- Utah Investor Report

- Posts

- SLC Avenues Plan Update

SLC Avenues Plan Update

SLC Duplex Sells for $350k; Mortgage Rates Down .25% on the Week

> Featured Listings

Click images below to request details.

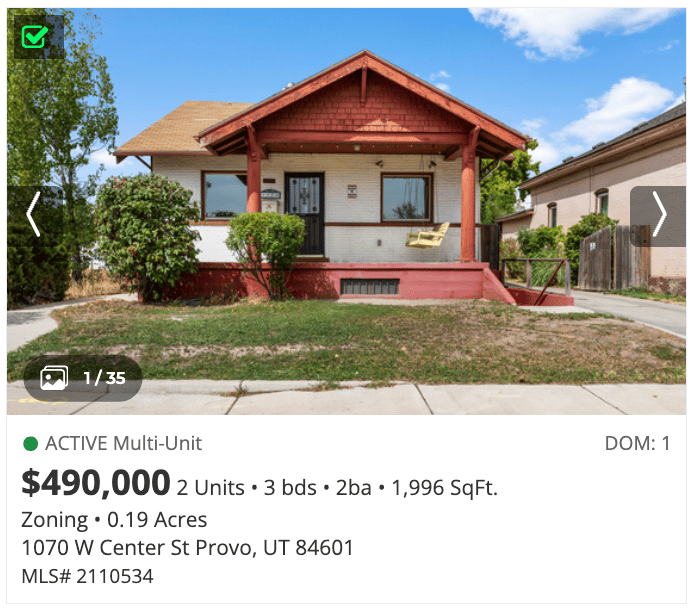

This Legal Duplex is a charming and well-cared-for rambler in the heart of Provo! Ideally located near freeway access, Brigham Young University, Utah Valley University, and Provo Center Street's dining and shopping, this home offers convenience and comfort. Featuring some modern updates with old-school charm, a spacious lot with a large patio, and a storage shed, it's perfect for outdoor entertaining. The basement includes a kitchenette and its own private entry, providing versatile living options and great potential income earning property.

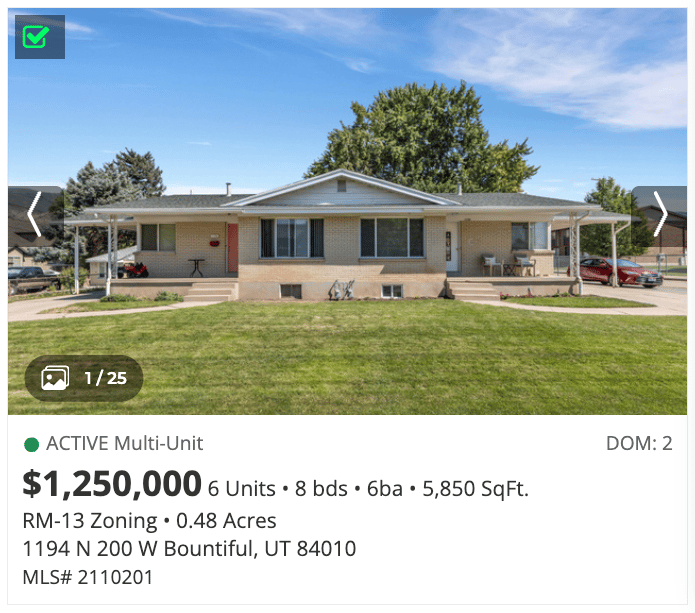

Unique investment opportunity in Bountiful. This property includes both a duplex and a 4-plex, offering six total units-all fully occupied with rents currently below market value. Significant upside exists with improvements and rent adjustments. Each unit features a carport with storage and laundry hookups. The duplex units also include unfinished basements with walkouts that could be finished to add additional bedrooms and bathrooms which would provide a large value & rent increase possibility. Conveniently located near Viewmont High School, local amenities, and freeway access.

