- Utah Investor Report

- Posts

- November Utah Market Review

November Utah Market Review

December Rate Cut at 88% Likely; Redfin Predicts "Great Housing Reset" in 2026; Median Single Family Home Price Up While Multi-Unit Down.

> Featured Listings

Water, sewer, garbage and gas are billed to owner. Owner then bills renters $125 a month. The rest of the utilities are in renters names. New roof 5 years ago.

Wonderful opportunity to build or start your rental portfolio with these 2 units (or 4 units in the same area, as neighboring 487 Wall Ave is also for sale). This is one of the largest duplexes available in the area and has been well-cared for by the landlord. Properties have been consistently rented with extremely low vacancy time. Please allow as much notice as possible for showings to coordinate tenants.

Perfect first time buyer or investor multi unit house hack totaling over 4357 square feet! Live in part and rent out the rest to cover most if not all the monthly payments. Located in Pleasant Grove's Downtown Village Transitional Subdistrict, this multi-unit property is a unique and versatile investment. Registered with the County as a triplex with 3 separate electric meters, and registered with Pleasant Grove City as a Duplex, this property actually has 4 kitchens, multiple living areas, multiple separate entries, and so many possibilities on how the spaces could be rented or used separately or joined together. Much of this property has been recently renovated. Besides the versatile interior, the .39 acre lot offers a large, shady backyard with established shade trees, fruit trees and garden boxes. The front yard is lined with beautiful rose bushes, property has PLENTY of uncovered parking, a 1-car attached garage, a detached carport, and room for RV parking as well. Come see this property and let your imagination run wild! There are three total laundry's including a shared laundry that is separate from all the units. The shared laundry is 267 square feet, but is not part of the advertised square footage as it is not being used as living space.

Canovo Group may not be the listing brokerage for the above properties. The information provided is not guaranteed and should not be relied upon to make investment decisions. Buyers should complete their own analysis and due diligence before making any investment.

> Sold Multi-Unit Listings

Sell Your Property for Top Dollar

Request a free, no obligation property value estimate. Get market rent data, sales comparables and a return on equity analysis.

> Utah Market Data

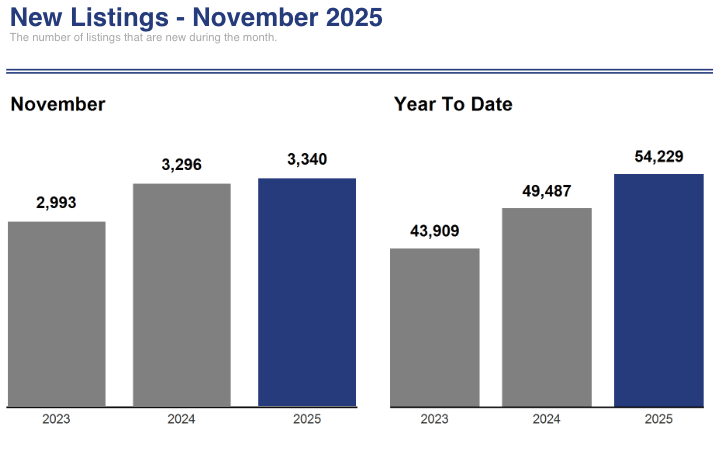

Single Family Homes - November Review

Utah’s single-family market showed mixed trends in November. New listings increased 1.3% year-over-year (and are up 9.6% YTD), while pending sales jumped 10.4%, signaling stronger buyer activity. Closed sales, however, fell 16.1% for the month but remain up 1.9% year-to-date. Homes are taking longer to sell, with days on market rising to 68 — a 13% increase from last year and 17% higher YTD.

Prices continued to climb: the median sales price is up 4.2% year-over-year (1.8% YTD), and the average sales price rose 9.1% (5.1% YTD). Sellers are receiving slightly less of their original list price compared to last year (95.9%, down 0.5%). Meanwhile, inventory increased 18%, and months of supply climbed to 4.8 months, showing a market that is easing toward more balanced conditions.

