- Utah Investor Report

- Posts

- Expected Fed Cut, But 2026 Outlook Could Shake Rates

Expected Fed Cut, But 2026 Outlook Could Shake Rates

Ogden Duplex Listed for $350k; Utah Single Family and Duplex Listing Prices Increase, But Fourplexes Drop; Salt Lake City Rethinks "Family" Zoning Rules

> Featured Listings

Classic side by side duplex with steady occupancy history. Great addition to your portfolio or live in one side and offset your mortgage payment with income from other unit. The room downstairs is currently being used as the second listed bedroom. Garage unit east of the home is NOT included in the sale. Property line goes between the duplex and garage. The room downstairs is currently being used as the second listed bedroom in both units. Tenant's are currently month-month and would like to stay.

Provo 4 Plex, 5 total bedrooms, 4 total bathrooms. 2 Studios, a 1 bedroom, and a 2 bedroom apartment. This Provo multifamily property presents a unique opportunity for investors and house-hackers alike. A prime location in Provo with easy access to amenities, close proximity to BYU, an attainable price point, and recent upgrades in the form of a new roof, fascia, soffit, and gutter system all of which will benefit new ownership for years to come. Not sold yet? This 4-unit apartment building checks all the boxes: ✅ 5% Cap Rate with room to increase profitability ✅ Ideal location just a few blocks away from BYU ✅ Purchase price under 800K and a price per door of just 191K ✅ Charming curb appeal and ample off street parking Unit & Financial Details: The 2 bedroom apartment is not currently rented and will be delivered vacant at closing. Rent it out to maximize rental income, or take advantage of this awesome multi-unit house hack by moving in yourself! The other 3 units are being rented for a total income of $2,550 per month with room to increase rents (Studio 1: $800 per month, Studio 2: $850 per month, 1 Bedroom Apartment: $900 per month). The owner currently pays gas, water, and sewer.

Hard to find newer twin home side x side. Single level living. One half acre lot with synthetic grass. Stainless steel appliances, master bath with double sinks and walk in closet. Easy care laminate flooring. Solid surface counters. RV parking

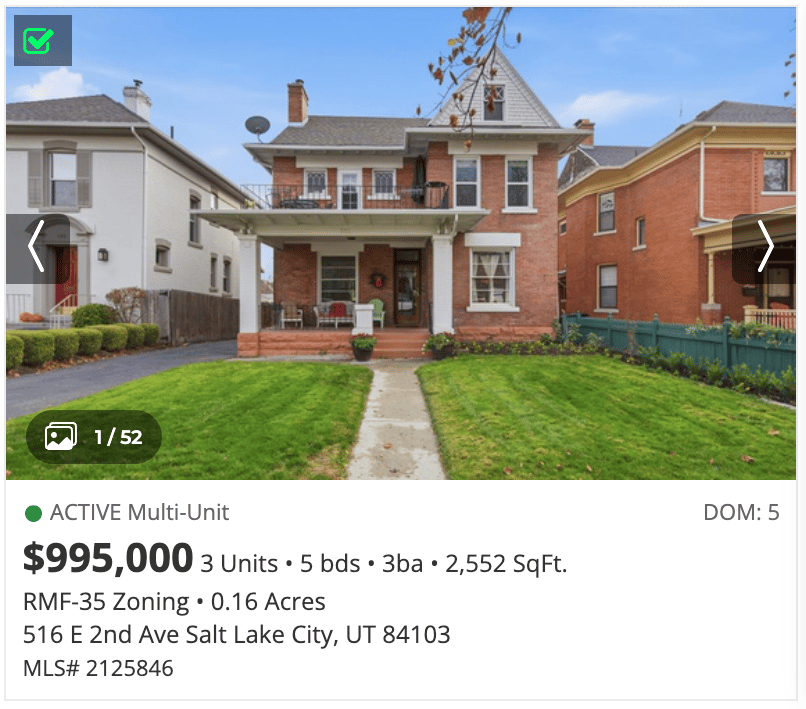

This attractive 2-story victorian triplex is ideally located in the heart of the Avenues neighborhood and has neat curb appeal! There is one larger unit on the main floor, and two smaller units upstairs. Ideally set up as an owner-occupy residence or investor opportunity. The roof is approximately 10 years old, updated electrical, gas forced air furnace is 3 years old, central air conditioning in all units, common laundry is located in the basement with storage space. There are separate electric meters and one gas meter. All units have natural light and are well maintained. There are covered carports in the rear of the property and a small one car garage that could also be used for yard equipment storage space- a real plus for the Avenues. The landscaping is tasteful and well maintained. Only minutes to the U of U, downtown, city creek canyon and the airport!

Canovo Group may not be the listing brokerage for the above properties. The information provided is not guaranteed and should not be relied upon to make investment decisions. Buyers should complete their own analysis and due diligence before making any investment.

> Sold Multi-Unit Listings

Sell Your Property for Top Dollar

Request a free, no obligation property value estimate. Get market rent data, sales comparables and a return on equity analysis.

> Utah Market Data

A Tale of Two Markets: Steady Homebuyer Demand vs. Cautious Investors

Median List Price Per Sq Ft by Dwelling Type

The year-to-date numbers show that Utah’s housing market is moving in two different directions. Single-family homes are still strong, with list prices per square foot rising 1.62% this year. This means buyer demand for regular homes is steady, even though there are more houses for sale.