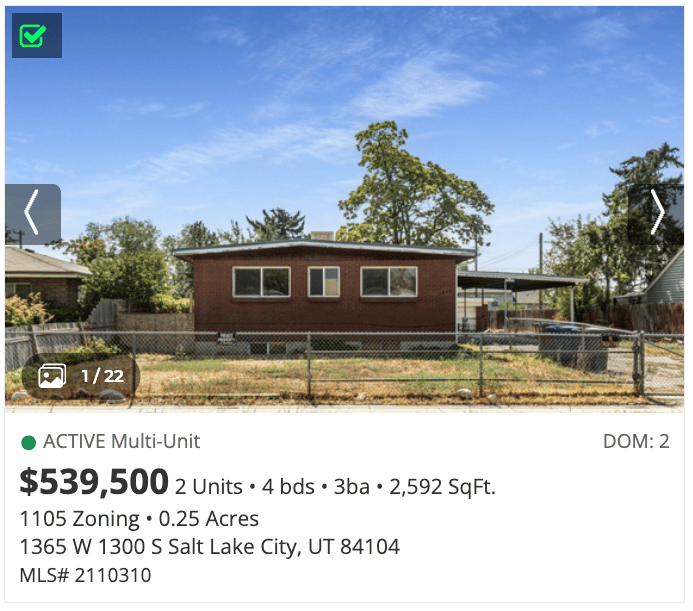

Rare investment opportunity with this versatile up/down duplex, ideally situated just minutes from the heart of Downtown Salt Lake City, Salt Lake International Airport , shopping, restaurants, fair grounds. Whether you're an investor looking for strong rental income or a homeowner wanting to offset your mortgage, this property delivers on flexibility, space, and convenience. The upper-level unit features a spacious layout with 3 bedrooms and 2 full bathrooms, ideal for families or roommates. You'll appreciate the comfort of brand-new carpeting, ample natural light, and a fully equipped kitchen ready for everyday living or entertaining. The lower-level unit offers a cozy yet functional 1-bedroom, 3/4 bathroom setup with its own private entrance and full kitchen, perfect for guests, tenants, or short-term rentals. This lock-off configuration provides excellent income-generating potential with full separation between units. Out back, a large garage with a mechanic's bay offers rare workspace potential, great for hobbyists, gearheads, or extra storage. Whether you're house hacking, expanding your portfolio, or looking for a multi-generational setup, this duplex combines location, practicality, and income opportunity into one smart purchase.

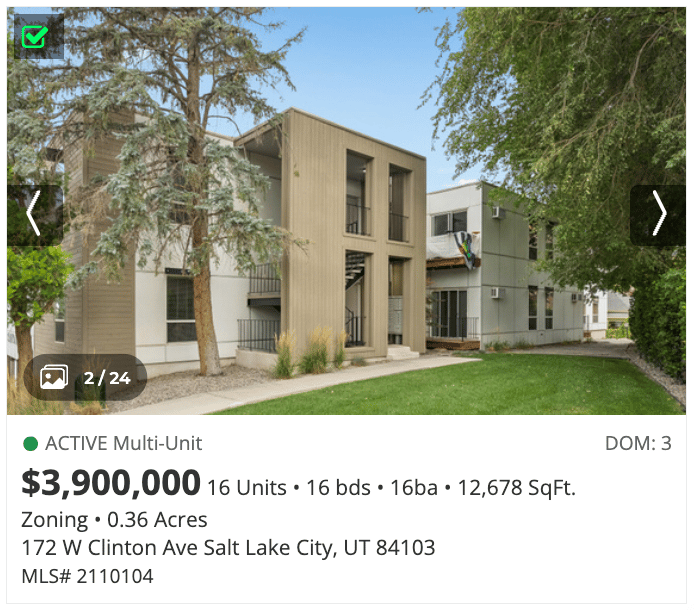

ASSUMABLE FINANCING: 16 Plex in eastern Marmalade district. High growth area with amazing walkability to local restaurants and amenities. All units are updated and property is professionally managed and maintained. Exterior recently renovated with modern features. Don't miss this opportunity to owner a turn key investment in Salt Lake City. # of Units 16 Current monthly Income RENT $22,169 Other Monthly Income $1,960 Total Possible Annual Income $289,548 Price per Door $243,750 Inquire about amazing ASSUMABLE financing on this property.

Canovo Group may not be the listing brokerage for the above properties. The information provided is not guaranteed and should not be relied upon to make investment decisions. Buyers should complete their own analysis and due diligence before making any investment.

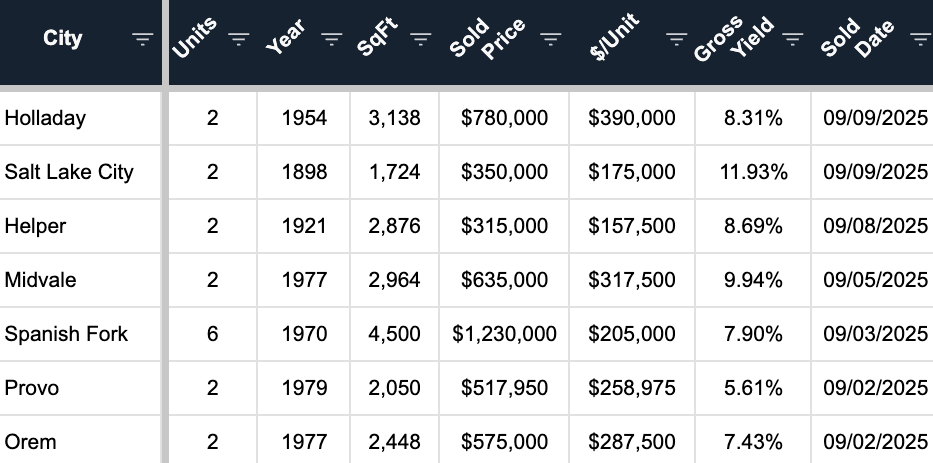

> Sold Multi-Unit Listings

Is it time to sell or refinance?

