- Utah Investor Report

- Posts

- Market Confident in Another Fed Cut

Market Confident in Another Fed Cut

Clearfield fourplex sells for $194k/unit; Sugarhouse Fourplex Reduced 50K

> Featured Listings

Click images below to request details.

PRICE REDUCED 50K. Fourplexes of this quality and location rarely hit the open market. Meticulously maintained and significantly upgraded over the years. All units have been fully remodeled with updated kitchens, bathrooms, flooring, fixtures, electrical panels, and plumbing improvements. Exterior upgrades include new double-pane vinyl windows, motion lighting, updated walkways, and a new boiler, tankless water heater, and evaporative coolers. The detached garages have been secured, finished, and freshly painted. Located on a spacious 0.26-acre lot in one of Salt Lake City's most desirable neighborhoods, this turnkey asset offers stable cash flow, low maintenance, and strong long-term appreciation potential.

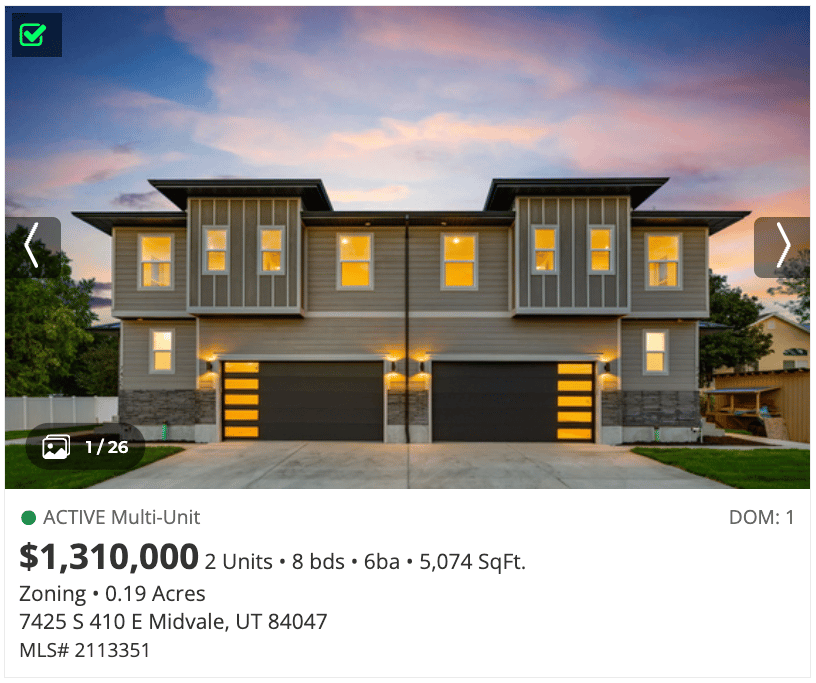

Duplex-style investment with two separate parcels, meters, and addresses. Each property offering 2,537 sq. ft. across three levels, designed with tenants in mind. The main floor features a bright, open kitchen and living space with a half bath. Upstairs you'll find four full bedrooms, including a primary suite with a private bath and walk-in closet, plus a full guest bath to serve the additional rooms. The basement adds a flexible finish option for a fifth bedroom, office, or rec space, allowing for higher rents and stronger tenant appeal. At projected rents, the property delivers an attractive ~5.5% cap rate. Combined with the benefits of new construction - low maintenance, modern finishes, and strong tenant demand - this is a turnkey asset positioned for long-term growth and income stability.

Fully turn-key property, all units rented/leased, all rents paid on time every month. Strong rental history. Discover this well-Maintained 9-unit multifamily property located in the heart of charming downtown Bountiful. 9 Spacious units: 8: 2 bed/1 bath and 1: Casita 3 Bed/1 bath single level living(no stairs) with walk out patio and private lush green back yard Brand new roof. Updated systems. Fixed programmable outdoor lighting. 11 Locking Storage sheds/closets. This property is ideal for investors seeking stable cash flow and long-term appreciation. Large Laundry room on main level with 3 coin operated washers and 3 coin operated dryers generating $350/month laundry income.

Canovo Group may not be the listing brokerage for the above properties. The information provided is not guaranteed and should not be relied upon to make investment decisions. Buyers should complete their own analysis and due diligence before making any investment.

