- Utah Investor Report

- Posts

- Buyers Gain Leverage as Multi-Unit Momentum Shifts

Buyers Gain Leverage as Multi-Unit Momentum Shifts

49 unit Provo student housing portfolio · BYU 6-plex cash flow · Rates volatile but better YoY

Utah Market Data

Utah Multi-Unit Properties: Sold Price Per Square Foot - Median (2020-2025)

source: WFRMLS

From 2020 to 2022, all multi-unit property types—duplexes, triplexes, fourplexes, and 5+ unit buildings—saw strong growth in median price per square foot. Prices rose quickly during this period as investor demand increased and interest rates stayed low.

In 2023, the market began to cool. Prices flattened or dipped slightly for most property types, especially 5+ unit buildings, which saw a noticeable drop. This lines up with rising interest rates and tighter financing, which made larger deals harder to close.

In 2024, prices rebounded across the board. Duplexes and fourplexes reached their highest levels, both around $250 per square foot, showing strong demand for smaller multifamily properties. Triplexes and 5+ unit properties also moved higher, though with more volatility.

By 2025, prices pulled back modestly. Duplexes and fourplexes slipped slightly but remain well above pre-2022 levels. Triplexes saw a larger drop, while 5+ unit properties also declined slightly after their strong 2024 jump.

Overall takeaway: Multi-unit prices in Utah rose sharply from 2020 to 2022, peaked around 2024, and then softened in 2025. Smaller properties like duplexes and fourplexes have held up the best, while larger properties show more price swings as interest rates and investor returns changed.

Featured Listings

City - Provo | Asking - $12,150,000 | Year built - 1981, 1967, 1996 | Total Units - 49 | Beds/Baths - 147/49

The Pointe Portfolio, a three property student housing portfolio strategically located in Provo, Utah— one of the most vibrant university-driven markets in the Mountain West. Situated just minutes from Brigham Young University, the portfolio benefits from exceptional walkability to campus, consistent student demand, and long-term occupancy stability. Each property offers spacious floorplans and shared amenity potential, while also benefiting from operational efficiencies as part of a larger portfolio. Listed by Marcus and Millichap

Fully occupied 6-Plex two blocks from BYU ready to cash flow! Current owner has had zero vacancies and often has a wait list for these units. Five of the units are now month to month with the last year lease expiring this April and going month to month after that for an easy transition for new owners to restructure the rents and add value to the property if desired. 9 off street parking spaces and coin operated laundry onsite. Unit 1 is given a rental discount to manage the complex and tenants. 6 electric meters 1 gas/water meter Owner currently pays internet and all utilities 3 water heaters (Unit 1 supplies for units 1 & 4; Unit 2 supplies for units 2 & 5; utility room has water heater for units 3, 6, & laundry room washing machine. 6 furnaces. All units have A/C serviced through 3 A/C units.

Office/Warehouse 1272 W Sportsplex Dr Kaysville, UT 84037 | Asking $2,850,000 | Total SF - 10,119 |

Positioned within the thriving North Davis County corridor, 1272 West Sportsplex Drive offers a sophisticated office/flex environment designed for high-performance enterprise operations. Built with contemporary professional aesthetics, featuring high-quality finished showroom and an efficient floor plan. Ample on-site parking ratios designed to accommodate high-density staffing requirements. This facility represents a rare opportunity to occupy or invest in the prestigious Kaysville Business Park—a strategic hub known for its corporate synergy and immediate proximity to the I-15 technology corridor.

Canovo Group may not be the listing brokerage for the above properties. The information provided is not guaranteed and should not be relied upon to make investment decisions. Buyers should complete their own analysis and due diligence before making any investment.