Request a free, no obligation property value estimate. Get market rent data, sales comparables and a return on equity analysis.

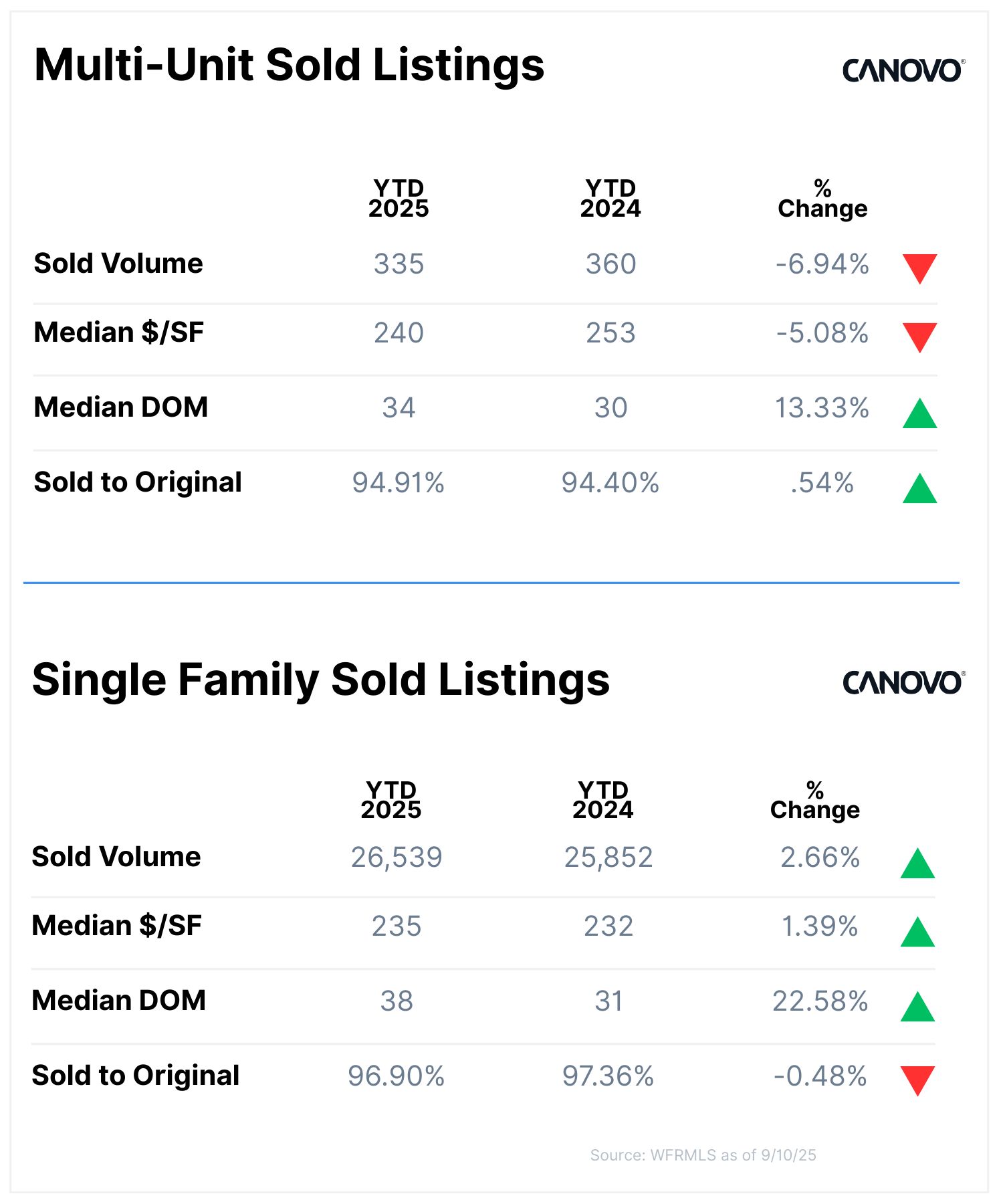

> Utah Market Data

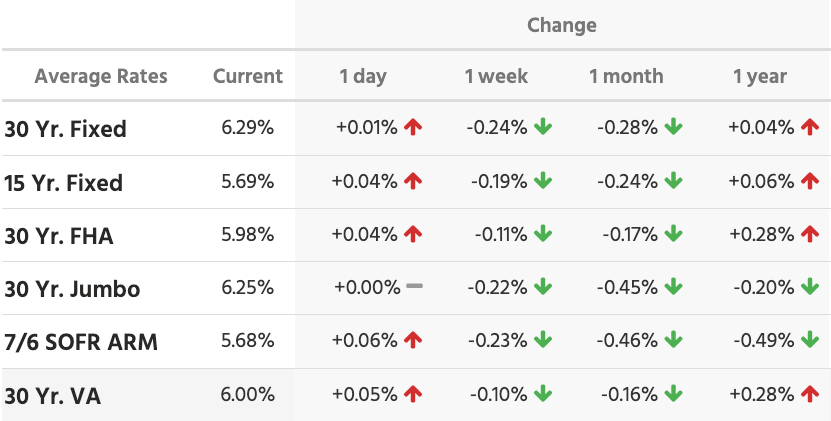

> Rates & Financing

Mortgage Rates as of 9/10/2025

Source: Mortgage News Daily

> Headlines & Insights

Utah Headlines

Steel-to-Townhomes in Salt Lake — Developers cut the ribbon on TheYard, a 157-unit townhome community built on the former Mark Steel Company site near the Jordan River Parkway. About half the units are now open, with rents ranging from $2,395 to $3,095 for mostly three- and four-bedroom layouts. The project benefited from opportunity zone incentives and extensive land remediation. Positioned near the future “Power District,” which could include a new MLB stadium, TheYard signals how underutilized industrial land in Salt Lake is being transformed into family-friendly rental housing with room to grow.

Avenues Plan Update — For the first time since 1987, Salt Lake City is updating its master plan for the historic Avenues neighborhood. The 3,000-acre area, home to about 16,500 residents, is dominated by homes built before 1920 and protected by multiple historic districts. City planners say housing affordability, transportation safety, and a lack of local businesses are top concerns. Surveys show residents want more housing options like adaptive reuse and mixed-use development—so long as new projects respect the neighborhood’s character. A final plan is expected in 2026, shaping zoning, housing, and growth policy for decades ahead.

National Headlines

Lumber Hits Yearly Low — Lumber prices sank to $526 per thousand board feet, their lowest in a year and down 24% since August’s peak. Oversupply, weak demand, and tariff uncertainty with Canada are driving the slump, signaling slower homebuilding ahead. For Utah, where construction costs directly impact housing supply, falling lumber prices could ease builder expenses but also reflect broader housing market weakness.

