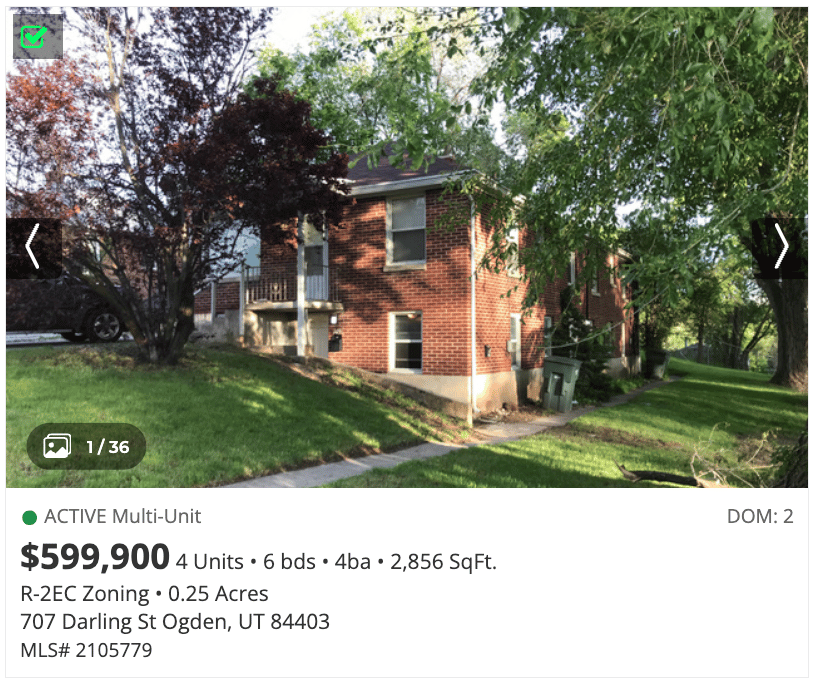

Investor-ready 4-unit property in Ogden at 707 E Darling St - well-maintained, updated unit interiors, dedicated parking, and a proven occupancy track record. Three of four units currently rented; perfect addition to a multifamily portfolio. This well-kept property blends long-term rental performance with recent, value-adding updates. Key mechanical upgrades include new water heater replaced in 2019, and a new sewer line, reducing near-term maintenance costs. Great location just steps from Monroe Park and close to 25th street amenities. Easy access to shopping and I-15. Basement units have updated kitchens with new cabinets, quartz countertops, and subway tile backsplash. Shared laundry room. Unit 709 Vacant and easy to show.

SELLER FINANCE AVAILABLE: Newer 20 plex in great Layton location. All units are Studio apartments with full size appliances including dishwasher and stackable washer/dryer. Gross rents are $20,345. Other income is 5500 and total operating expenses including property management fee is 7000. Net income after all expenses is roughly $18,800 per month. Seller willing to offer seller financing for 1 year at 4% interest with 25% downpayment.

Canovo Group may not be the listing brokerage for the above properties. The information provided is not guaranteed and should not be relied upon to make investment decisions. Buyers should complete their own analysis and due diligence before making any investment.

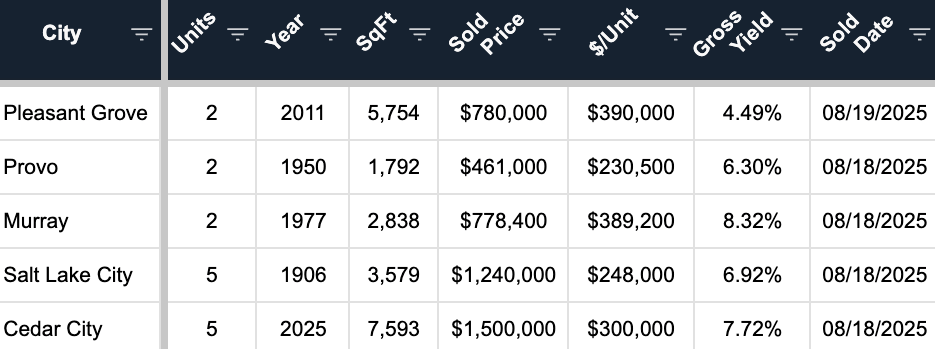

> Sold Multi-Unit Listings

Trapped Equity?

