- Utah Investor Report

- Posts

- Rates Climb After Fed Cut

Rates Climb After Fed Cut

October Utah Market Review; Multifamily Delinquencies Hit 10-year High; Layton 20-unit Seller for $167k/unit;

> Featured Listings

Great duplex in the heart of Logan. Recently updated with new paint inside and out, new lights fixtures/switches/outlets, new roof on the shed (new roof on the home approximately 8 years ago) new carpet, some new appliances and new fence. Property has been well maintained and has an excellent rental history. All appliances included including washer/dryer in both units.

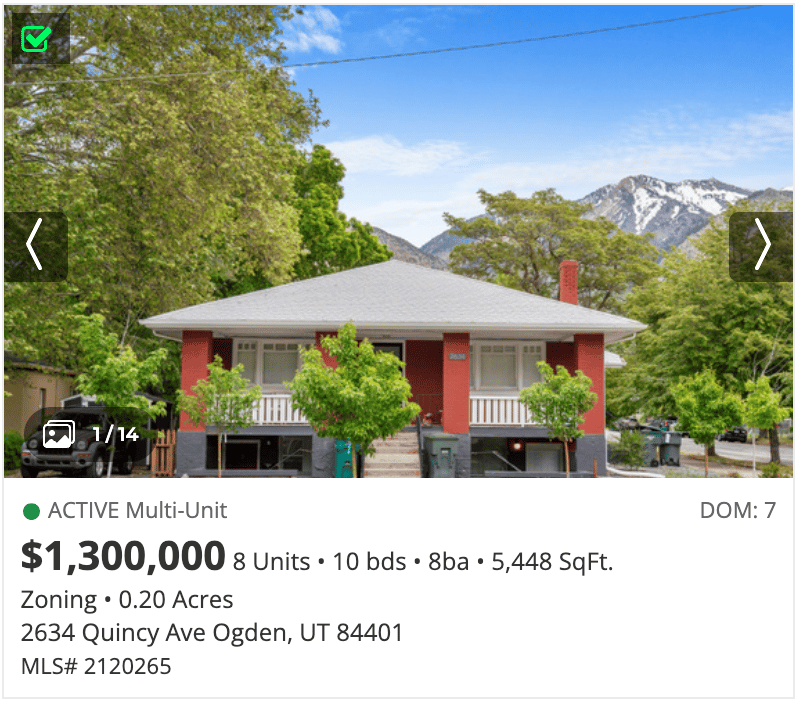

Located strategically between downtown Ogden and Weber State, the Quincy Avenue Apartments present an exceptional investment opportunity. This renovated property features modern upgrades such as new vinyl flooring, granite countertops, and French Gray painted walls across units. Professionally managed and maintained, the property ensures high standards while offering potential for increased income through self-management. With comprehensive renovations completed and scope for further enhancements, this opportunity combines contemporary living with future growth potential. The prime location, coupled with extensive upgrades, positions Quincy Avenue Apartments as a lucrative asset for discerning investors.

The Monterey Apartments, a rare opportunity to acquire a well-maintained multifamily asset located near the University of Utah in one of Salt Lake City’s most established rental corridors. The property offers investors a value-add investment with immediate upside through targeted interior renovations. Positioned in a high-demand pocket of Salt Lake City, Monterey Apartments benefits from durable tenant demand driven by its proximity to major employment, higher education, and healthcare anchors. With the potential to capture ~$250 rent premiums through interior upgrades, Monterey presents a compelling value-add opportunity in a market known for its economic resilience, consistent renter demand, and long-term growth trajectory.

Canovo Group may not be the listing brokerage for the above properties. The information provided is not guaranteed and should not be relied upon to make investment decisions. Buyers should complete their own analysis and due diligence before making any investment.

> Sold Multi-Unit Listings

Sell Your Property for Top Dollar

Request a free, no obligation property value estimate. Get market rent data, sales comparables and a return on equity analysis.

> Utah Market Data

Monthly Metrics - October 2025

Utah’s housing market in October 2025 shows a clear shift toward balance. New listings continue to rise, bringing more inventory to the market, while closed sales remain steady but slightly below last year’s pace. Homes are taking longer to sell, with the average days on market climbing to 65. Despite the slower pace, median home prices reached new highs—up to $626,750 in October—showing that values remain strong. Meanwhile, overall inventory has grown sharply to more than 13,000 homes statewide, signaling more choices for buyers and a market gradually moving away from the tight conditions of previous years.

New Listings

New Listings – Utah saw a continued rise in new listings this October, reaching 4,915 compared to 4,670 last year. Year-to-date totals are also higher at 51,783, showing that more homeowners are choosing to list their properties in 2025.

Closed Sales

Closed Sales – Closed sales came in at 3,226 for October, slightly below last year’s 3,309. However, year-to-date sales remain strong at 32,878, up from 31,980 in 2024, indicating steady buyer demand despite a cooling pace.