The small multifamily market tells a different story. Duplexes are one of the bright spots, with prices per square foot going up 1.80%. This shows that many buyers still like duplexes because they are more affordable and can work for both living and renting.

But fourplexes are not doing as well. Their prices per square foot have dropped 2.35% this year. This same pattern is happening with other small apartment types too. Higher interest rates and more properties for sale are making investors more careful, so sellers are lowering prices.

Overall, the biggest takeaway is that single-family homes (+1.62%) and duplexes (+1.80%) are holding strong, while fourplexes (–2.35%) and other multifamily buildings are seeing weaker prices as investors slow down and look for better deals.

> Mortgage Rates & Financing

Mortgage Rates (as of Dec 10, 2025)

Mortgage rates moved only slightly. The 30-year fixed is at 6.35%, up 0.05% from last week but still 0.37% lower than a year ago. Other loan products show similar small week-over-week increases, though all remain lower year-over-year. The 7/6 SOFR ARM saw the largest weekly bump (+0.15%), while FHA, VA, and jumbo rates inched up modestly.

10-Year Treasury Yield (as of Dec 10, 2025)

The 10-year Treasury is sitting at 4.17%, slightly below yesterday’s close of 4.19%. After rising earlier in the morning, the yield pulled back, reflecting shifting investor sentiment. Treasury yields remain well below their 52-week high of 4.82%, helping ease pressure on long-term borrowing costs.

Overall Takeaway

Rates have ticked up a bit over the past week, but the broader trend remains favorable compared to last year. With the 10-year Treasury stabilizing in the low 4% range, long-term mortgage rates are holding steady and remain well below their 2024 highs.

Source: Mortgage News Daily

> Headlines & Insights

FEATURED ARTICLE

The Fed is almost certain to cut interest rates by 25 bps this Wednesday—but that cut alone won’t move mortgage rates much. The real action will come from the Fed’s new 2026 projections and Chair Powell’s comments, which could spark volatility if they differ from what markets expect.

Markets are currently pricing in two rate cuts in 2026, but Fed officials are expected to project only one cut in 2026 and another in 2027. A divided Fed—with several regional presidents likely dissenting—adds even more uncertainty to how rates may react.

Main Takeaways

A 25 bps rate cut is fully priced in, meaning mortgage rates won’t drop just because of Wednesday’s announcement.

Mortgage rates could move sharply depending on 2026 projections, especially if the Fed signals fewer cuts than markets expect.

Recent data is muddy: ADP showed job losses, inflation stayed firm, and official jobs numbers are delayed due to the government shutdown.

Kevin Hassett is emerging as the likely nominee for next Fed Chair in 2026, a choice that could influence Fed unity and long-term rate stability.

Investor activity remains muted, with only slight growth in purchases, more deals falling through, and starter-home inventory hitting a 9-year high.

What This Means for Utah Investors

Don’t expect a big rate dip this week. Markets already priced in Wednesday’s cut, so any movement will come from Powell’s tone and the Fed’s 2026 outlook.

Volatility is likely. If the Fed shows only one cut for 2026, mortgage rates could bump higher briefly, affecting underwriting and cap rate assumptions on Utah deals.

Starter homes are gaining momentum nationally, which mirrors Utah’s strong demand in lower price segments—important for investors targeting entry-level rentals or flips.

Fall-through rates rising means Utah buyers may face more negotiation leverage as uncertainty keeps buyers cautious.

Muted investor activity nationwide matches what we’re seeing locally: tighter margins, more conservative underwriting, and fewer “easy” deals.

Utah Headlines

Salt Lake City Rethinks ‘Family’ Rules – City leaders want to rewrite old zoning rules that limit how many unrelated people can live together, hoping to lower housing costs and reflect modern households. The preferred plan would allow any number of people in a home, though officials still want safeguards to prevent overcrowding.

Northwest Salt Lake County Shows Rapid Growth and Diversity – New research highlights the area as young, diverse, and multilingual, with more than 1 in 10 Utahns living in the region. Population growth varies widely by city, and the community includes many foreign-born and multigenerational households, with over 95 languages spoken.

National Headlines

Fed Cut Expected, But 2026 Could Shake Rates – The Fed is almost certain to cut rates this week, but the real action will come from their new 2026 projections, which could cause mortgage rates to swing. Economists expect the Fed to signal fewer future cuts than markets hope, making Powell’s tone and the committee’s dissents key drivers of rate volatility.

Hawkish Rate Cut Likely – The Fed is expected to cut rates again, but officials will likely warn that more cuts aren’t guaranteed as they remain split over inflation and a weakening job market. Investors will watch Powell’s tone, updated economic forecasts, and the new dot plot to see how cautious the Fed plans to be moving forward.

High Insurance Costs Push Homeowners Toward Risky Deductibles – With premiums soaring, more homeowners are choosing higher deductibles to save money, even though it means taking on more financial risk if they need to file a claim. This trend is strongest in high-risk states like Florida and Texas, where insurers are pulling back and leaving fewer affordable options.

Fed Cut Won’t Lower All Borrowing Costs – The Fed is expected to cut rates again, which could slightly reduce costs for people with variable-rate debt like credit cards, ARMs, and HELOCs. But most loans — especially mortgages — may not get cheaper, and experts say improving your credit score is still the best way to lower what you pay.

David Robinson

Principal Broker/Owner

Thinking about buying, selling, or exchanging investment property in Utah?