- Utah Investor Report

- Posts

- Monthly Market Review - Aug 2025

Monthly Market Review - Aug 2025

Trump May Declare Housing Emergency; Salt Lake City Fourplex Sells for $195k/unit; Fed Rate Cut Odds Surge to 92%

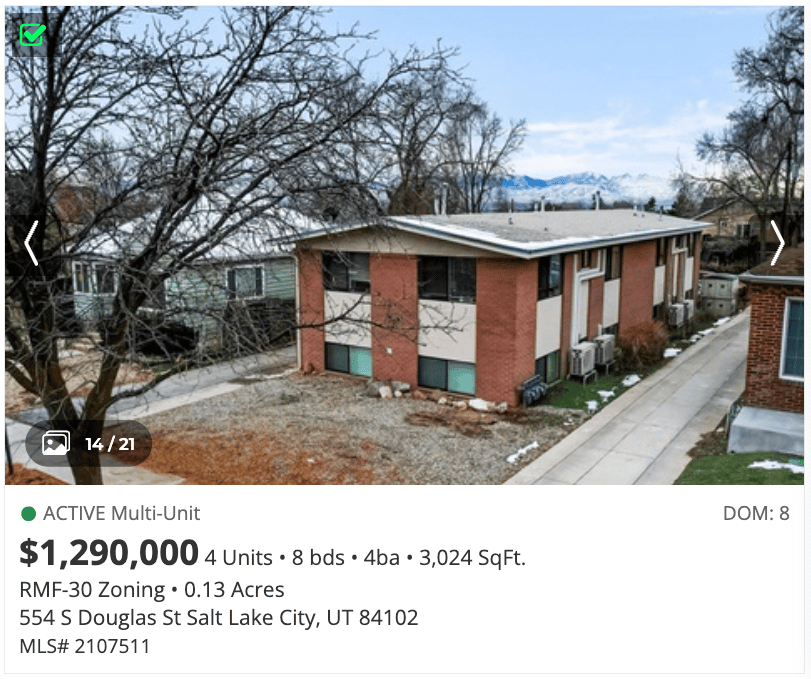

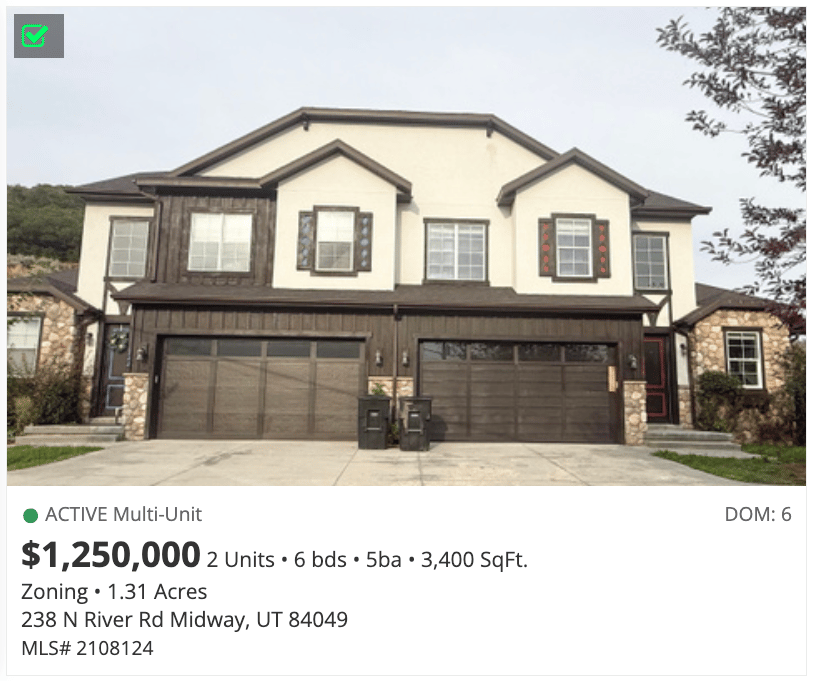

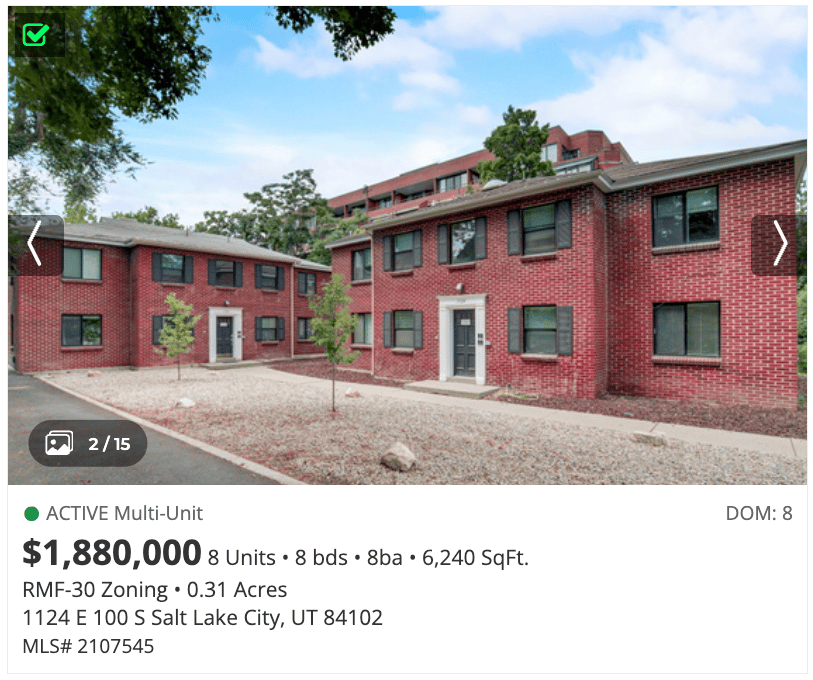

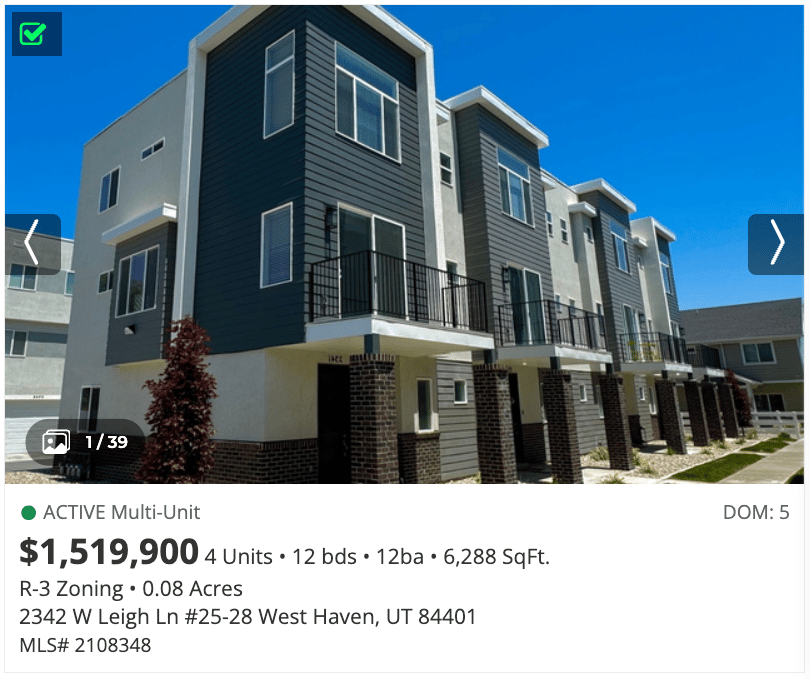

> Featured Listings

Click images below to request details.

