- Utah Investor Report

- Posts

- 2024 In Review - Utah single family & multi-unit property finish up.

2024 In Review - Utah single family & multi-unit property finish up.

1996 Riverdale Fourplex Sells for ONLY $700k; 34% Of Homeowners Say They’ll Never Sell; Mortgage Rates Surge... Again.

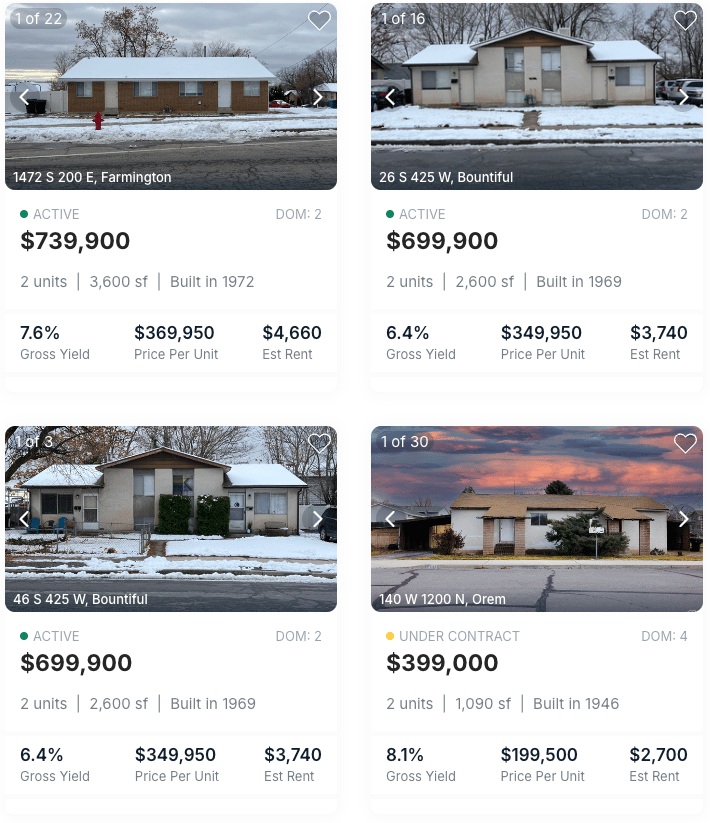

Featured Multi-Unit Listings

Click images below to view details and run cash flow analysis.

> DUPLEX LISTINGS:

> FOURPLEX LISTINGS:

> 5+ UNIT LISTINGS:

Canovo Group may not be the listing brokerage for the above properties. The information provided is not guaranteed and should not be relied upon to make investment decisions. Buyers should complete their own analysis and due diligence before making any investment.

Utah Market Snapshot - 2024 Review

> Key Metrics - 2024 Compared to 2023 (% change)

Key Metric | Single Family | Multi-Unit (2+ Units) |

|---|---|---|

New Listings | +11.9% | +18.1% |

Closed Sales | +6.8% | +14.2% |

Days on Market | +5.9% | +10.5% |

Median Sales Price | +3.5% | +5.4% |

> Multi-Unit (2+ Units):

Overview of key metrics for multi-unit property in Utah.

> Single Family:

Overview of key metrics for single family property in Utah.

Sold Multi-Unit Listings This Week

Rates & Financing

> Mortgage Rates as of 1/8/2025

Source: Mortgage News Daily

Property Management

> Incentivize Timely Rent Payments

Encouraging timely rent payments can be a challenge, but offering small incentives can help motivate tenants to pay on time. Consider offering a discount for early payments, or a small reward like a gift card or service upgrade (e.g., a free carpet cleaning) for tenants who consistently pay their rent on or before the due date. Not only does this create positive cash flow for you, but it fosters a sense of appreciation and trust between you and your tenants. Small incentives can go a long way in building good relationships and improving overall rent collection efficiency.

Get professional property management starting at only $59/unit. Learn more.

