- Utah Investor Report

- Posts

- Falling Prices: A Turning Point for Utah Multifamily

Falling Prices: A Turning Point for Utah Multifamily

Utah tops charts for safest places to live; Salt Lake City Duplex listed for $499k; Job market data sends cooling signals

> Featured Listings

List price is below market value! Both units have recently been vacated, but were leased out at $1800 ea. Replaced tub and flooring in up bathroom last year.

Well located 20-unit apartment community along Highland Drive in Holladay, one of Salt Lake County's most established and desirable residential submarkets. The property has benefited from recent capital improvements, with 13 of the 20 units renovated, providing immediate upside and strong tenant appeal. Holladay is known for its high household incomes, strong rental demand, and limited multifamily supply. The property offers excellent access to I-215, I-80, Downtown Salt Lake City, the University of Utah, Sugar House, and major employment centers, while being surrounded by mature neighborhoods, retail, dining, and everyday services. Renovated units feature updated interiors that attract long-term tenants, while the remaining units offer a clear path for continued renovations and future rent growth. The property's visibility along Highland Drive, combined with the strength of the Holladay market, supports durable cash flow and long-term appreciation. A compelling opportunity for investors seeking a core-plus / value-add multifamily asset in a high-barrier, supply-constrained Salt Lake County location.

Triplex in the Marmalade area of Salt Lake City. Beautiful 2 story turn of the century house converted to 3 apartment buildings. Great layout with 1 unit on each floor. Easy to rent and tenants love the location and the character.

4 duplexes and 1 home. Each duplex has 2 carports, storage shed and washer/dryer hookups. Fenced property with auto sprinklers and full landscaping. Ideal investment property.

Canovo Group may not be the listing brokerage for the above properties. The information provided is not guaranteed and should not be relied upon to make investment decisions. Buyers should complete their own analysis and due diligence before making any investment.

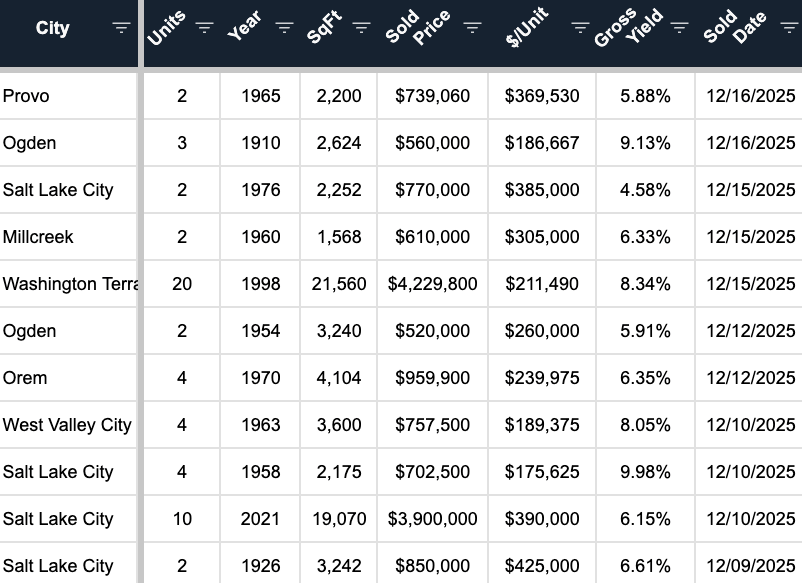

> Sold Multi-Unit Listings

Sell Your Property for Top Dollar

Request a free, no obligation property value estimate. Get market rent data, sales comparables and a return on equity analysis.

> Utah Market Data

Falling Prices: A Turning Point for Utah Multifamily

Multi-Unit Property in Utah – Number of new listings and median $/SqFt

This chart shows a strong link between interest rate hikes and multi-unit inventory in Utah. After rates began rising in 2022, the number of multi-unit listings dropped sharply, hitting a low point in 2023. Higher borrowing costs made it harder for investors to buy and sell, which caused many owners to hold onto their properties instead of listing them.

