- Utah Investor Report

- Posts

- The Canovo Report - March 6, 2024 - SUBS

The Canovo Report - March 6, 2024 - SUBS

🗞️ Canovo Report: March 6, 2024

This week in the Canovo Report…

New Ogden fourplex at $1.4M, Utah multifamily median price/sqft up 12% YTD, mortgage rates hit 3-week low, national rents rise after 6-month drop!

If you find value in our weekly report, please consider forwarding it to a friend!

If this is your first time here, you can subscribe here.

Happy Investing,

David

// NEW MULTIFAMILY LISTINGS THIS WEEK

> Our team has analyzed these properties using our custom bulk property analyzer. If you’d like more detail regarding any of these listings, click the links below.

$849,999

2089 E Donegal Cir Salt Lake City Utah , 84109

Type: 2

Est Proforma Cap: 4.54%

Total Monthly Expenses: $1,263.32

Gross Monthly Income: $4,616.00

$899,900

1761 E 4620 S #1-2 Salt Lake City Utah , 84117

Type: 4

Est Proforma Cap: 5.77%

Total Monthly Expenses: $1,506.83

Gross Monthly Income: $6,016.00

$1,400,000

See Directions Ogden Utah , 84404

Type: 4

Est Proforma Cap: 4.07%

Total Monthly Expenses: $1,980.73

Gross Monthly Income: $6,936.00

$875,000

860 E 500 N Spanish Fork Utah , 84660

Type: 4

Est Proforma Cap: 4.39%

Total Monthly Expenses: $1,281.31

Gross Monthly Income: $4,624.00

$1,050,000

1536 S Green Street St Salt Lake City Utah , 84105

Type: 4

Est Proforma Cap: 4.83%

Total Monthly Expenses: $1,607.65

Gross Monthly Income: $6,016.00

$370,000

240 N 1400 W Cedar City Utah , 84721

Type: 2

Est Proforma Cap: 4.42%

Total Monthly Expenses: $543.12

Gross Monthly Income: $1,964.00

Canovo Group may not be the listing brokerage for the above properties. The information provided is not guaranteed and should not be relied upon to make investment decisions. Buyers should complete their own analysis and due diligence before making any investment.

🔥🔥🔥 NEW SECTION 🔥🔥🔥

// FAIR MARKET RENT RATES

> Below you will find the current Fair Market Rents for Each Metropolitan Area by Published by HUD.

Fair Market Rents, as defined in 24 CFR 888.113 are estimates of 40th percentile gross rents for standard quality units within a metropolitan area or nonmetropolitan county.

Work with our team to find, analyze, & buy top-performing multifamily property in Utah.

// SOLD MULTIFAMILY LISTINGS LAST WEEK

> Here's a roundup of multifamily properties sold over the past week. We've estimated their selling cap rates using our bulk analyzer.

Is it time to sell? Request a Free Brokers Valuation.

// UTAH MARKET SNAPSHOT 2/20/2024

> MULTIFAMILY (2+ UNITS): Below is a report showing data for sold multifamily listings with 2+ units.

The Sold listing count year-to-date sits at 72 which is 26% higher than last year which came in at 57.

The Average Sold Price Per Square Foot year-to-date is $240, up 12.67% compared to last year which came in at $213.

