- Utah Investor Report

- Posts

- Salt Lake City Ranks 8th For Deepest Rent Cuts

Salt Lake City Ranks 8th For Deepest Rent Cuts

Utah Single Family Home Inventory Spikes 49% in April; Utah Home Builders start to sweeten deals to attract buyers.

Featured Listings

> Click images below to view details and run cash flow analysis.

Looking for Off-Market Deals?

We work with a select number of serious buyers through our Off-Market Acquisition System™—a proven process for quietly sourcing 2–50 unit properties directly from long-term owners before they ever hit the MLS, Loopnet, or Crexi. Learn More

Canovo Group may not be the listing brokerage for the above properties. The information provided is not guaranteed and should not be relied upon to make investment decisions. Buyers should complete their own analysis and due diligence before making any investment.

Sold Multi-Unit Listings This Past Week

Utah Market Data - April Review

> Multi-Unit (2+ Units)

Closed Multi-Unit Sales

Closed Multi-Unit Sales was up 18.4% in April compared to last year but down slightly YTD going from 150 to 149.

Median Sales Price

Median sales price for multi-unit property was up 2.7% in April compared to 2024 and up 2.3% YTD going from $671,200 to $686,600.

Total Available Listings For Sale

Inventory of available listings was up 31% in April compared to 2024 going from 197 to 258.

> Single Family Homes

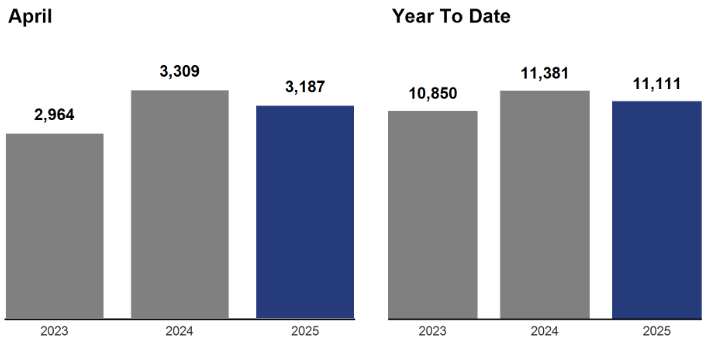

Closed Single Family Home Sales

Closed single family homes sales was down 3.7% in April compared to 2024 and down 2.4% YTD going from 11,381 to 11,111.

Median Sales Price for Single Family Homes

The median sales price for single family homes was up ~1% in April compared to 2024 and up 1.2% YTD going from 499k to 505k.

Single Family Home Listings for Sale

The total number of available single family home listings is up 49% in April compared to 2024 going from 7,545 to 11,259.

Rates & Financing

> Mortgage Rates as of 5/6/2025

Source: Mortgage News Daily

Headlines & Insights

FEATURED

U.S. apartment occupancy jumped to 95.7 % in April—the biggest April boost since 2010—even as rent growth cooled, signaling operators are prioritizing filled units over higher rents.

Salt Lake City ranks among the top market with deepest rent cuts over last 12 months

Key insights:

Occupancy rose 40 bps month‑over‑month to 95.7 %.

Effective rents grew just 0.2 % MoM, trimming annual rent growth to 1.0 %.

High‑supply markets like Salt Lake City, Denver and Austin gained 50 bps in occupancy.

Renewal rates ticked up to 55 %, while lead volume stayed strong—pointing to sustained leasing demand.

What this means for Utah investors:

Salt Lake City’s 0.5‑point occupancy pop shows local demand heating up early in prime leasing season. Expect tighter vacancy but modest rent growth—an ideal setup for value‑add plays that boost NOI through renovations and fee income rather than rent hikes alone. Read More

Utah Headlines

Utah Landlord‑Tenant Coalition Forms - A new Landlord & Community Partners Coalition aims to connect property owners and renters with rent‑relief and voucher resources to cut evictions across Utah.

Builders Sweeten Deals to Attract Buyers – With home sales slowing, builders are offering big perks like lower mortgage rates, price cuts, and even $5,000 vouchers to help buyers afford new homes. These deals aim to make monthly payments easier and get more people to buy.

National Headlines

Fed Expected to Hold Rates Steady- With inflation still elevated and tariffs fueling economic uncertainty, the Federal Reserve is expected to hold interest rates steady this week—affecting borrowing costs across credit cards, mortgages, auto loans, and more.

New‑vs‑Existing Home Price Gap Narrows- Median new‑home prices fell to $416.9K, leaving just a $14.6K premium over existing homes—the smallest spread in years as builders cut prices while resale supply stays tight.

Record Monthly Housing Costs- Redfin says the typical buyer payment hit an all‑time high $2,870, pushing mortgage‑purchase apps down 6 % MoM and pending sales off 2.8 % YoY. Listings, however, are up 6.1 % YoY.

What did you think of today's report? |

David Robinson

Principal Broker/Owner

Whenever you’re ready, there are a couple of ways I can help you:

Skip the MLS, Crexi & Loopnet—Buy Off-Market Multifamily

We work with a select number of serious buyers through our Off-Market Acquisition System™—a proven process for quietly sourcing 4–50 unit properties directly from owners before they ever hit the open market.Sell Your Multi-Unit Property for Top Dollar:

We’ll strategically position your multi-unit property for full market exposure, extract maximum value, and streamline the sales process.