Mortgage Rates & Financing

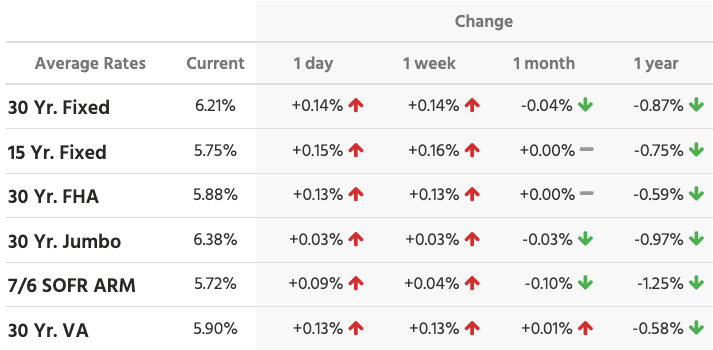

Mortgage Rates (as of Jan 21, 2026)

Mortgage rates moved higher over the past day and week, even though they are still lower than they were a year ago. The 30-year fixed rate is now 6.21%, up about 0.14% this week, but still down 0.87% year over year. Other loan types show the same pattern—short-term bumps, but meaningful improvement compared to last year.

10-Year Treasury Yield (as of Jan 21, 2026)

At the same time, the 10-Year Treasury has climbed to about 4.28%, near the higher end of its recent range. Since mortgage rates closely follow the 10-Year Treasury, this rise helps explain why rates have ticked up in the short term.

Bottom line: Rates are choppy day to day, but they remain better than last year. Short-term increases are tied to higher Treasury yields, while the longer-term trend is still pointing toward easing compared to 2025.

Source: Mortgage News Daily/Market Watch

Headlines & Insights

FEATURED ARTICLE

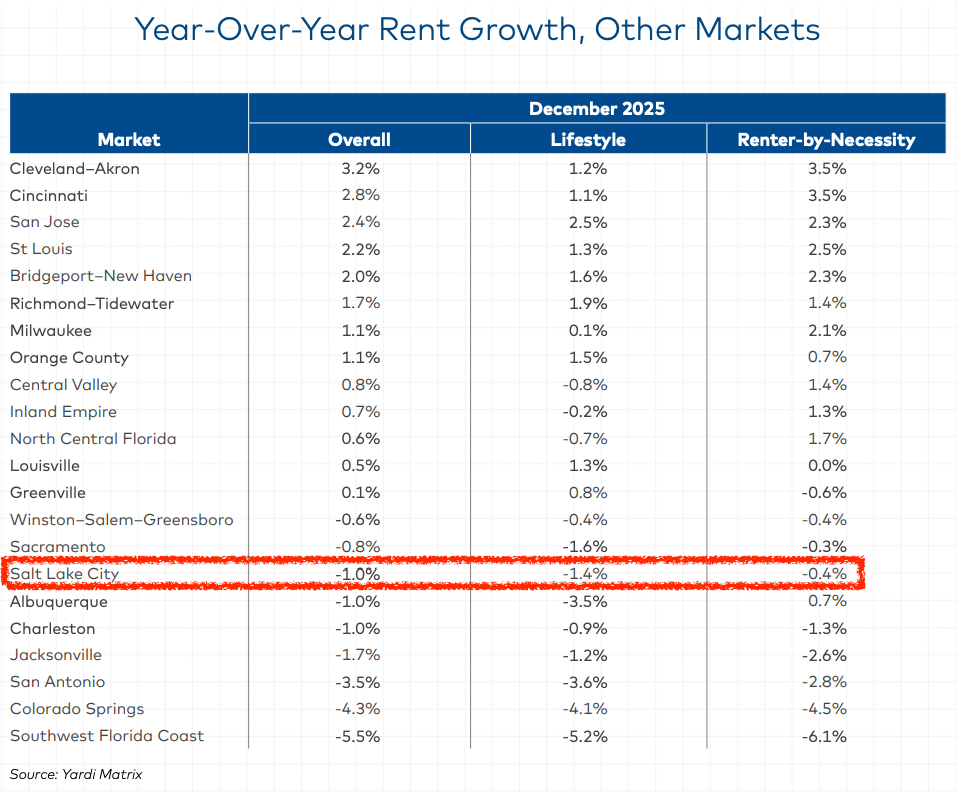

National multifamily rents ended 2025 right where they started, with zero year-over-year growth after a weak finish to the year. While rents slipped slightly in December, occupancy remained strong, showing that demand is still there even as pricing power fades. The report suggests the market is stabilizing and could see modest rent growth return in 2026.