Multifamily (2+ Units): Sold Listings, Average $/SqFt, and Median $/SqFt

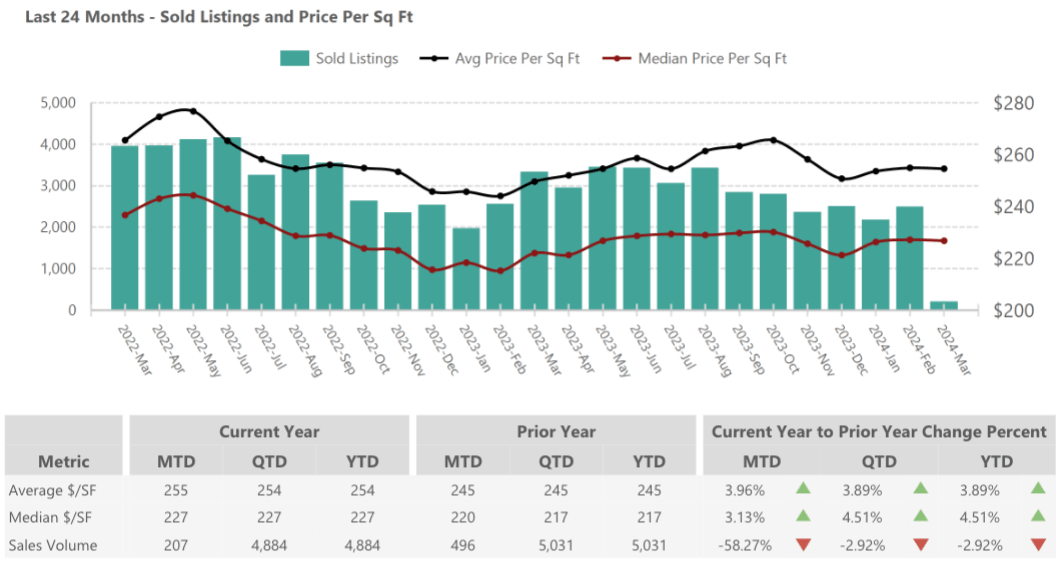

> SINGLE FAMILY: For contrast, below is a report showing data for single family residential listings.

The Sold listing count year-to-date sits at 4,884 which is 2.92% lower than last year which came in at 5,031.

The Average Sold Price Per Square Foot year-to-date is $254, up 3.89% compared to last year which came in at $245.

Single Family Residential : Sold Listings, Average $/SqFt, and Median $/SqFt

Source: wfrmls

// INTEREST RATES & FINANCING

> Mortgage Rates as of 3/5/2024

Source: mortgagenewsdaily.com

Sponsored by: Spencer Allen | Trillion Mortgage NMLS #2296408

// TOP NEWS, REPORTS, & INSIGHTS

Mortgage rates have dropped to their lowest level in three weeks, influenced by bond market movements and recent economic data, including a weaker-than-expected services sector report.

Main takeaways:

Economic reports, especially from the services sector, indicating weakness and a faster pace of decreasing price increases, have contributed to the reduction in mortgage rates.

This week's economic data is deemed more significant than last week's, with particular attention on the upcoming big jobs report, suggesting a cautious approach to rate forecasting.

Despite various factors influencing the bond market, the average lender has managed to lower 30-year fixed mortgage rates to the lowest since February 12th, albeit within a narrow range and modest day-to-day movement.

The March 2024 Apartment List National Rent Report indicates a slight month-over-month increase in median rents, marking a potential seasonal shift, amidst a broader context of year-over-year rent decline and increasing apartment vacancies.

Main takeaways:

After six months of declining, median rent prices in the U.S. increased by 0.2% in February 2024 to $1,377, suggesting a return to the seasonal pattern of rising rents during the spring and summer months, despite being 1% lower year-over-year.

The national vacancy index rose to 6.6%, with expectations for further increases due to a high number of apartment completions anticipated, highlighting a shift from the tight market conditions of previous years.

Rent growth varied significantly across the U.S., with 57 of the 100 largest cities experiencing month-over-month increases, but only 43 showing positive year-over-year growth, particularly noting declines in Sun Belt cities due to expanding multifamily inventory.

There has been a significant increase in the construction of condos and townhomes in Utah as a response to the housing market's demand for more affordable "starter" homes, with a notable shift in building permits and units over the past decade.

Main takeaways:

There was a substantial increase in permits for condos and townhomes in Utah in 2022, marking a 311% increase in permits and a 197% increase in units compared to 2013, indicating a significant shift towards more affordable housing options.

The trend towards building townhomes and condos is described as a response to market demand, with these types of housing being cheaper to build and buy compared to single-family detached homes, thus filling the gap for affordable starter homes.

Despite the growth in condo and townhome construction, some counties in Utah have not embraced this trend, and overall residential permits have slightly decreased, highlighting a complex and varied housing market landscape across the state.

We hope you found this weeks report valuable. If you have any questions, feedback, or if we can serve you in any way, don’t hesitate to reach out! [email protected]

" target="_blank">unsubscribe