***12 Months Property Management + Income Guarantee*** Fully leased 2022-built 4plex in prime West Haven, turnkey and loaded with all appliances (refrigerator, range, microwave, dishwasher, washer, dryer) and smart-home features (lighting, thermostat, garage door control, keypad entry, and video doorbell). Oversized garages fit a FULL-SIZED truck plus a second vehicle. Includes 12 months of professional property management and a 12-month rental income guarantee (up to $10K) with approved management company and rent guidelines. Excellent rental demand, strong rent history, and convenient commuting make this an immediate, worry-free cash-flow opportunity

Canovo Group may not be the listing brokerage for the above properties. The information provided is not guaranteed and should not be relied upon to make investment decisions. Buyers should complete their own analysis and due diligence before making any investment.

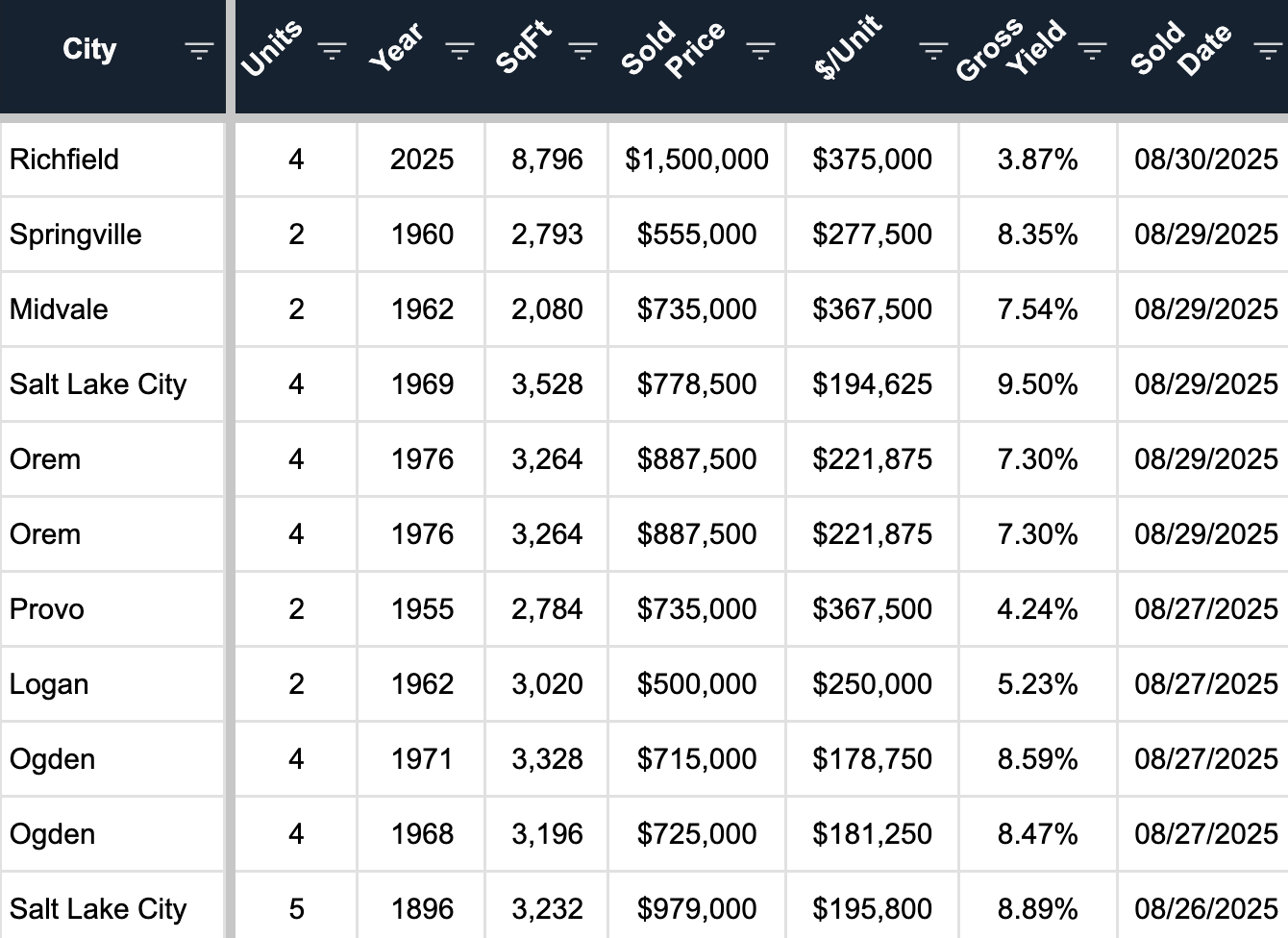

> Sold Multi-Unit Listings

Is it time to sell or refinance?

Request a free, no obligation property value estimate. Get market rent data, sales comparables and a return on equity analysis.

