- Utah Investor Report

- Posts

- Inflation Rises to 3%; Salt Lake City Rent Drops 6.5% YoY

Inflation Rises to 3%; Salt Lake City Rent Drops 6.5% YoY

Murray 8-unit Listed for under $200k; Two Packaged Fourplexes in Pleasant Grove Sell for $277k/unit

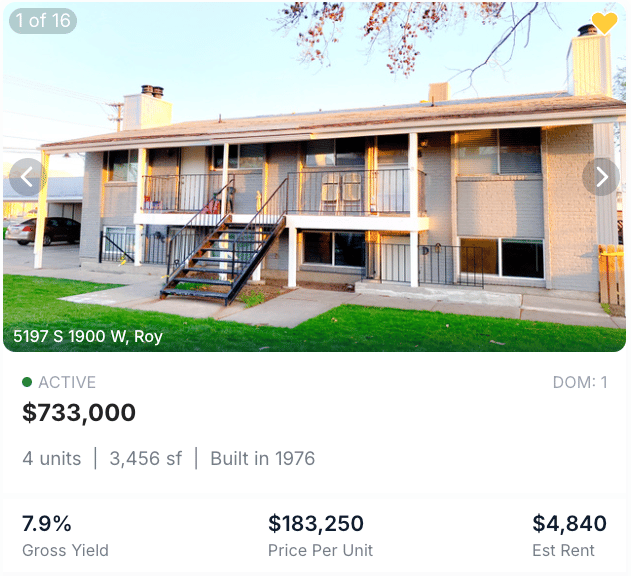

Featured Listings

> Click images below to view details and run cash flow analysis.

Canovo Group may not be the listing brokerage for the above properties. The information provided is not guaranteed and should not be relied upon to make investment decisions. Buyers should complete their own analysis and due diligence before making any investment.

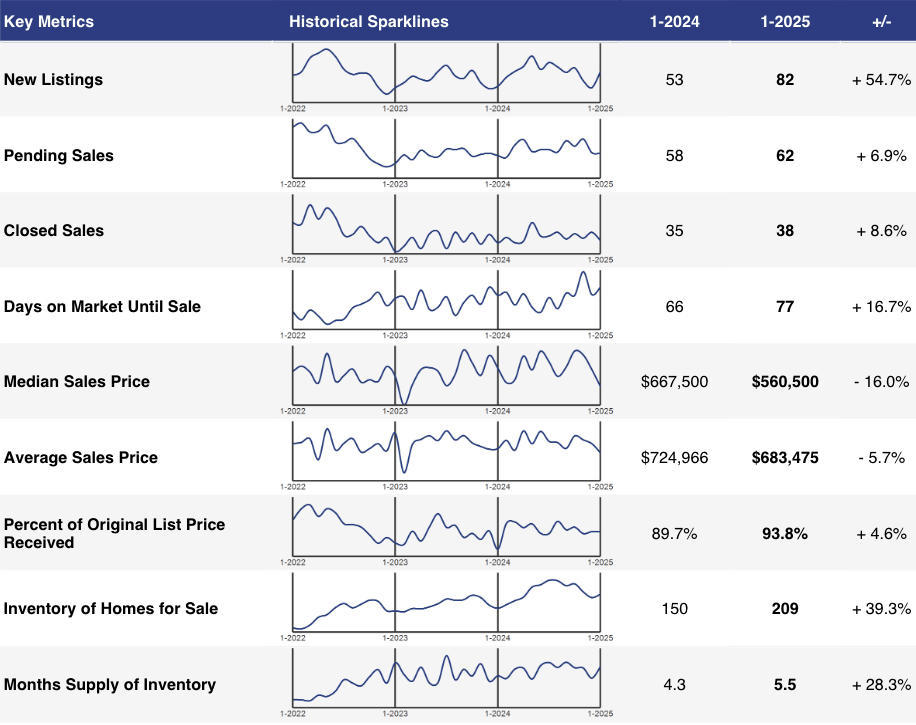

Utah Market Snapshot

> Multi-Unit (2+ Units) - January 2025 Market Summary

In January 2025, Utah's multi-unit property market experienced a notable 8.6% increase in closed sales compared to January 2024, rising from 35 to 38 transactions. However, the median sales price dropped significantly by 16.0%, from $667,500 to $560,500, suggesting a shift in buyer preferences or market dynamics. Meanwhile, inventory saw a sharp rise of 39.3%, with available properties increasing from 150 to 209, indicating more options for buyers but potentially a more competitive environment for sellers.