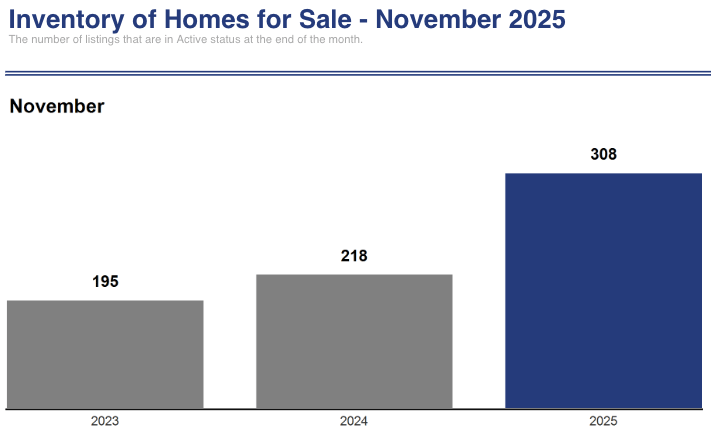

Multi-unit (2+ units) Property - November Review

Utah’s multi-unit market showed mixed performance in November. New listings rose 10.9% year-over-year and are up 6.8% year-to-date, while pending sales jumped 18.5%, signaling stronger buyer interest. Closed sales increased 7% for the month but remain down 4.8% year-to-date, showing fewer total transactions in 2025.

Properties are selling much faster than last year, with days on market dropping from 108 to 71 (a 34% improvement). Prices softened slightly in November, with the median sales price down 2.6% and the average sales price down 1.7% year-over-year, though the median is still up 3.1% YTD.

Sellers are receiving slightly less of their original list price (92.4%, down 1.1%). Inventory saw a sharp increase of 41%, pushing months of supply up to 6.7—indicating a more buyer-friendly environment and a clear loosening of market conditions.

> Mortgage Rates & Financing

Mortgage Rates as of 12/3/2025

Mortgage rates ticked up slightly this week but remain lower than they were a year ago. The 30-year fixed is now 6.30%, up 0.10% from last week, while the 15-year fixed sits at 5.79% with a small weekly increase as well. FHA, VA, and SOFR ARM rates also rose modestly over the past week, though all are still down compared to last year. Jumbo rates hold steady at 6.40%, showing no meaningful short-term movement. Overall, rates are experiencing minor week-to-week bumps but continue trending lower year-over-year.