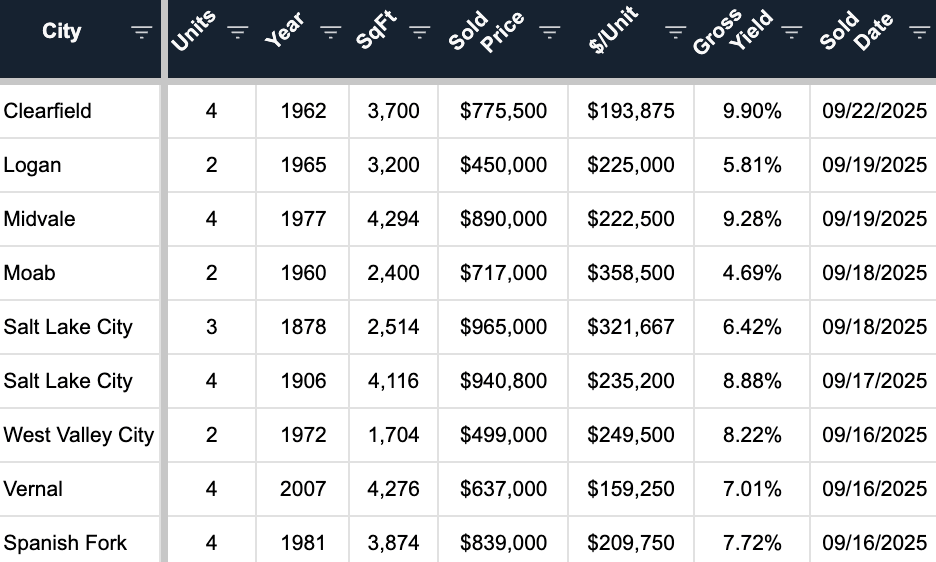

> Sold Multi-Unit Listings

Sell Your Multi-Unit Property for Top Dollar

Request a free, no obligation property value estimate. Get market rent data, sales comparables and a return on equity analysis.

> Utah Market Data

> Rates & Financing

Mortgage Rates as of 9/24/2025

Source: Mortgage News Daily

> Headlines & Insights

FEATURED

The CME FedWatch Tool shows a 94.1% probability that the Fed will cut rates again at its October 29, 2025 meeting, lowering the target range from 4.00–4.25% down to 3.75–4.00%. Just 5.9% of traders expect rates to stay unchanged, and no one is betting on a hike.

Main takeaways:

Traders are nearly certain the Fed will follow September’s cut with another quarter-point move in October.

One month ago, markets were split—only 43.5% expected this outcome. Confidence in easing has surged as economic softness continues.

This would mark back-to-back cuts, signaling the Fed is shifting into an easing cycle to counter slowing growth.

What this means for Utah investors:

If the Fed delivers another cut, borrowing costs for commercial and residential real estate should gradually improve. For Utah multifamily investors, that could mean slightly better debt terms and renewed buyer interest heading into year-end. Acting before demand rebounds could help lock in favorable opportunities.

Utah Headlines

Salt Lake Village Expansion — Salt Lake City’s Other Side Village secured $30M in donations, including support from the LDS Church and Gail Miller, to fund Phase 2 of its tiny home community for the chronically homeless. The expansion will add nearly 400 units, a medical center, and community facilities, aiming to provide stability and self-sufficiency for Utah’s most vulnerable residents.

Affordable Housing Project in Summit County — Ivory Homes and Francis City launched Innovation Park at Francis Commons, bringing affordable townhomes priced under $470K to Summit County, Utah’s most expensive housing market. The project, part of Gov. Cox’s starter-home initiative, prioritizes essential workers and bans investor purchases to keep units for full-time residents.

New Ogden Valley City Debate — As Ogden Valley moves toward official incorporation in January 2026, supporters and critics clash over financial feasibility and readiness to provide city services. While some warn taxes may rise and contracts may lag, backers argue early challenges are typical and trust that local leadership can guide the new city of 7,600 residents through its launch.

National Headlines

Labor Market Weakens — The U.S. unemployment rate rose to 4.3% in August, with long-term joblessness now making up 26% of the unemployed, the highest since the pandemic. The broader U-6 underemployment rate shows growing slack, highlighting a cooling job market despite historically low headline unemployment.

Multifamily Cap Rates Stabilize — Multifamily cap rates appear to have leveled off after two years of increases, with rent growth now the key signal for future trends. Analysts see improved liquidity and rising deal volume as signs the sector could be on the verge of a rebound heading into 2026.

Holiday Hiring to Fall to Lowest Level Since 2009 — Retailers are on track to add fewer than 500,000 seasonal jobs in late 2025, the weakest holiday hiring since 2009. Analysts say tariffs, inflation, and automation are leading companies like Target and Macy’s to scale back, signaling a softer shopping season ahead.

Powell Speech Recap — At a Rhode Island luncheon, Fed Chair Jerome Powell acknowledged slower growth, rising unemployment risks, and tariff-driven inflation. He emphasized the Fed’s “balanced” approach, noting last week’s 25 bps cut brought policy closer to neutral while keeping inflation control a top priority.

Construction Lending Tightens — Outstanding single-family construction and land development loans fell to $89.8B in Q2 2025, down 2% year-over-year and far below 2008 peaks. While overall loan volumes continue to contract, delinquencies also eased slightly, with just 1.2% of loans past due or in nonaccrual status.

David Robinson

Principal Broker/Owner

Thinking about buying, selling, or exchanging investment property in Utah?