Yields Ease on Soft Inflation – Treasury yields slipped after August wholesale prices unexpectedly fell 0.1%, fueling bets that the Fed will cut rates next week. The 10-year yield dipped to 4.07%, while traders now see a 100% chance of at least a quarter-point cut in September. Lower yields could translate into falling mortgage rates, a welcome shift for Utah buyers and refinancers.

Jobs Revised Sharply Down – The Labor Department cut prior job growth estimates by 911,000 through March, the biggest downward revision on record. The weaker labor market signals slower income growth and bolsters the case for Fed rate cuts, though it also points to a shakier economic foundation heading into late 2025.

AI Talent Drives Real Estate Demand — The U.S. and Canada saw a 50% surge in AI-skilled workers over the past year, now totaling 517,000, with talent concentrated in San Francisco, New York, Seattle, Toronto, and D.C. This influx is reshaping office and apartment demand: AI firms accounted for 17% of U.S. leasing in early 2025, and rents in top AI markets like Manhattan and Seattle are rising as high salaries support affordability.

Job Growth Slows — U.S. job growth nearly stalled in August, adding just 22,000 positions, while unemployment rose to 4.3%, the highest in almost four years. Construction took another hit, losing 7,000 jobs—including 6,100 in residential building—continuing a six-month trend of weakness.

Apartments Show Signs of Softness — U.S. apartment occupancy dipped to 95.4% in August, right at the five-year average but down slightly from July. For the first time since 2021, annual rents fell nationwide, slipping 0.2% year-over-year. The South and West—regions that include Utah—led the decline, with oversupply in cities like Austin, Denver, and Phoenix dragging performance lower.

Few Markets Buck Supply Slowdown — While U.S. apartment completions are set to fall nearly 34% over the next year, only 10 major metros are projected to see new supply increase. Los Angeles leads with deliveries nearly doubling to 15,500 units, followed by sharp jumps in Detroit, San Diego, Anaheim, and Cincinnati. Fort Worth stands out in Texas with a 23% increase, while Northeast markets like New York, Boston, Newark, and Pittsburgh will see smaller gains.

David Robinson

Principal Broker/Owner

Thinking about buying, selling, or exchanging investment property in Utah?