- Utah Investor Report

- Posts

- Builders are pulling back

Builders are pulling back

Two Utah cities rank among most mobile; Ogden duplex listed for $310k; Utah multi-unit sales down 5% on the year.

> Featured Listings

Duplex Near Downtown & Outdoor Recreation! Discover this cute and well-maintained duplex ideally located just minutes from downtown shopping, local parks, and a short drive to world-class ski resorts. Perfect for both investors or owner-occupants, the property features two cozy units with separate gas meter and separate electric meter. Enjoy the convenience of city living combined with easy access to mountain adventure.

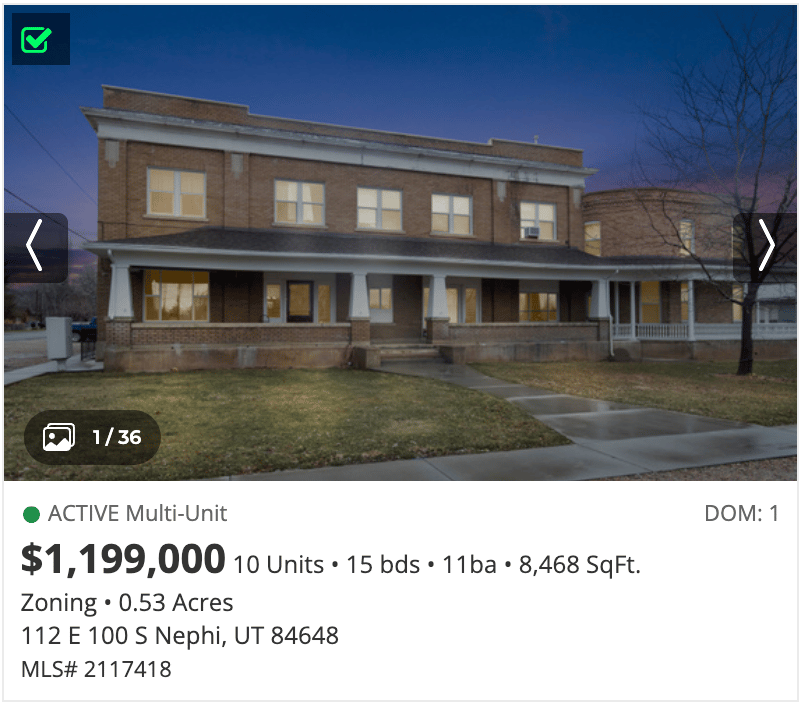

The Annex, a one-of-a-kind 10-plex in the heart of Nephi, Utah. Built in the early 1900s, this well-known property shows off classic craftsmanship and timeless character you don't find every day. It's even a piece of local pop culture-Brandon Flowers, lead singer of The Killers, once lived here as a kid, and it's featured in his short film Notes from a Quiet Town. Each of the ten apartments has been updated over the years-many down to the studs-with new plumbing, electrical, windows, and heating systems while keeping its original charm like tall ceilings, 7-foot windows, and a full-length front porch. The Annex is currently set up as a long-term residential rental and has been well cared for, offering options for continued long-term use, newly approved short-term rentals, or even multi-family living. Please do not disturb tenants. Showings by appointment only. Seller is a licensed Utah real estate agent.

Totally redone in the past 7 years, from the insides with new kitchens, and appliances including dishwashers. New vanities in the bathrooms, newer flooring throughout and newer furnaces and water heaters. Outside, enjoy the great look of the new vinyl siding and the new stairway. No major repairs for the new owner! Each unit has its own laundry hook ups. With such great units, you have very little turnover and steady income. Don't miss this opportunity.

Remodeled Duplex – Rare 1-Bedroom Units! Beautifully remodeled and meticulously maintained, this hard-to-find 1-bedroom duplex is a fantastic investment opportunity! Both units are always fully occupied, with long-term tenants currently on month-to-month leases. Rents are reviewed and adjusted annually at the beginning of each year. Each unit includes its own private garage, offering excellent storage space. The property is fully landscaped and features an automatic sprinkler system for easy care. Both units are equipped with newer furnaces, ensuring comfort and efficiency. Don't miss this opportunity to own a turn-key duplex with steady income and great curb appeal This is a 1031 Exchange

Canovo Group may not be the listing brokerage for the above properties. The information provided is not guaranteed and should not be relied upon to make investment decisions. Buyers should complete their own analysis and due diligence before making any investment.