> Utah Market Data - August Review

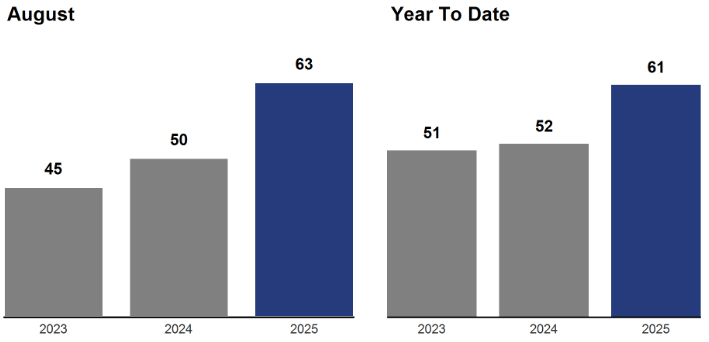

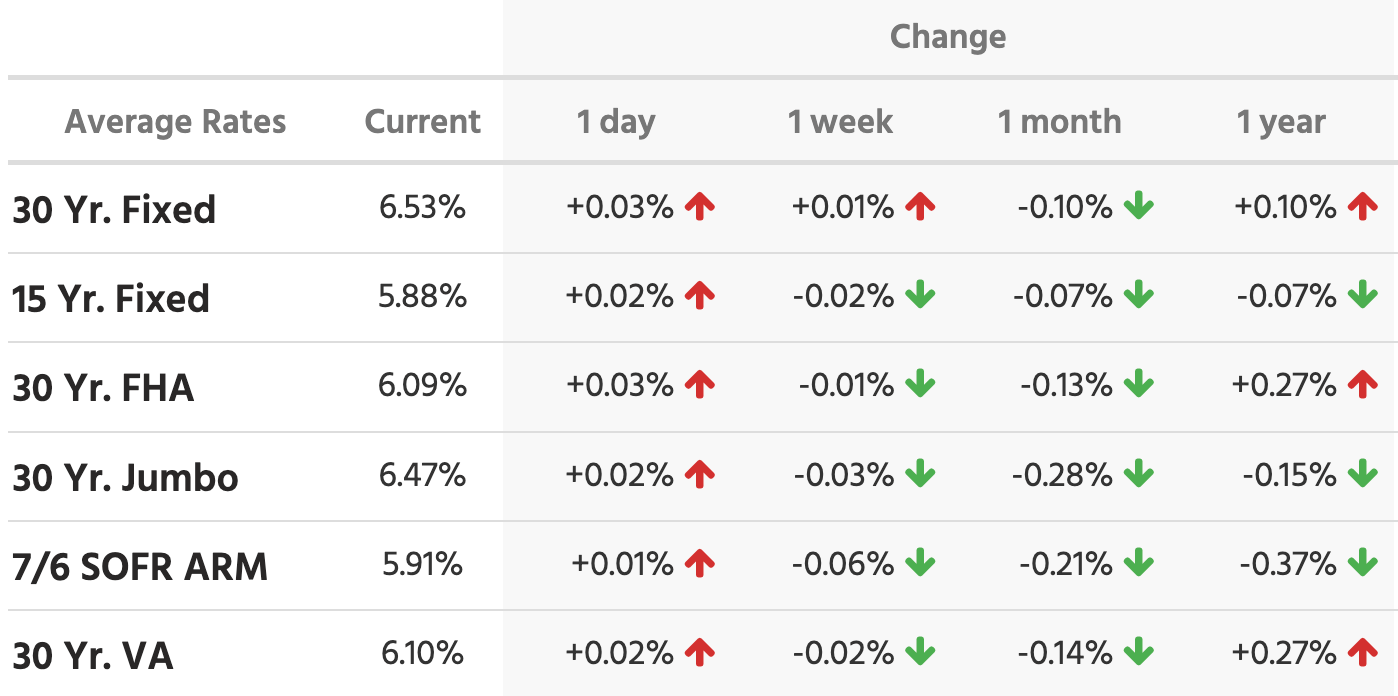

Multi-Unit Property

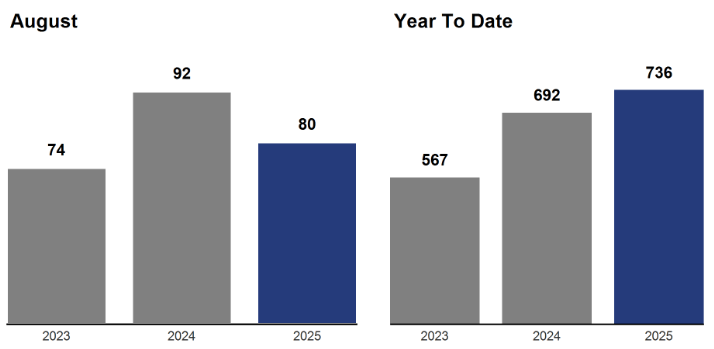

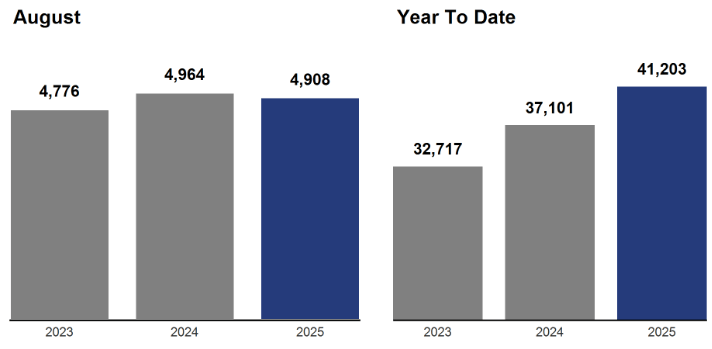

New Listings

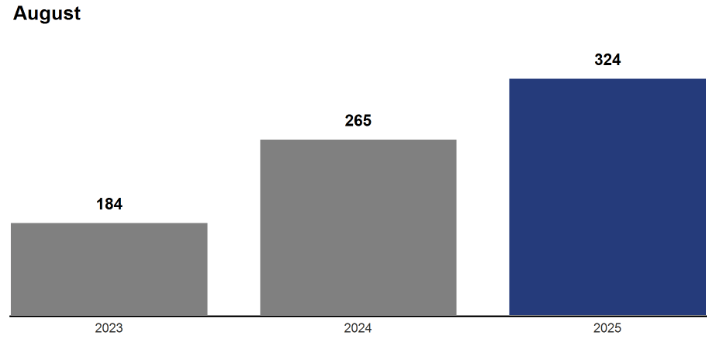

Closed Sales

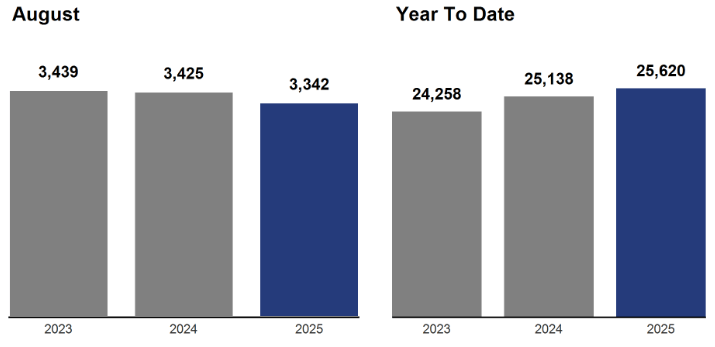