Source: Mortgage News Daily

> Headlines & Insights

FEATURED ARTICLE

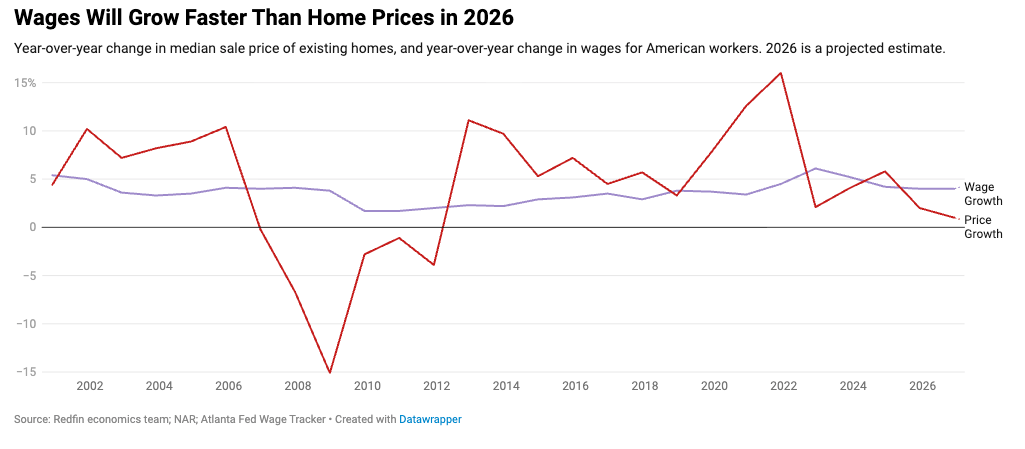

Redfin’s 2026 Forecast: The Great Housing Reset Begins

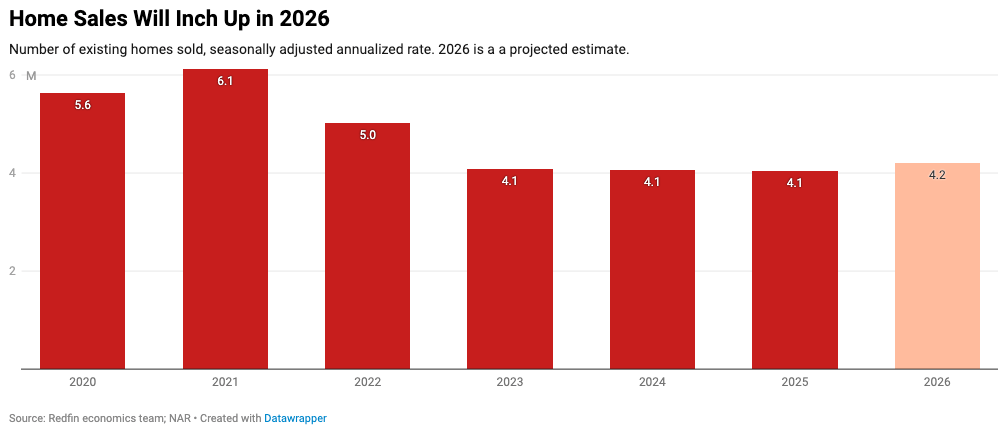

Redfin says 2026 will mark the start of a long, slow “Great Housing Reset”—a years-long period where the housing market normalizes and affordability improves. Prices won’t crash, but home sales, wages, and buyer activity should gradually strengthen as mortgage rates fall into the low-6% range.

Mortgage rates are expected to average 6.3% in 2026, down from 6.6% in 2025. Home prices are projected to rise only 1%, while wages are expected to grow faster than home prices for the first time in more than a decade. That gap will create slow but real improvement in affordability, though many Gen Z and young households will continue to struggle.

Redfin expects existing-home sales to rise 3%, and rents to climb 2–3% as apartment demand increases while new construction slows. More Americans will refinance or tap home equity for remodels, since many owners have gained significant equity over the past few years.

Lifestyle changes will also accelerate—more roommates, more multigenerational living, and smaller families—as high costs reshape how people live. Policymakers on both sides are expected to push new housing laws, from zoning reform to manufactured housing strategies, though no single policy will fix affordability quickly.

What This Means for Utah Investors

Utah mirrors national trends, with buyers still constrained by affordability but better conditions expected as rates fall and wages rise.

A slow improvement in affordability means stronger buyer activity in 2026, especially for entry-level and mid-tier units.

Rent growth of 2–3% nationally aligns with Utah’s own tight rental supply and steady population growth, supporting stable cash flow for landlords.

Expect more Utah buyers to refi and remodel, as equity is strong and move-up buyers remain rate-locked.

Policy changes (YIMBY laws, ADU expansion, and pro-housing bills) will likely pick up steam in the Utah Legislature, which may increase long-term development opportunities for multifamily investors.

Utah Headlines

Utah MLS Launches AI Voice Search – UtahRealEstate.com rolled out new AI-powered voice search tools that let users speak natural-language requests to instantly pull up listings and reports. The MLS says this makes home searching faster and plans even more AI features in 2026.

Ogden Pushes to Preserve Open Space – Ogden’s mayor wants to buy the former Taylor Canyon Elementary site and turn it into a park instead of new housing, responding to strong neighborhood support. Even though the land could fit 20+ homes, city leaders say protecting green space will help keep the community strong.

National Headlines

Markets Expect a December Rate Cut – Traders now see an 88.9% chance the Fed will cut rates to the 350–375 bps range at the December 10 meeting. Only 11.1% expect the Fed to hold steady, and no one expects a hike.

Record High Vacancies Push Rents Down – U.S. apartment rents fell 1% in November as vacancies hit an all-time high of 7.2%, driven by a surge of new multifamily supply. Weaker demand—especially from young adults delaying household formation—is amplifying the downturn and slowing rent growth nationwide.

Construction Lending Ticks Up – Single-family construction loans rose slightly in Q3, reaching $91.2 billion — the first annual increase in more than two years. Overall Lending Still Down – Total AD&C lending continued to fall for the seventh straight quarter, showing builders still face tight credit even as loan quality remains stable.

Homeownership Slips Again – The U.S. homeownership rate hit a six-year low in 2025 and is expected to fall even more in 2026 as high prices and big down payments keep many first-time buyers out. Even though buying may get slightly cheaper next year, falling rents mean renting will save more money, especially for Gen Z.

David Robinson

Principal Broker/Owner

Thinking about buying, selling, or exchanging investment property in Utah?