Do you have years of built up equity trapped in your property? Is your equity under-performing? Get a free, no obligation, Trapped Equity Analysis.

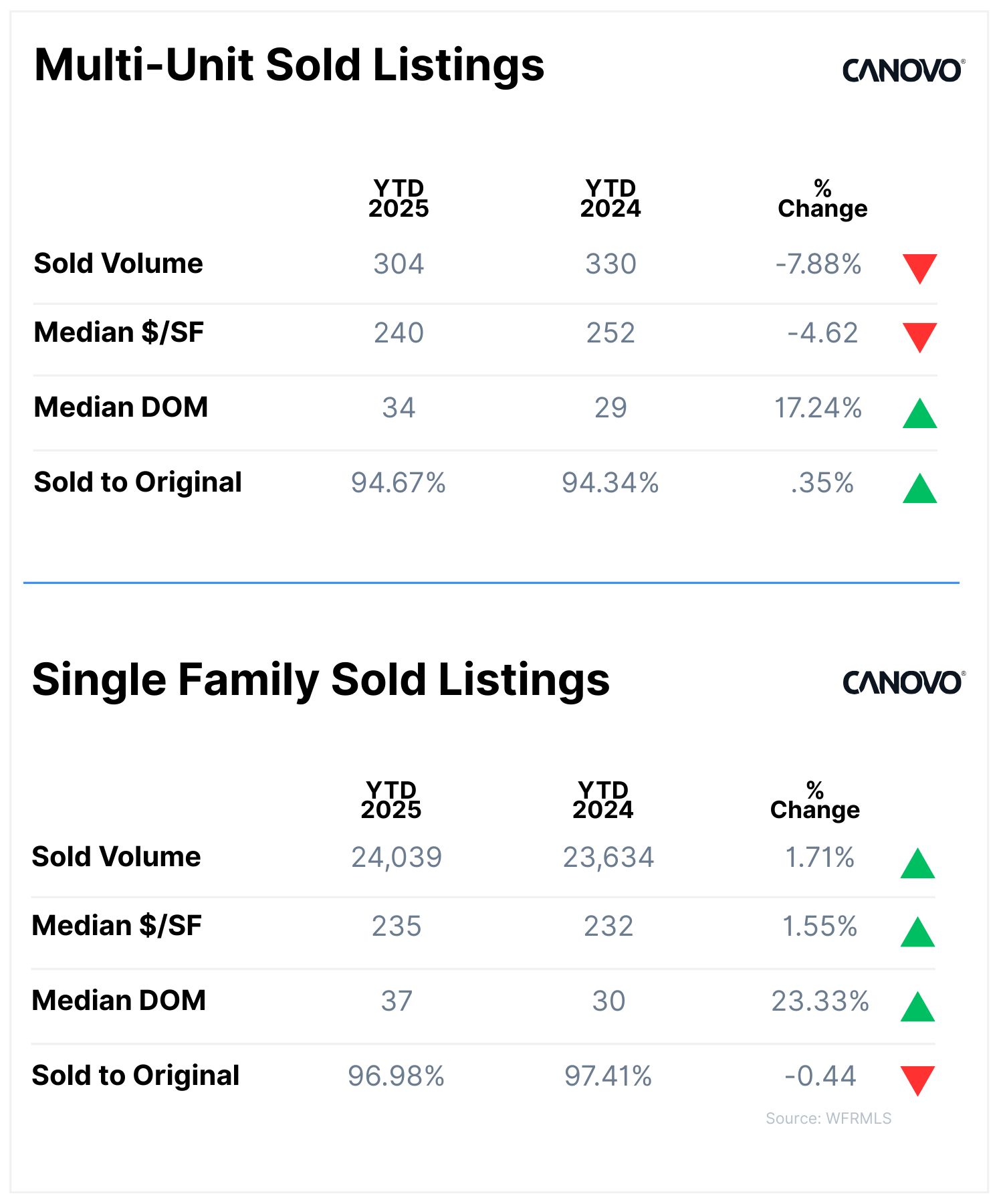

> Utah Market Data

> Rates & Financing

Mortgage Rates as of 8/19/2025

Source: Mortgage News Daily

> Passive Investor Principles

Cash Flow ≠ Return — Distributions are only part of your return. Real wealth comes from a combination of cash flow, equity upside, and tax advantages.

> Headlines & Insights

FEATURED

SLC Ranks 18th in Nation for Apartment Deliveries in 2025

The U.S. is on track to add over 500,000 new apartment units this year, led by major construction in the South and key cities like New York, Dallas, and Austin. While down from 2024’s record pace, this year’s supply is still well above normal.

Main takeaways:

The South leads the nation, with 265,000+ new units expected in 2025 — more than half of all U.S. apartment completions.

Texas metros dominate the list, with Austin, Dallas, and Houston all ranking in the top 10 cities for new construction.

Salt Lake City, UT, ranks 18th nationally, with 6,498 new units in the metro and 4,189 in the city proper, showing strong local growth despite national headwinds.

What this means for Utah investors:

Salt Lake City is still growing – With over 6,000 units being delivered in 2025, multifamily remains a strong asset class across the Wasatch Front.

National oversupply could soften rents elsewhere – While Utah’s growth is more moderate, investors should watch how oversupply in the South and Texas impacts national rent trends.

Now’s the time to focus on location and tenant demand – In a year of big deliveries, Utah’s more balanced market may offer less risk and steadier cash flow compared to boom-and-bust metros like Austin or Phoenix.

Consider infill and Class B opportunities – With many new units being high-end, demand for well-located, modestly priced rentals in Utah is likely to remain strong.

Utah Headlines