Headlines & Insights

Featured Story

Summary:

A new survey shows 34% of U.S. homeowners say they’ll never sell their homes, while another 27% won’t sell for at least 10 years. High housing costs, low mortgage rates, and a sense of satisfaction with their current homes are the main reasons.

Key Points:

Generational Trends:

43% of baby boomers say they’ll never sell, compared to 34% of Gen X and 28% of millennials/Gen Z.

Why Homeowners Stay:

39%: Their home is fully or almost paid off.

37%: They love their home and have no reason to move.

30%: Home prices are too high to buy again.

18%: They don’t want to lose their low mortgage rate.

Market Impact:

Home listings remain low because fewer homeowners are willing to sell.

Only 25 of every 1,000 homes sold in the first 8 months of 2024, a historic low.

Why It Matters:

Rising home prices (+40% since 2019) and mortgage rates (averaging 6.91%) keep people from upgrading. Most sellers today move out of necessity, not desire.

More News & Reports

Utah

Federal Funding Boosts Home Safety Efforts in Salt Lake County and Central Utah: Salt Lake County and six central Utah counties have been awarded significant federal funding aimed at removing home health hazards like lead paint, enhancing safety for seniors, and addressing other risks. This initiative is part of a broader effort by the U.S. Department of Housing and Urban Development, distributing $6.8 million across the Mountain West region to improve home safety.

National

Multifamily Sector to Lead Growth in 2025 Despite Rising Operational Costs: Despite challenges from rising insurance costs and operational expenses, the multifamily sector is expected to lead real estate investment sales in 2025. Key factors supporting this growth include stabilizing fundamentals, falling interest rates, and robust household formation. Savills predicts rent growth to strengthen nationwide as the market adjusts to reduced construction and increased demand, particularly from Generation Z.

Mortgage Rates Surge, Dampening Homebuyer Enthusiasm: Mortgage rates reached their highest point since July last week, causing mortgage application volumes to fall 3.7%. The spike in rates, now at 6.99% for 30-year fixed mortgages, combined with higher home prices, has significantly cooled buyer interest, with home purchase applications dropping 7% from the previous week and 15% from last year. Even as more homes are available on the market, elevated costs are keeping potential buyers at bay.

CFPB Clears Billions in Medical Debt from Credit Reports: The Consumer Financial Protection Bureau (CFPB) has finalized a transformative rule that will erase approximately $49 billion in medical debt from 15 million Americans' credit reports. The move, which predicts an increase in credit scores and a potential approval of 22,000 additional mortgages annually, aligns with the CFPB's ongoing efforts to protect consumers from the disproportionate impact of medical debt on financial stability.

Wealth Gap Between Homeowners and Renters Highlighted: Homeowners significantly outpace renters in asset accumulation, with a median net worth of $396,000 versus $10,400 for renters, largely due to equity from their primary residences. This disparity underscores homeownership as a key factor in wealth building, according to the National Association of Home Builders.

DOJ Targets Major Landlords in Expanded Antitrust Lawsuit Over Rent-Fixing: The U.S. Department of Justice has expanded its antitrust lawsuit to include six major landlords, accusing them of using a rent-pricing algorithm to fix prices across 1.3 million rental units, a move that broadens the allegations of nationwide rent inflation originally leveled against software provider RealPage.

What did you think of today's report? |

David Robinson

Principal Broker/Managing Partner

Whenever you’re ready, there are a few ways I can help you:

Free Multi-Unit Deal Finder App

Use our custom deal finder app to quickly find, screen and analyze the best multi-unit deals available in our market.

Buy Off-Market Multifamily Deals:

Skip the competition and discover exclusive off-market and top-performing multi-unit properties tailored to your investment goals.Sell Your Multi-Unit Property for Top Dollar

List your multi-unit property on the Utah MLS and dozens of other websites through our brokerage and save thousands with our flat fee MLS listing.