Days on Market

Days on Market – Homes are taking longer to sell, averaging 65 days on the market this October versus 56 days last year. Year-to-date, the average is 61 days, suggesting a slower-moving market as inventory levels increase.

Median Sales Price

Median Sales Price – Utah’s median home price climbed again in October, reaching $626,750, up from $515,000 last year. Year-to-date, prices are also higher at $515,000, showing steady appreciation despite more inventory on the market.

Inventory of Homes for Sale

Inventory of Homes for Sale – Active listings continued to rise, with 13,335 homes for sale in October compared to 11,003 last year and 9,339 in 2023. This marks a significant increase in available inventory, giving buyers more options and easing competition.

> Rates & Financing

Mortgage Rates as of 11/05/2025

Source: Mortgage News Daily

> Headlines & Insights

U.S. Home Sales Hit 30-Year Low

Only 28 out of every 1,000 homes changed hands in 2025—the lowest turnover rate since the 1990s. With affordability stretched and homeowners clinging to sub-5% mortgages, the U.S. housing market has become largely frozen in place.

Main takeaways:

Historic slowdown: Just 2.8% of homes sold in the first nine months of the year—38% fewer than during the 2021 boom and 31% below 2019 levels.

Buyers and sellers both hesitant: Homeowners are locked into ultra-low mortgage rates, while would-be buyers face steep prices and high borrowing costs. New listings also remain scarce—39 per 1,000 homes, down more than 25% from pre-pandemic norms.

Regional standouts: Virginia Beach (35 sales per 1,000 homes) and West Palm Beach (33) had the most turnover. The slowest markets were New York (10), Los Angeles (12), and San Francisco (13).

What this means for Utah investors:

Utah’s housing market mirrors the national freeze—low inventory, fewer transactions, and persistent buyer fatigue. This dynamic favors investors with patient capital and local relationships: off-market or distressed listings may offer rare opportunities. If rates ease in 2026, pent-up demand could quickly spark new activity, particularly in Salt Lake and Utah counties where population growth remains strong.

Utah Headlines

218 new affordable units open in Salt Lake City – The $50 million Alta Vue Apartments project adds 218 income-restricted units for residents earning 60–80% of the area median income, marking a major public-private effort to keep Salt Lake City’s workforce housed amid rising rents and limited supply.

Salt Lake City boosts affordable housing funds – The city announced $14.4 million in new funding for affordable housing projects, including low-interest rehab loans and a renter equity program, as part of its broader $179 million commitment to expand housing access amid soaring prices and population growth.

Park City luxury boom reshapes the Wasatch Back – As Deer Valley’s East Village and nearby developments add thousands of multimillion-dollar homes, Park City is emerging as a national hub for luxury real estate—balancing record growth, wealth migration, and rising affordability concerns across Utah’s mountain communities.

Utah Housing Corp. issues $50M in bonds for South Salt Lake project – The state agency is selling $50 million in revenue bonds to finance a 255-unit multifamily development called South Salt Lake Market Center, an affordable rental project expected to break ground soon and finish within 30 months.

National Headlines

Mortgage rates rise after Fed cut – Despite the Fed’s rate reduction, 30-year mortgage rates jumped 20 basis points to 6.33% as bond markets reacted negatively to Jerome Powell’s comments, tempering expectations for more cuts this year.

Multifamily delinquencies hit decade high – The CMBS delinquency rate for multifamily loans climbed 53 basis points in October to 7.12%, surpassing 7% for the first time since 2015 and signaling growing stress in the sector despite broader stability in other property types.

Fannie Mae shakeup sparks controversy – The Trump administration fired the FHFA’s inspector general and laid off more than 60 Fannie Mae employees—including members of its ethics team—amid plans to take the mortgage giant public, raising fresh concerns over oversight and political influence.

Three-bedroom homes dominate new construction – In 2024, three-bedroom single-family homes made up 47% of all new starts—the highest share since 2011—while four-bedroom builds declined for the third straight year, reflecting a shift toward more efficient floor plans and affordability-focused designs.

Apartment demand falls short – U.S. apartment absorption dropped to just over 42,000 units in Q3 2025, trailing new supply by more than 63,000 units as weaker job growth and economic uncertainty cooled renter activity.

Shutdown drags on, rates rise – With the federal government still closed and economic data frozen, mortgage rates climbed 15–20 bps last week as uncertainty grows around whether the Fed will deliver another rate cut in December.

Shutdown threatens multifamily stability – With HUD largely shuttered and key programs like Section 8 and LIHTC funding frozen, the prolonged federal shutdown is stalling affordable housing projects, delaying closings, and putting both Utah developers and renters at rising risk of financial fallout.

David Robinson

Principal Broker/Owner

Thinking about buying, selling, or exchanging investment property in Utah?