Homelessness Rising in Utah — A new state report shows homelessness in Utah jumped 18% in 2025, with chronic homelessness up 36%. While officials say recent investments are helping some, housing shortages, mental health challenges, and economic pressures are driving a growing humanitarian crisis—especially in Salt Lake County.

New Downtown Venue Announced — Smith Entertainment Group and Live Nation will build a 6,000-seat indoor concert venue in Salt Lake City’s new Downtown entertainment district. The mid-size space is designed to attract major touring acts that currently skip over Utah, boosting the city’s cultural scene and drawing over a million visitors annually.

National Headlines

Rates in a Holding Pattern Ahead of Fed Meeting — Treasury yields stayed flat this week as investors await the Fed's July meeting minutes and Jerome Powell’s Jackson Hole speech. With Utah buyers watching mortgage rate trends closely, markets are now pricing in an 83% chance of a rate cut in September.

Builder Sentiment Stays Subdued — Builder confidence remains stuck at low levels, with the national index at 32 in August. Western region builders, including Utah, reported the lowest sentiment nationwide at just 24, signaling ongoing affordability and buyer traffic challenges in the state.

Supply Drop Coming — Utah isn’t on the “deepest drop” list, but national trends suggest a meaningful slowdown is ahead. U.S. apartment completions are expected to fall nearly 34% next year, returning to more normal supply levels. This decline in new units could strengthen occupancy and rent growth across Utah’s multifamily markets.

David Robinson

Principal Broker/Owner

Whenever you’re ready, here are a few ways I can help you:

1. Access David’s Private Deal Flow: Get access to my private pipeline of pre-market and off-market multi-unit deals.

2. Free Property Value Estimate: Thinking about selling, exchanging, or refinancing? Request a Free Property Valuation.

3. Free 15-Minute Strategy Call: Whether you're a new or experienced investor, this quick call is a chance to talk through your goals, learn more about our services, explore investment options, or get feedback on a current property or project.