Key Takeaways

National advertised rents fell 0.3% in December and finished 2025 at 0.0% year-over-year growth, a rare outcome outside major downturns.

Occupancy stayed near 95%, as landlords used concessions and lower renewal increases to keep tenants in place.

Performance varied widely by region: Midwest and gateway markets held up best, while Sun Belt markets struggled under heavy new supply.

What This Means for Utah Investors

Salt Lake City was specifically called out, posting -1.0% year-over-year rent growth in December, with weakness across both lifestyle and renter-by-necessity units. That said, occupancy remains solid, signaling that demand hasn’t disappeared—pricing is just under pressure. For Utah investors, this is a market that rewards conservative underwriting, realistic rent assumptions, and long-term holds, especially on well-located, workforce-oriented assets.

Utah Headlines

Utah Voters Focused on Cost Of Living This Legislative Session– Rising living costs are the top concern for Utah voters as the 2026 legislative session begins, far outweighing other issues. Housing affordability, taxes, and everyday expenses are putting pressure on households across the state. Lawmakers are expected to focus heavily on policies tied to housing and cost relief.

Push for Housing Near Transit – Utah Sen. John Curtis introduced bipartisan legislation aimed at speeding up housing construction near transit stations. The proposal would reduce red tape and better align transportation funding with housing development. Supporters say it could boost housing supply, improve affordability, and make better use of existing infrastructure.

National Headlines

Rates Could Fall More Than Expected in 2026 – Mortgage rates in 2026 may drop more than expected, potentially averaging around 5.8% if large purchases of mortgage-backed securities continue. Lower rates could boost home sales, bring more sellers to market, and slightly lift prices as affordability improves. Even a small drop in rates could make a meaningful difference for buyers and homeowners.

Homes Getting Smaller – New single-family homes have been shrinking since 2015 as affordability has worsened, with higher interest rates pushing buyers toward smaller homes. In Q3 2025, the median new home size fell to about 2,176 square feet, while average size stayed mostly flat. Looking ahead to 2026, home sizes may level off if mortgage rates settle around 6%.

Refi Boom Fades – Mortgage refinance activity jumped again as rates dipped, pushing applications to their highest level in months. But that surge may be short-lived, as mortgage rates quickly moved higher this week after bond markets sold off. Buyers and homeowners still face affordability challenges despite more homes for sale.

CRE Deals Slow – Commercial real estate deal activity fell again in November, with total transactions down 10% from last year. Investors are focusing on fewer but larger, higher-quality properties, especially deals over $100 million. Multifamily led the way, while office and industrial deals continued at slower levels as high interest rates and uncertainty weigh on the market.

Rate Lock-In Shift Point – More homeowners now have mortgages above 6% than below 3%, marking a key shift in the housing market. While many owners are still locked into low rates, more buyers are moving forward despite higher borrowing costs. This change suggests housing activity may slowly increase, even as affordability remains tight.

Thinking about buying, selling, leasing or exchanging property in Utah?

David Robinson - Principal Broker | Investor

Disclaimer: Canovo Group LLC is not a registered broker-dealer, investment adviser, or financial advisor. This email is for informational purposes only and does not constitute an offer to sell, solicitation of an offer to buy, or a recommendation of any securities or investment strategies. All investments carry risk, including the potential loss of principal. Recipients should perform their own due diligence and consult with their own legal, tax, and financial advisors before making any investment decisions. Canovo Group LLC it’s licensed brokers or agents do not endorse, guarantee, or verify the accuracy of any third-party information provided herein.