> Sold Multi-Unit Listings

Sell Your Multi-Unit Property for Top Dollar

Request a free, no obligation property value estimate. Get market rent data, sales comparables and a return on equity analysis.

> Utah Market Data

Multi-unit properties have slowed down this year. The number of sold buildings dropped about 5%, and prices per square foot fell around 5%. Homes are taking longer to sell, with the average days on market rising to 37.

Single-family homes are holding stronger. Sales are up about 3%, and prices have inched up 1%. Even though it’s taking a bit longer to sell, demand for single-family homes in Utah remains steady.

New multi-unit listings are up about 5%, showing more inventory coming to market. Prices per square foot are nearly flat, dipping less than 1%.

For single-family homes, new listings jumped over 10%, and prices rose slightly by about 1%.

> Rates & Financing

Mortgage Rates as of 10/15/2025

Source: Mortgage News Daily

> Headlines & Insights

Homebuilders stayed cautious in August as single-family construction permits fell for the eighth month in a row. Rising costs and affordability challenges continue to weigh on new home demand.

Main takeaways:

Single-family slowdown: Year-to-date, single-family permits dropped 7.1% from last year to 637,096, showing that builders remain wary of high mortgage rates and slower buyer traffic.

Multifamily resilience: Multifamily permits rose 1.4%, reaching 330,617, with most growth coming from smaller projects in lower-density areas.

Regional trends:

Midwest was the only region with growth (+1%).

West led declines (-11.5%), followed by the South (-7.5%) and Northeast (-4.4%).

Top states: Texas and Florida still lead in total single-family permits, though both are down sharply. Mississippi saw the biggest jump in multifamily permits (+113%), while Maryland posted the steepest drop (-46%).

What this means for Utah investors:

Builders across the West, are clearly pulling back. That slowdown could help stabilize construction costs but may keep housing supply tight through 2026. For Utah multifamily investors, the small uptick in lower-density apartment projects signals continued opportunity in secondary markets—especially if borrowing costs ease after future Fed rate cuts.

Utah Headlines

Utah Tops Move-Easy Rankings: Provo and Salt Lake City Among Nation’s Most Mobile Rental Markets

Nationwide, 38% of renters move within two years, with Austin #1 and the Southeast dominating mobility; Gen Z is the most transient (72%). Utah stands out too—Provo ranks #2 (60% move within two years) and Salt Lake City #6 (51%), reflecting strong student and tech-driven churn.

Old OfficeMax Site to Become 252-Unit Student Housing Near University of Utah

Salt Lake City approved Cole West’s plan to redevelop the former OfficeMax at 410 S. 900 East into a six-story, 252-unit student housing complex featuring courtyards, coworking lounges, public art, and a café. The project targets students from nearby universities and sits adjacent to the 900 East TRAX station, promoting transit-oriented living despite some neighborhood parking concerns.

National Headlines

Economic Uncertainty Tempers Rent Growth Outlook — Despite strong 2nd quarter GDP growth of 3.8%, labor market weakness and a government shutdown have clouded the 3rd quarter forecast. The Fed’s recent 25 bps rate cut to 4–4.25% aims to counter slowing hiring and modest inflation. National rent growth is projected below 2% through Q3 2026, with Miami leading at nearly 4% and several markets like Denver expected to see declines.

Trade Tensions Nudge Rates Down – Mortgage rates dipped about 10 basis points last week as renewed U.S.-China trade tensions rattled global markets and lowered Treasury yields. The Fed’s September minutes showed concern about labor market weakness, suggesting more rate cuts ahead, while homebuyers continued backing out of deals at record rates amid high costs and financing challenges.

Developers Pivot to 'Powered Land' — A surge in AI and data demand is creating a new CRE asset class: powered land—sites with grid access and permits ready for data center use. Global developer Hines and others are racing to secure power rights, as roughly 40,000 new acres (nearly 2B sq. ft.) will be needed in five years. With energy capacity now the key constraint, tech firms and investors view AI-ready land as the new oil, reshaping development across the U.S. and beyond.

Investor Activity Hits 5-Year High — Real estate investors purchased one-third of all U.S. single-family homes in Q2 2025—the highest share in five years, according to CJ Patrick Co. and BatchData. While large institutions are selling more than they buy, small investors now dominate the market, targeting lower-priced homes as affordability challenges push more Americans toward renting.

David Robinson

Principal Broker/Owner

Thinking about buying, selling, or exchanging investment property in Utah?