Days on Market

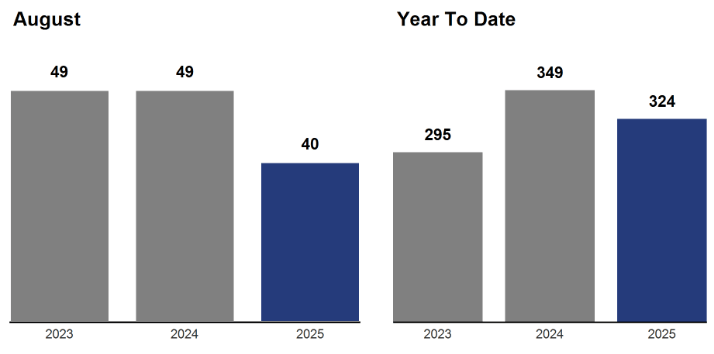

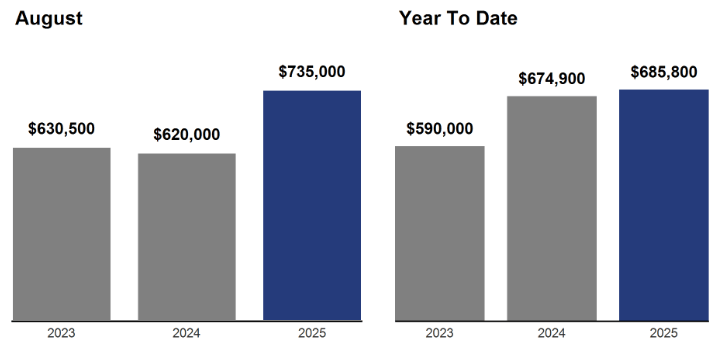

Median Sales Price

Inventory

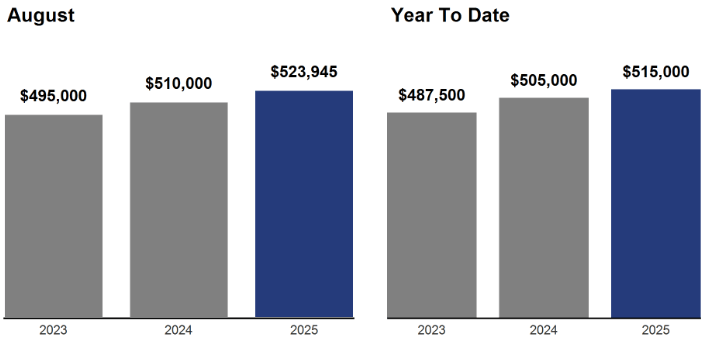

Single Family Home Property

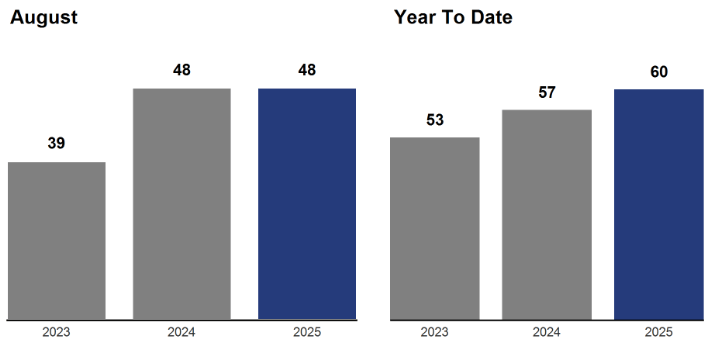

New Listings

Closed Sales

Days on Market

Median Sales Price

Inventory

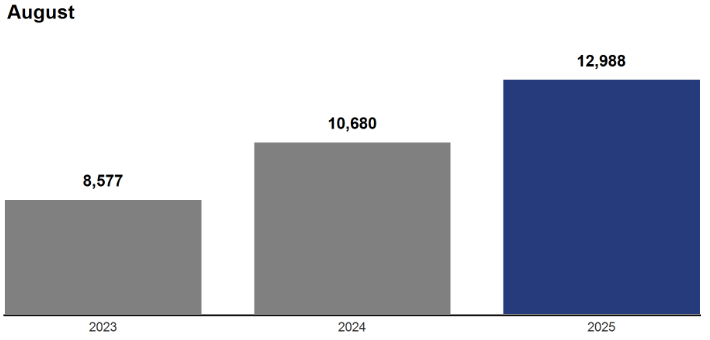

> Rates & Financing

Mortgage Rates as of 9/2/2025

Source: Mortgage News Daily

> Headlines & Insights

FEATURED

The U.S. housing market is frozen: inventory keeps rising, but sales are stuck at multi-decade lows. Buyers, sellers, and builders are all frustrated for different reasons, leaving the market stalled.

Main takeaways:

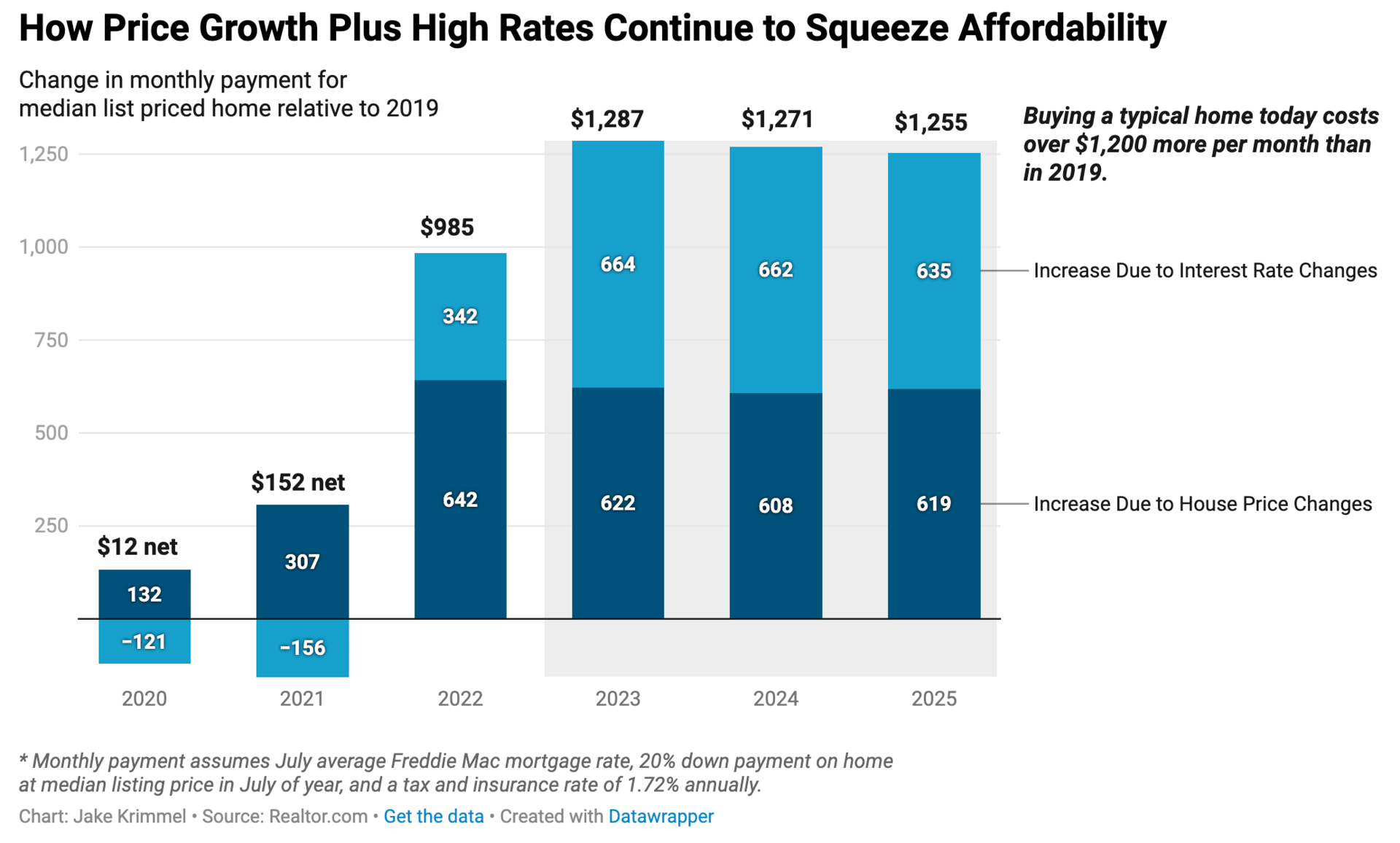

Buyers face the “double whammy” of high home prices and high mortgage rates, adding over $1,200 a month compared to 2019.

Sellers resist lowering prices, often delisting instead—slowing inventory growth and keeping prices from falling further.

Builders are pulling back on new projects due to weak demand, higher financing costs, and tariffs, adding to the long-term housing shortage.

Regional divide: The South and West have too much supply and weak demand, while the Northeast and Midwest remain tight with homes selling quickly.

The overall picture is one of stagnation, not crisis—progress is slow, but the market is gradually working toward balance.

What this means for Utah investors:

Utah is part of the Western housing slowdown, where rising inventory and weaker demand are putting pressure on prices. Investors should expect more negotiating power when buying, but also be cautious about rent growth and property appreciation in the near term. Long term, Utah’s population growth and housing shortage still support strong fundamentals, but patience and careful deal selection are key in today’s environment.

Utah Headlines

Utah’s Starter Home Push — Utah’s goal to build 35,000 starter homes in 5 years is off to a slow start—only 5,100 are underway—but projects like Nilson Homes’ Plain City development show promise. With state-backed low-interest loans and flexible lot sizes, developers are creating $370K–$400K homes aimed at first-time buyers, teachers, and veterans. Demand is high, with long waitlists signaling a hunger for attainable entry-level housing across Utah.

National Headlines