> Single Family - January 2025 Market Summary

In January 2025, Utah's single-family home market showed mixed trends. Closed sales decreased by 9.9%, from 2,234 in January 2024 to 2,013. Meanwhile, the median sales price increased slightly by 2.1%, rising from $489,900 to $500,000, reflecting stable demand for homes despite fewer transactions. Inventory levels saw a substantial 30.9% increase, with the number of homes for sale growing from 6,897 to 9,030, contributing to a 45.3% rise in the months' supply of inventory, from 3.1 to 4.5 months, indicating a more balanced market.

Sold Multi-Unit This Week

Rates & Financing

> Mortgage Rates as of 2/12/2025

Source: Mortgage News Daily

Deal Review

> 2nd Ave Apartments, Salt Lake City UT

11 Units

Built in 1958

Renovated in 2021-2023

5,907 Square Feet

Listing price: $2,850,000

Underwritten purchase price: $2,200,000

5- Year Hold Return Projections:

Levered IRR: 15.23%

Levered Equity Multiple: 1.93x

Average Cash-on-Cash: 6.35%

Net Profit: $731,169

Only "value-add" to this project is increasing one of the tenant's rent from $1,325 per month to the average of $1,450. Other than that, this is pretty much a turn-key deal. It would have to be self-managed by the buyer to achieve these returns.

Underwritten By:

Follow Tyler on Linkedin for more underwriting tips and strategies

Headlines & Insights

Featured Story

> Inflation Rises to 3%: A Warning Sign for Consumers and Homebuyers

Inflation ticked up to 3% in January, with core inflation at 3.3%, signaling tougher times for consumers and pushing mortgage rates even higher. As higher prices—especially in housing—continue to impact the economy, the Federal Reserve is unlikely to cut rates soon, keeping borrowing costs elevated.

Main takeaways:

Overall prices rose 3% year-over-year in January, while core inflation climbed 3.3%, driven by increases in car insurance, used vehicles, medical care, and airline fares.

Higher yields on long-term Treasury notes have pushed 30-year fixed mortgage rates close to 7%, making homebuying more expensive.

Housing costs, which remain a major driver of inflation, showed a slight slowdown to a 4.4% annual increase, but still pose a challenge to reaching the Fed's 2% inflation target.

What this means for investors:

Investors should brace for a prolonged period of high mortgage rates and elevated borrowing costs, which could temper housing market activity and consumer spending. Diversifying portfolios to include assets that perform well in inflationary environments—such as inflation-protected securities or real estate in markets with growing supply—may help mitigate risks in this uncertain economic climate.

More News & Reports

Utah

Salt Lake Rent Drops – The median asking rent in Salt Lake City fell 6.5% year-over-year to $1,476, ranking fourth in the nation for rent declines. Redfin attributes the drop to increased supply and reduced demand, but warns rents could rise again as construction slows.

Clinton Townhome Battle Escalates – Clinton residents opposing a 341-unit development have filed a lawsuit after their petition to block the project fell short. The suit claims misleading tactics led to 37 disputed signatures being removed, enough to reverse the city’s decision if reinstated.

National

Multifamily Investors Adapt to Higher Rates – With the Fed keeping rates steady, investors are shifting strategies, accepting a prolonged higher-rate environment. Many plan to be more aggressive in 2025, selling underperforming assets and deploying capital into higher-growth opportunities, signaling renewed confidence in the multifamily sector.

Inflation Stubborn Ahead of CPI Report – January’s consumer price index is expected to show inflation remains above the Fed’s 2% target, with forecasts at 2.9% annually. While disinflationary trends exist, rising auto costs and potential Trump tariffs could keep inflation elevated, delaying Fed rate cuts.

Builders Brace for 2025 Challenges – High interest rates remain the top concern, though fewer builders expect them to be as severe this year (78% vs. 91% in 2024). Rising inflation concerns have eased, but material costs, lot availability, and labor shortages persist as major obstacles for homebuilders.

Job Growth No Longer Drives Rent Growth – While job gains once predicted apartment rent increases, the correlation has weakened in the 2020s. Remote work and growth in lower-wage sectors mean job location no longer determines where renters choose to live, shifting traditional housing market dynamics.

Office-to-Apartment Boom – A record-breaking 71,000 apartments are set for conversion from office spaces in 2025, nearly tripling since 2022. With rising office vacancies and housing demand, cities like New York, D.C., and L.A. lead the trend, offering incentives to accelerate urban transformation.

What did you think of today's report? |

David Robinson

Principal Broker/Managing Partner

Whenever you’re ready, there are a couple of ways I can help you:

Buy The Best Multi-Unit Properties in Utah:

Work directly with our team to find, finance, buy and manage the best multi-unit properties in Utah (2-50 units) to grow your wealth.Sell Your Multi-Unit Property for Top Dollar:

We’ll strategically position your multi-unit property for full market exposure, extract maximum value, and streamline the sales process.