- Utah Investor Report

- Posts

- !!️ Canovo Report: Fed Cuts Rates to Manage Risks

!!️ Canovo Report: Fed Cuts Rates to Manage Risks

Fed expects two more cuts in 2025, but fewer in 2026.

Fed Cuts Rates to Manage Risks

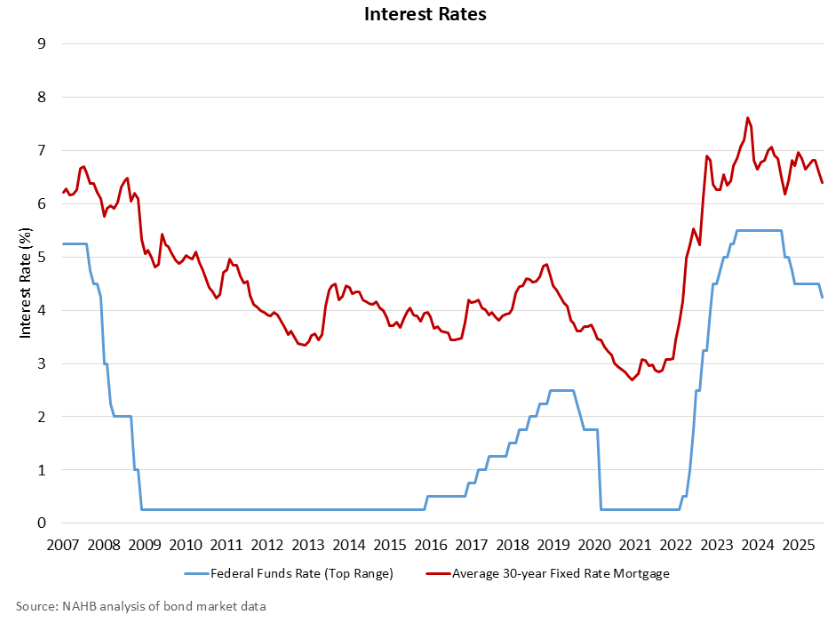

The Federal Reserve lowered interest rates by a quarter percent today. Chair Jerome Powell said the move is not about panic, but about managing risks as the job market slows and inflation stays high. The Fed also hinted that more cuts could come later this year.

Key Takeaways

Small cut today: Rates dropped by 0.25% to a range of 4.00–4.25%.

Powell’s message: Called it a “risk management cut” as the labor market cools.

More cuts likely: Fed expects two more cuts in 2025, but fewer in 2026.

Inflation still a problem: Tariffs and rising goods prices may keep costs high.

Mortgage rates steady: Home loan rates may not move much right away.

What This Means for Utah Investors

For Utah real estate investors, this shift means borrowing costs should slowly start to ease. While 30-year mortgage rates may not fall right away, loans for construction and apartment deals are likely to get cheaper. That’s good news for investors looking at value-add properties or refinancing.

At the same time, higher costs for goods and services could keep expenses up. The Fed is trying to balance these risks, but overall the outlook is better for buyers and builders. For Utah multifamily investors, this creates a window to lock in financing at improving rates while demand for affordable housing stays strong.

David Robinson

Principal Broker/Managing Partner