Trump May Declare Housing Emergency — President Trump may declare a national housing emergency this fall to tackle affordability. For Utah, this could mean builder-friendly reforms like reduced regulations, lower construction loan rates, and zoning code standardization—moves that may slowly improve supply and affordability by decade’s end.

Affordability by 2030? — A new Redfin analysis says U.S. housing costs could return to “normal” by 2030 if mortgage rates ease to 5.5% and home prices grow modestly. Using July 2018 as a baseline, affordability is measured by the mortgage payment-to-income ratio at 30%. Under stable conditions, costs normalize by late 2030, while faster price growth could push recovery to 2032. If rates stay near 6.7%, affordability wouldn’t return until mid-2030s—or not at all in some metros.

Rate Cut Odds Surge to 92% — Markets Nearly Certain Fed Will Ease in September – According to the CME FedWatch Tool, there’s a 91.7% probability the Fed will cut rates by 25 basis points at its September 17 meeting, lowering the target range to 4.00%–4.25%. While the Fed’s decision isn’t final, markets are signaling strong confidence that relief is coming soon.

AI Finds Hidden CRE Gems – Global investor BGO is using artificial intelligence to uncover undervalued real estate markets, focusing less on property pricing and more on local fundamentals. One model-driven bet in Las Vegas proved especially successful, with rents soaring far above expectations, showing how data science can spot overlooked opportunities. For Utah investors, this highlights the power of local market insights and advanced analytics in driving outsized returns.

David Robinson | Principal Broker/Owner

Thinking about buying, selling, exchanging investment property in Utah?