At the same time, something important happened on the pricing side. After nearly 10 straight years of price growth, multi-unit prices per square foot have finally dipped in 2025 (~4% decline). This is the first meaningful pullback in a decade and signals a shift in the market. While prices are still far higher than they were in the past, investors are no longer able to push prices higher as easily.

The big takeaway is that rising interest rates slowed sales, reduced inventory, and eventually put pressure on prices. Even with strong long-term demand for multi-unit housing, the market is adjusting to higher rates and tighter cash flow conditions.

> Mortgage Rates & Financing

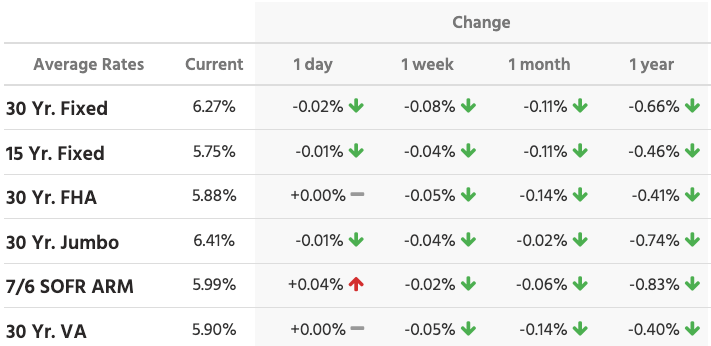

Mortgage Rates (as of Dec 17, 2025)

Mortgage rates moved slightly lower this week and are clearly down compared to last year. The 30-year fixed rate sits at 6.27%, down 0.08% from last week and 0.66% lower than a year ago. The 15-year fixed dropped to 5.75%, and FHA and VA loans remain in the high-5% range, both lower than they were last year.

Jumbo loans are still the highest at 6.41%, but they are down 0.74% year over year. Overall, rates are trending in the right direction, giving buyers a bit more breathing room as borrowing costs slowly ease.

10-Year Treasury Yield (as of Dec 17, 2025)

The 10-Year Treasury yield is sitting at 4.16%, slightly higher than yesterday. Over the past month, yields have moved up and down but have stayed mostly in the low-4% range.

This matters because the 10-Year Treasury strongly influences mortgage rates. As long as it stays near current levels and below its recent highs, it helps keep mortgage rates from moving much higher and gives buyers some stability heading into the end of the year.

Source: Mortgage News Daily

> Headlines & Insights

Utah Headlines

Court Clears Sandy Project – A federal court ruled in favor of a developer after Sandy City rejected a proposed mixed-use project, saying the city violated federal housing laws. The decision could make it harder for cities to block housing projects and may lead to more development along Utah’s Wasatch Front.

Utah Tops Charts for Safety – Utah was ranked the safest place to live in the U.S., thanks to low crime rates, strong community ties, and high emergency preparedness. The ranking adds to Utah’s appeal for families and newcomers, even as housing costs remain a growing challenge.

Affordable Ownership Opportunity in St. George – The final phase of the Lone Rock Condos in Washington City is offering a rare chance for affordable homeownership, with prices aimed at local workers and first-time buyers. The project highlights growing efforts in Southern Utah to create for-sale housing options that are more attainable in a high-cost market.

National Headlines

Job Market Starts to Cool – Hiring slowed in November as job openings fell and fewer workers changed jobs, signaling a softer labor market. While layoffs remain low, slower hiring could ease wage pressure and reduce inflation over time.

Jobs Data Sends Mixed Signals – November jobs data showed slower hiring and cooling wage growth, pointing to a labor market that is losing momentum. While employment is still growing, the slowdown supports the case for lower interest rates in 2026 if the trend continues.

High-Risk Homes Cost More – Homeowners in disaster-prone areas are facing higher insurance premiums and new taxes as states and insurers try to cover rising climate risks. These added costs are making it harder to own homes in high-risk areas and may push some buyers and owners to look elsewhere.

David Robinson

Principal Broker/Owner

Thinking about buying, selling, or exchanging investment property in Utah?